In a post on Nov. 29, Ryan Chow, the co-founder of Solv Protocol, announced that the company is launching an “onchain MicroStrategy” to introduce yield-bearing Bitcoin reserves to decentralized finance (DeFi).

“We are developing the first-ever On-Chain MicroStrategy, a transparent, permissionless platform that converts Bitcoin from a passive store of value to an active financial powerhouse,” stated Chow.

Solv’s objective, as per Chow, is to establish a “Bitcoin reserve that is not only strategically managed but also generates yield and enhances returns.”

He needed to provide a specific method by which Solv intended to accomplish this objective.

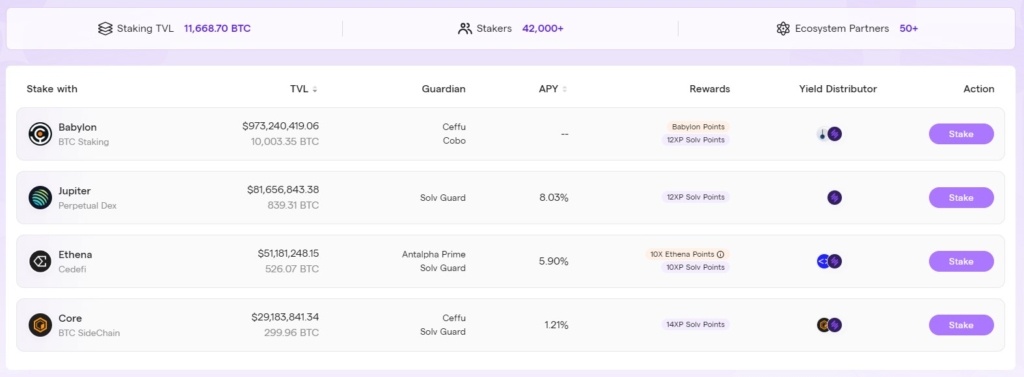

Solv is a Bitcoin staking platform that provides a variety of yield strategies across more than half a dozen blockchain networks.

It generates yield by pledging BTC to Bitcoin layer-2s, including Babylon, CoreChain, and DeFi protocols like Jupiter and Ethena.

According to DefiLlama, Solv manages over $3 billion in total value locked (TVL).

MicroStrategy’s Bitcoin acquisition frenzy

MicroStrategy, a business intelligence firm, essentially transformed into a Bitcoin hedge fund in 2020 when chairman Michael Saylor implemented an ambitious BTC purchasing strategy.

According to data from Google Finance, MSTR shares have increased by over 450% year-to-date, making it one of the most successful equities in 2024.

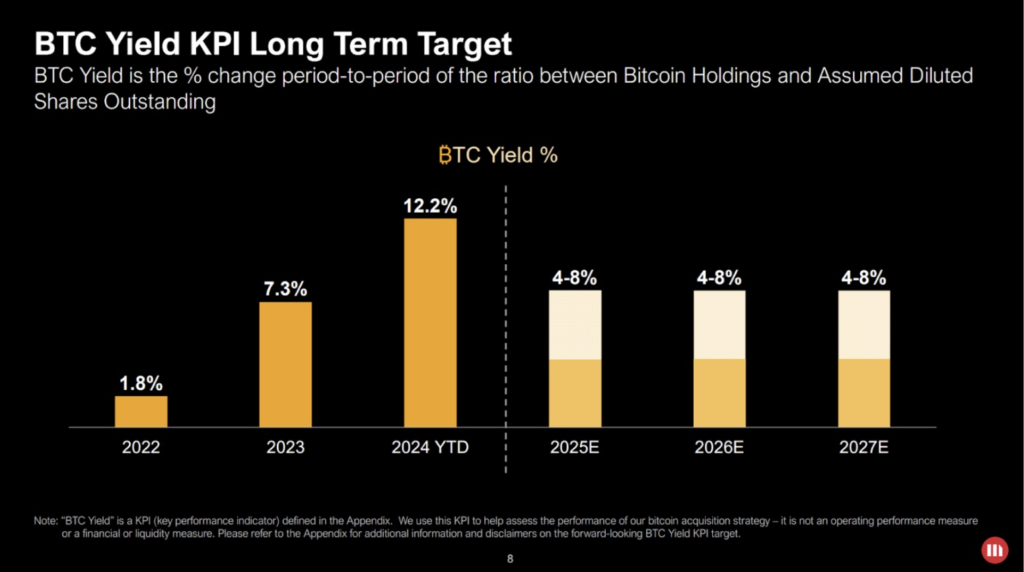

In its Aug. 1 earnings call, MicroStrategy reiterated its commitment to purchasing Bitcoin by establishing a distinctive performance metric: Bitcoin yield.

The Bitcoin yield is a metric that quantifies the ratio of outstanding shares to BTC holdings, effectively establishing BTC-per-share as a benchmark for corporate performance.

MicroStrategy’s objective is to progressively increase its BTC-per-share ratio, which will benefit shareholders by leveraging its balance sheet, primarily through issuing shares or borrowing, to accumulate Bitcoin.

MicroStrategy announced on Oct. 30 that it intended to raise $21 billion in equity and an additional $21 billion in debt to finance a three-year, multibillion-dollar BTC buying binge known as the “21/21 Plan.”

A benchmark analyst, Mark Palmer, anticipates that MicroStrategy will produce a Bitcoin yield of 12.7% in 2025.

According to Chow, MicroStrategy has transformed Bitcoin into “more than a reserve—it is a catalyst for explosive growth.”.

He also stated that its success has “redefined the potential of institutional Bitcoin reserves.”