If its fundraising efforts are successful, Metaplanet could buy around 652 more Bitcoins for $62 million.

Japanese investment firm Metaplanet plans to raise over $62 million (9.5 billion Japanese Yen) through a stock acquisition initiative to expand its Bitcoin treasury, which currently holds 1,142 Bitcoin valued at over $109 million.

In a statement released on Nov. 28, the firm announced it would issue its 12th Stock Acquisition Rights to EVO Fund, a Cayman Islands-based investment management firm, via a third-party allotment totaling 29,000 units.

“The majority of the funds raised this time will be strategically allocated for the purchase of additional Bitcoin,” Metaplanet said.

The company also revealed its strategy of leveraging debt and periodic stock issuance to systematically increase its Bitcoin holdings while mitigating exposure to the depreciating Japanese yen.

Metaplanet noted that Bitcoin’s “prominence continues to grow” after reaching an all-time high of $99,645.39 on Nov. 22.

Meanwhile, the yen continues to weaken, with the USD/JPY exchange rate reaching the 154 mark, prompting concerns. “Given these circumstances, we recognize the urgent importance of increasing our Bitcoin holdings and have therefore decided to proceed with this fundraising initiative,” the statement added.

If approved under Japan’s Financial Instruments and Exchange Act, the stock acquisition plan will run from Dec. 16, 2024, to June 16, 2025.

At the current Bitcoin price of $95,000, Metaplanet could acquire approximately 652 additional Bitcoin if it raises the full $62 million.

The firm also announced a shift in focus away from its “metaverse-related business plans” due to a lack of profitability, incorporating Bitcoin acquisitions as a core part of its corporate treasury strategy.

This marks a continuation of its efforts to increase Bitcoin holdings. In October, Metaplanet completed its 11th Stock Acquisition Rights, raising $66 million (10 billion yen), which was also allocated to purchasing Bitcoin. The company first expressed its intentions to buy Bitcoin in April.

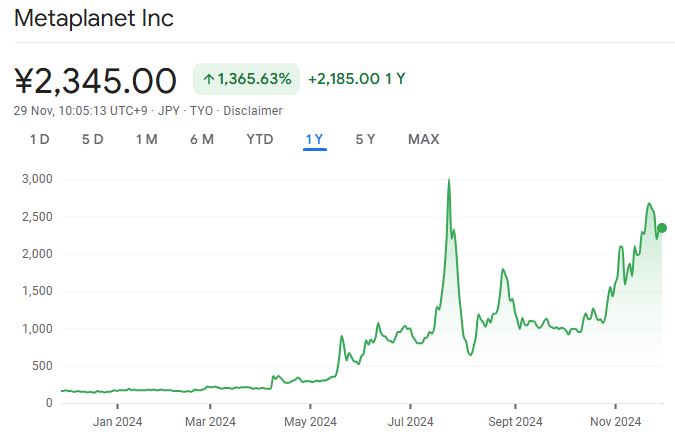

Metaplanet’s stock price has risen 1,365.63% over the past year, currently trading at around $15.60 (2,345 yen), according to Google Finance.

However, it remains significantly below its all-time high of $2,521.76 (379,000 yen) set on Feb. 22, 2013.

Other firms are also increasing Bitcoin in their reserves. On Nov. 25, YouTube alternative Rumble confirmed plans to buy Bitcoin after its CEO hinted at the move.

On Nov. 18, artificial intelligence company Genius Group purchased 110 Bitcoin for $10 million and outlined plans to hold up to 90% of its reserves in Bitcoin.

Tech solutions provider Semler Scientific also acquired 215 additional Bitcoin between Nov. 6 and 15 for $17.7 million, raising its total holdings to 1,273.