Since the launch of spot Bitcoin ETFs in January, Bitcoin has become the dominant asset in the ETF market.

Bloomberg Intelligence reports that on November 21st, exchange-traded funds (ETFs) investing in Bitcoin in the United States achieved a significant milestone by surpassing the $100 billion mark in net assets.

Since the introduction of spot Bitcoin ETF in January, Bitcoin has emerged as the dominant asset in the exchange-traded fund (ETF) landscape.

Immediately following the victory of crypto-friendly President-elect Donald Trump in the elections held on November 5 in the United States, investor interest increased.

According to Bryan Armour, director of passive strategies research at Morningstar, the increase in the net assets of Bitcoin ETF in November demonstrates “a more positive outlook for the future of Bitcoin after Trump’s election win, which boosted performance and brought over $5 billion of inflows.

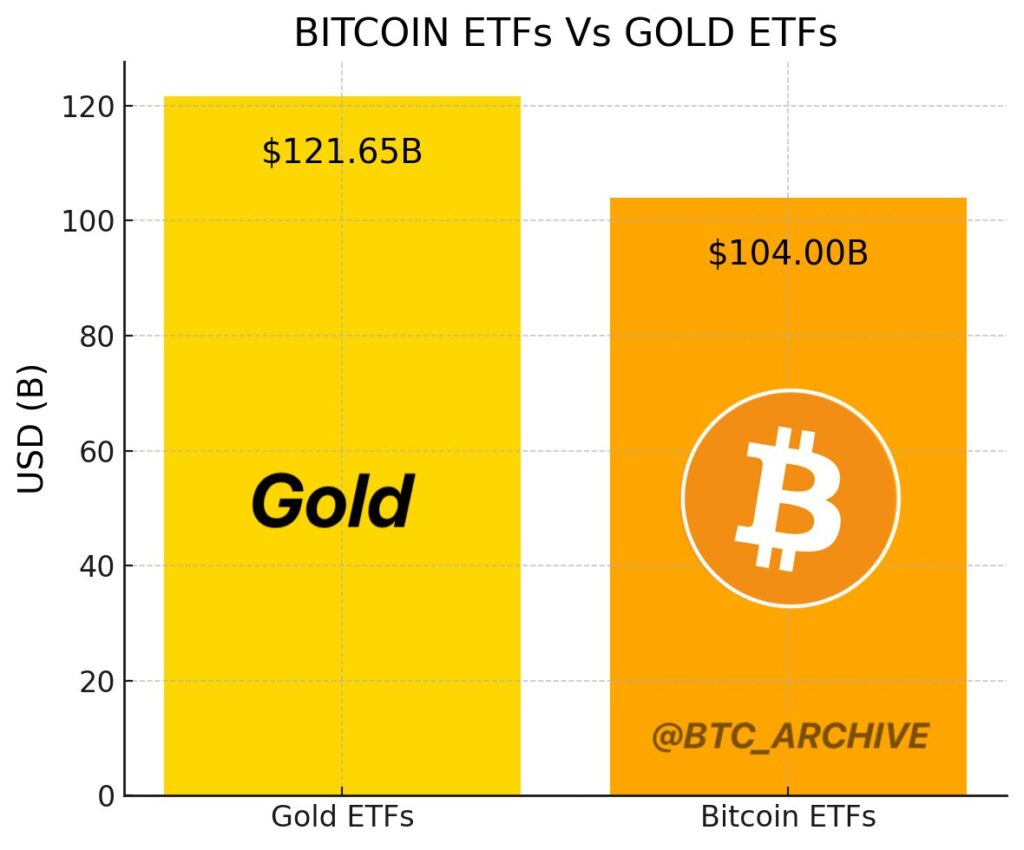

ETFs that invest in Bitcoin currently handle around $104 billion collectively. According to Bitcoin Archive, they are on course to exceed gold exchange-traded funds (ETFs) in terms of net assets. As of the 21st of November, these ETFs collectively possess around 120 billion dollars in assets under management (AUM).

Eric Balchunas, an ETF analyst for Bloomberg Intelligence, stated in a post on the X platform on November 21 that Bitcoin ETF are “now 97% of the way to passing Satoshi as the biggest holder and 82% of the way to passing gold ETFs.

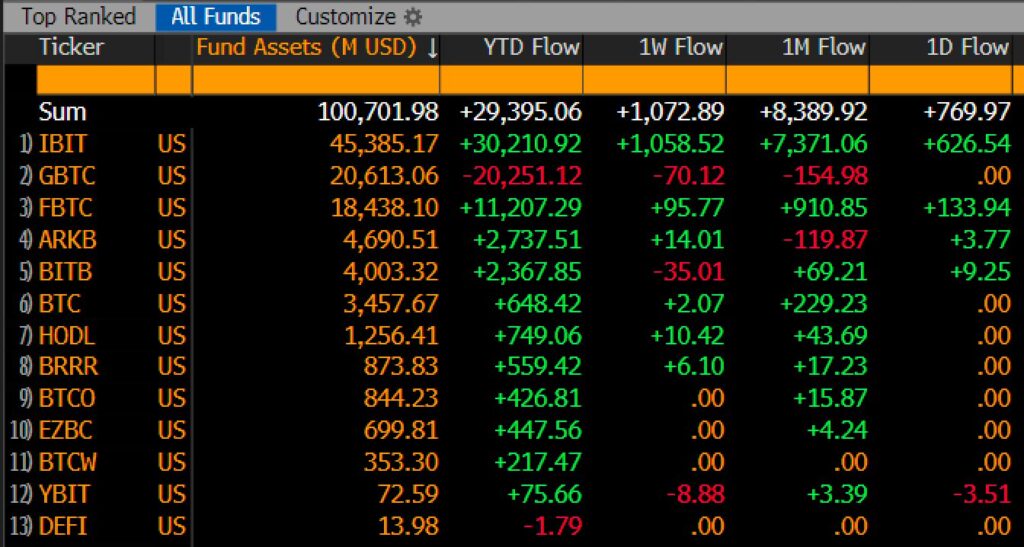

According to data provided by Bloomberg, the iShares Bitcoin Trust (IBIT) offered by BlackRock is currently in the lead, having received a total of $30 billion in net inflows since January. According to Bloomberg, the Fidelity Wise Origin Bitcoin Fund (FBTC) has been the second most popular Bitcoin exchange-traded fund (ETF) so far this year, with inflows totaling more than eleven billion dollars.

After Trump’s victory in the presidential election in the United States, the cryptocurrency market experienced a rise. According to data provided by Google Finance, the spot price of Bitcoin was over $96,000 as of the 21st of November, representing an almost 120% increase since the beginning of 2024.

The day of November 6 was the “biggest volume day ever” for IBIT, according to Balchunas, who stated in a post on November 6 X that investors flocked to cryptocurrencies after Trump’s election victory.

According to data provided by Farside, IBIT recorded a total of $1.1 billion in inflows on November 7, regaining its status as an inflow following two straight days of outflows totaling $113.3 million during that time period. MV Global predicts that the price of Bitcoin will range from $100,000 to $150,000 per coin.

BlackRock’s IBIT now owns more assets than the asset manager’s gold exchange-traded fund (ETF), despite its January launch. In response to escalating geopolitical tensions, investors are participating in a “debasement trade” by buying gold and Bitcoin.