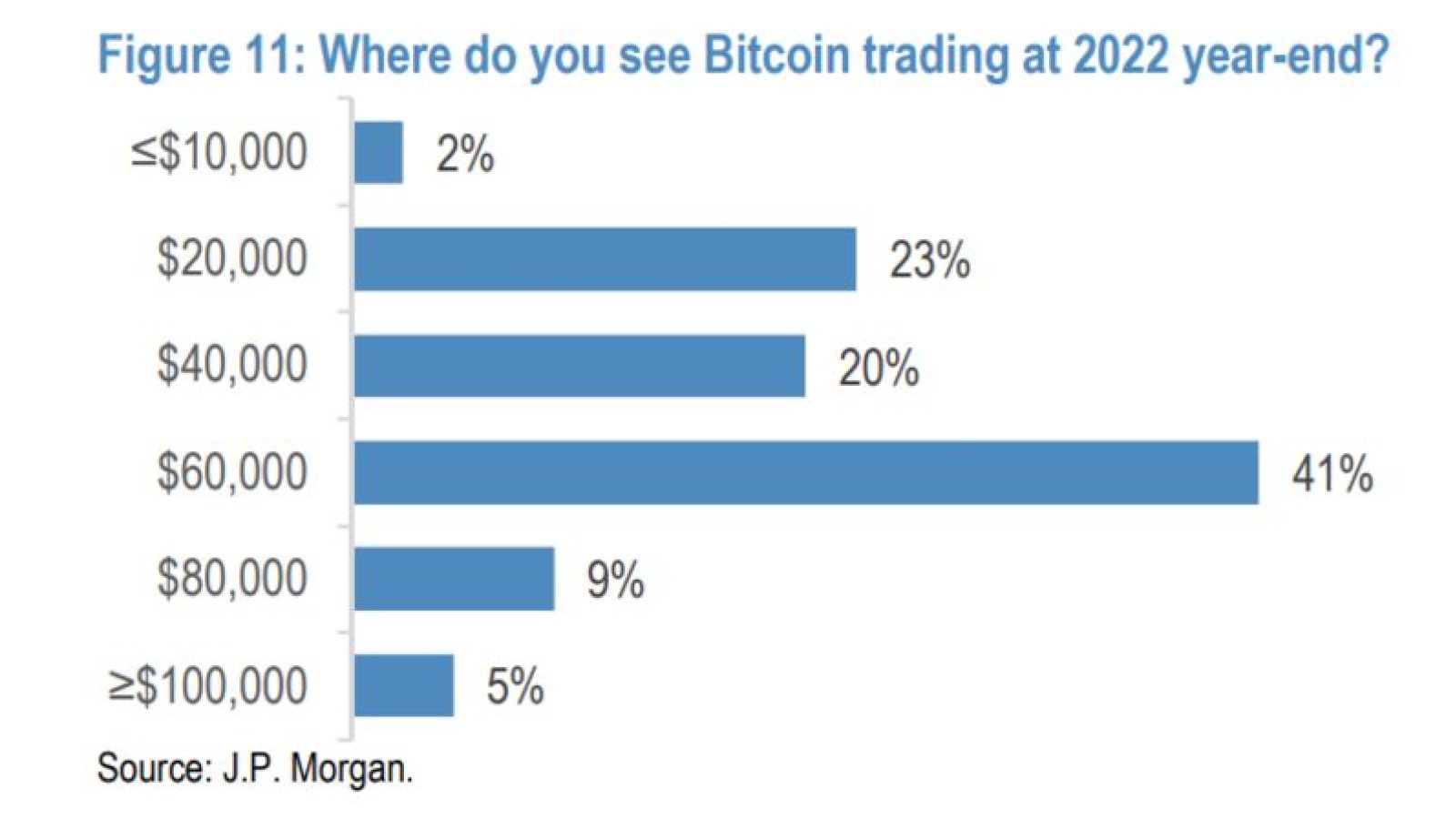

The majority of JPMorgan clients are bullish on Bitcoin as they see it finishing 2022 above $60,000.

41% see BTC above $60,000 by the end of 2022

Most clients surveyed by JPMorgan Chase anticipate Bitcoin will end the year above $60,000. According to the bank, only 2% of respondents think Bitcoin will fall below $10,000 by 2023.

This contradicts bears’ predictions that 2022 will be a rerun of 2018 when the Bitcoin price fell over 70%. Some analysts foresee a major Bitcoin correction owing to the US. The Fed is becoming hawkish.

Despite this, JPMorgan clients do not expect a major increase in the flagship cryptocurrency this year. According to the poll, only 5% predict that Bitcoin will reach $100,000.

Bitcoin might reach $100,000 in five years, according to Goldman Sachs, if it continues to eat into gold’s market share.

According to U.Today, Fundstrat’s permabull Tom Lee expects Bitcoin to hit $200,000 this year. Bitcoin, according to cryptocurrency evangelist Brock Pierce, may reach that level in 2022.

Sold out?

Bitcoin, according to analyst Nikolaos Panigirtzoglou, is oversold.

On Monday, Bitcoin fell below $40,000 for the first time since late September, but bulls rallied to bring it back to $42,000.

To regain its all-time high of $69,000, Bitcoin would need to recover nearly 39%.