THETA price rises 29% to $3.08, achieving a 12-month high with a market cap of $3.10 billion and 24-hour volume up 351%.

Theta Network’s price surged to a 12-month high of $3.08 within the last 24 hours, following support at an intraday low of $2.28.

This rally increased THETA’s market capitalization by 25% to $3.10 billion, while its 24-hour trading volume skyrocketed by 351% to $548.37 million.

The strong upward momentum has attracted attention from traders and analysts, with speculation growing about whether this rally will sustain.

THETA Price Surges Over 29%

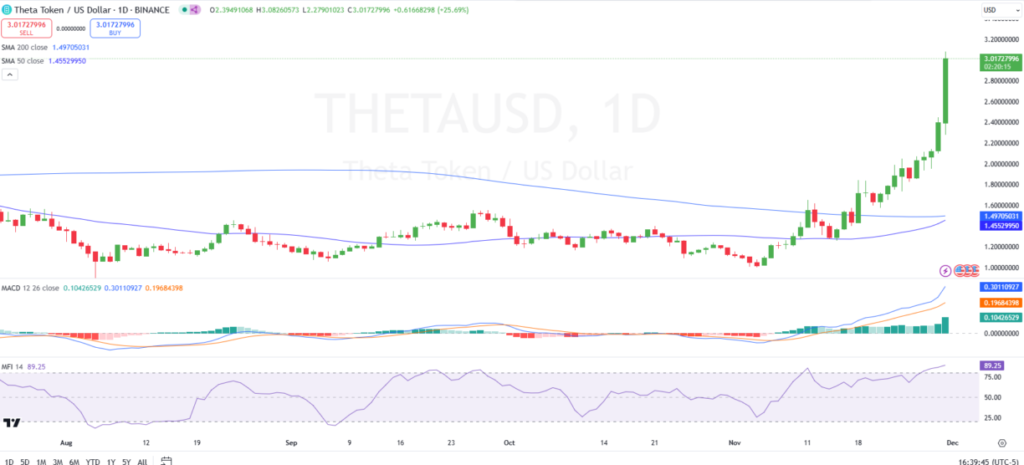

THETA demonstrated impressive gains, rising nearly 29% within 24 hours. The rally began after the price broke above a consolidation zone near $2.40, signaling heightened buying activity. By the end of the day, THETA hit a high of $3.08, reflecting strong bullish sentiment.

On a weekly basis, the price climbed from $2.10 to over $3.00, representing a 59% increase in seven days.

This consistent upward trend, marked by higher highs and higher lows, is viewed by analysts as an indicator of sustained bullish momentum.

The price has broken multiple resistance levels, suggesting traders’ optimism about its short-term potential.

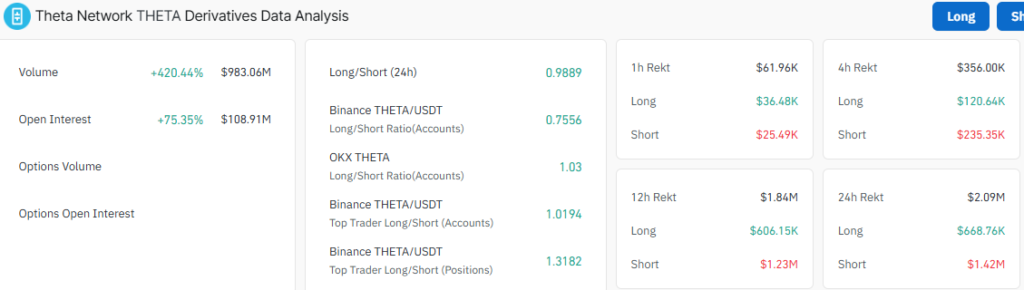

On-chain data reveals that derivatives trading volume jumped 420% to $983.06 million, signaling renewed interest from market participants.

Open interest in THETA derivatives also rose by 75.35% to $108.91 million, with the asset crossing key resistance levels at $2.40 and $2.50, confirming a strong uptrend.

Analysts Predict a 348% Upside

Technical analysts are optimistic about THETA’s potential for further gains. According to World of Charts, a breakout from the descending triangle could result in a rally targeting $9.00, a projected 348% increase from current levels.

Market analyst Javon Marks noted that breaking the long-term trendline signals a reversal of bearish momentum. Marks stated, “The steep upward trajectory and higher highs confirm that the bulls are in control, and the rally could extend to $8.00 in the near term.” He also pointed out that THETA has yet to encounter significant resistance, leaving room for continued growth.

Technical Analysis Supports Bullish Momentum

Technical indicators further validate the bullish outlook for THETA. The MACD (Moving Average Convergence Divergence) is well above its signal line, confirming strong upward momentum.

The widening gap between the MACD and the signal line suggests the uptrend is intact.

The Money Flow Index (MFI) currently sits at 93.69, placing THETA in the overbought zone. While this indicates robust buying pressure, analysts caution that a minor pullback or consolidation may occur before further upward movement.

Additionally, the 50-day moving average is nearing a bullish crossover with the 200-day moving average, forming a potential “golden cross.”

This pattern often signals sustained price increases, further supporting the possibility of a THETA breakout.