Donald Trump’s transition team is considering America-first strategic reserves, including XRP, Solana, and USDC.

Donald Trump, the former U.S. President, is making headlines with his recent proposal to include U.S. founded cryptocurrencies such as XRP, Solana (SOL), and USD Coin (USDC) in America’s strategic reserves.

This groundbreaking idea is part of his broader “America-first” financial strategy, which aims to solidify the United States as a leader in the digital asset revolution.

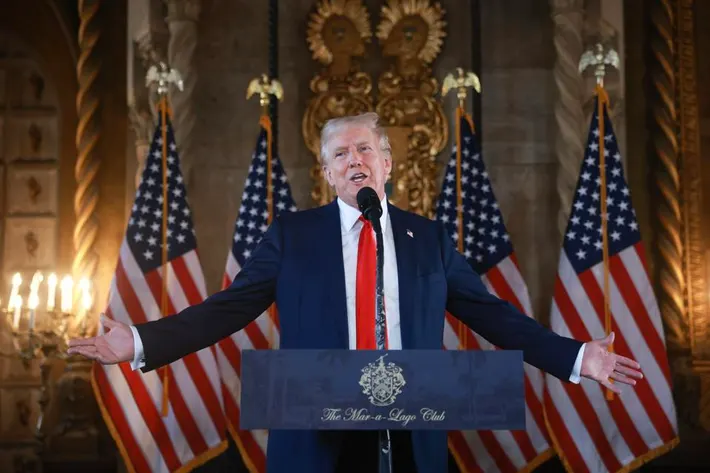

Trump reportedly engaged with prominent crypto leaders in private meetings at Mar-a-Lago, including Ripple CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty.

Trump expressed enthusiasm for integrating cryptocurrencies into the nation’s economic infrastructure, stating, “The future of finance lies in innovation, and America needs to lead this revolution.”

XRP, Solana, and USDC: The New Focus

Trump’s focus on XRP, Solana, and USDC highlights his intent to support U.S.-rooted cryptocurrencies with significant utility and adoption.

Ripple, the company behind XRP, has been at the forefront of cross-border payment solutions. Solana is recognized for its high-speed blockchain capabilities, while USD Coin, a stablecoin pegged to the U.S. dollar, offers unmatched stability for financial systems.

According to insiders, the discussions emphasized how these assets could diversify and strengthen the nation’s financial reserves. “This isn’t just about investing in cryptocurrencies,” said a source familiar with the talks. “It’s about ensuring that America has a stake in the future of digital finance.”

Bitcoin Advocates Voice Concerns

While Trump’s plan has garnered praise from many, it has also sparked debates within the crypto community.

Advocates for Bitcoin, the world’s largest cryptocurrency, have raised concerns about prioritizing altcoins.

“Bitcoin is the most decentralized and globally recognized cryptocurrency,” said a Bitcoin advocate. “Any strategic reserve should have Bitcoin as its foundation.”

Despite these concerns, Trump’s team argues that diversifying into multiple cryptocurrencies is a more forward-thinking approach, especially given the growing use cases for XRP, Solana, and USDC.

Regulatory Shifts Under Trump’s Leadership

Trump’s proposal is not just about building reserves; it signals broader regulatory changes that could reshape the U.S. cryptocurrency landscape.

Industry experts believe his administration could push for the repeal of restrictive policies like the Securities and Exchange Commission’s SAB 121, which has long hindered collaboration between banks and crypto firms.

Trump’s newly appointed AI and Crypto Czar, David Sacks is expected to play a pivotal role in these changes. “The goal is to create a regulatory environment where innovation can thrive,” Sacks said.

He is also set to host the inaugural Crypto Ball in Washington, D.C., an event that underscores the administration’s commitment to embracing blockchain and digital asset technologies.