MicroStrategy’s market capitalization experienced its most significant four-day decline in history, prompting inquiries regarding its status as a leveraged Bitcoin investment vehicle.

The company’s market value decreased by more than 35% from its apex on November 21, resulting in over $30 billion loss.

The Kobeissi Letter, which emphasized the decline in a November 26 X post, stated that this was the business intelligence firm’s largest four-day decline.

“MicroStrategy stock, MSTR, just fell a MASSIVE -35% from its peak seen on November 21st. That’s ~$30 BILLION of market cap erased in 4 trading days.”

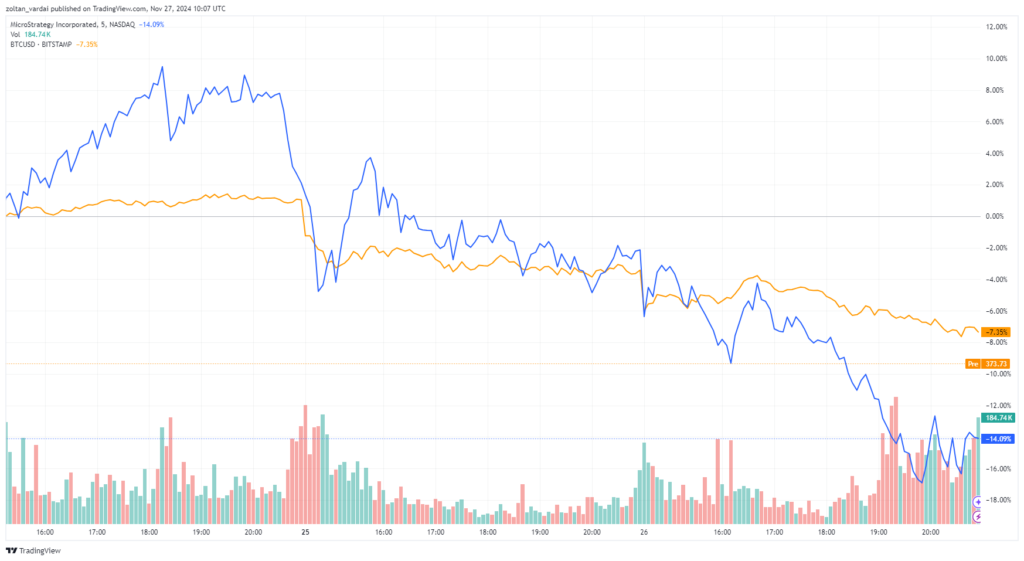

Despite a modest increase in MicroStrategy’s stock price since then, it experienced a decline in tandem with the subsequent Bitcoin correction this week. TradingView data indicated that MicroStrategy’s price decreased by 7.5% in the 24 hours preceding 9:52 am UTC on November 27 and currently trades at $354.10.

Is MicroStrategy still a leveraged Bitcoin trade?

After its record high of approximately $99,800 on November 22, Bitcoin’s correction was concurrent with the stock’s decline.

Nevertheless, Bitcoin and MicroStrategy have demonstrated substantial growth over a broader timeframe. Bitcoin experienced a 44% increase in value over the past month, while MicroStrategy experienced a 32% increase. Bitcoin experienced a 146% increase in value on the annual chart, while MicroStrategy experienced a more than 599% increase.

In anticipation of outperforming the returns of the world’s first cryptocurrency, numerous investors are considering MicroStrategy as a leveraged wager on the Bitcoin price.

Still, the volatility of MicroStrategy’s stock as a Bitcoin proxy is a cause for concern, as its recent 35% decline is more than four times as much as Bitcoin’s correction.

Retail investors and MicroStrategy’s volatility

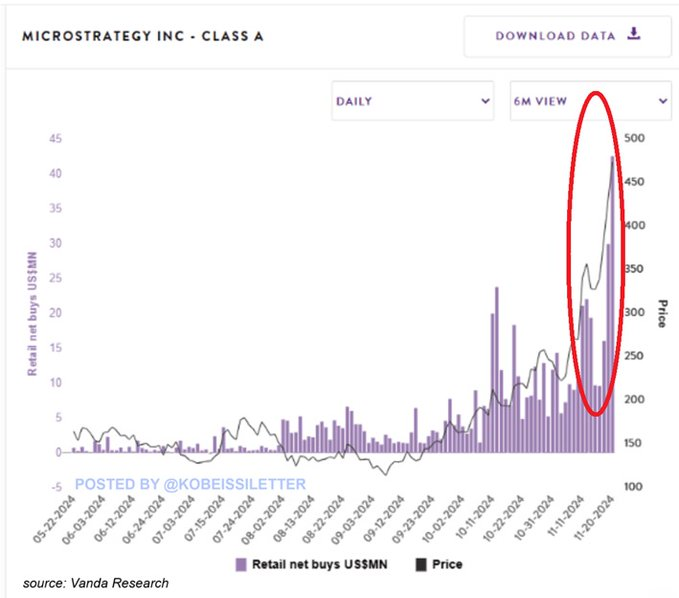

According to the Kobeissi letter, the increasing number of retail traders is the cause of this rising volatility.

“On Wednesday alone last week, retail investors bought ~$42 million worth of MicroStrategy stock, $MSTR. This marked the largest daily retail buy on record and was 8 TIMES higher than the daily average seen in October.”

MicroStrategy’s $2.6 billion note offering contributed to the increased interest of retail investors, who acquired nearly $100 million in the company’s stock over the past week.

Allianz, the second-largest insurance provider in Europe, is among the world’s greatest traditional institutions investing in Michael Saylor’s company. In March, Allianz acquired more than 24% of MicroStrategy’s $600 million note offering.