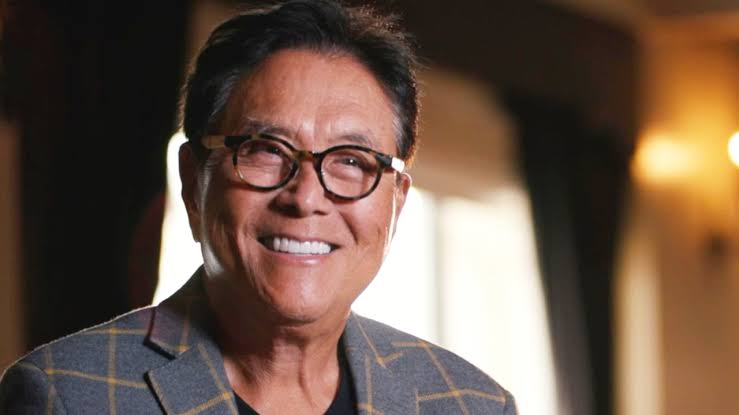

Robert Kiyosaki cautions that Bitcoin may soon surpass $100,000, which would make it more difficult for the middle class to invest. He also encourages early investors to experience FOMO.

Robert Kiyosaki, the author of Rich Dad Poor Dad, has initiated a conversation regarding the potential of Bitcoin to achieve new heights. He recently stated in a post that investors may benefit from FOMO (Fear of Missing Out) as the price of Bitcoin approaches $100,000.

Kiyosaki, a fervent proponent of alternative assets such as gold, silver, and Bitcoin, cautioned that holders of conventional fiat currencies risk missing out.

He thinks that the ultra-wealthy will be the only ones able to afford significant holdings as BTC approaches the $100,000 milestone.

Robert Kiyosaki Warns: As Bitcoin Approaches $100,000, FOMO Is Critical

In a tweet, Robert Kiyosaki recently expressed his conviction that Bitcoin will shortly surpass the $100,000 threshold. He underscored that the middle class will find it increasingly challenging to invest substantial amounts of BTC once it reaches this price threshold.

Kiyosaki contended that individuals who possess conventional fiat currencies, such as the dollar, euro, or yen, will be disadvantaged as Bitcoin becomes more accessible exclusively to the ultra-wealthy.

For an extended period, Robert Kiyosaki has been a vocal opponent of fiat currencies and a proponent of alternatives such as gold, silver, and Bitcoin. He has consistently maintained his belief that Bitcoin provides a unique opportunity to safeguard wealth in a manner that is impossible with traditional currencies.

Kiyosaki has advised those hesitant about Bitcoin to reconsider and adopt the “FOMO” mentality as the price of Bitcoin approaches new highs. He proposed that this apprehension of missing out could encourage more investors to invest in cryptocurrency, benefiting those who enter the market early.

As the author of Rich Dad, Poor Dad underscored,

“The horse will be out of the barn and running. Why? Once Bitcoin breaks $100,000 only the ultra-rich such as corporations, banks, and sovereign wealth funds will be able to afford Bitcoin of any consequence. FOMO is good. Don’t be left behind!”

Kiyosaki’s Criticism of Fiat Savings

Robert Kiyosaki refers to individuals who save in cash or retain fiat currencies as “losers” due to the devaluation caused by inflation.

In his most recent posts, he emphasized the significance of diversifying into assets such as Bitcoin, reiterating this message. His argument is predicated on the assumption that the purchasing power of conventional currencies will continue to be diminished by inflation and government monetary policies.

He anticipates that the Bitcoin price will shortly surpass $100,000 as it continues to increase. He noted that it will be nearly impossible for most individuals to follow up once this milestone is reached.

In addition, Kiyosaki stated,

“Savers are losers…because cash is trash. Bitcoin will soon break $100,000. Once Bitcoin passes $100,000 it will be almost impossible for the poor and middle class to catch up.”

Robert Kiyosaki commended Michael Saylor, the founder of MicroStrategy, for his Bitcoin strategy and commentary on the Bitcoin price. Kiyosaki described Saylor as a “genius” for employing the company’s treasury to acquire Bitcoin worth billions of dollars. He thinks that Saylor’s methodology enhanced MicroStrategy’s balance sheet.

Bitcoin is trading at approximately $96,400, having recently rebounded from a low of $91,000 earlier in the week. Analysts anticipate a BTC rally toward $100,000 shortly, as the cryptocurrency has demonstrated remarkable resilience.