Olympus DAO is a rebase project that has recently gained popularity owing to its enormous staker return of over 7,000 percent.

The constantly growing field of blockchain technology provides a diverse set of methods and tokenomic models for addressing the blockchain trilemma of building a decentralised, stable, and secure network.

The’rebase’ concept, which is structured in such a manner that token balances can fluctuate over time depending on changes in token price and circulating quantity, has seen numerous variants over the last year.

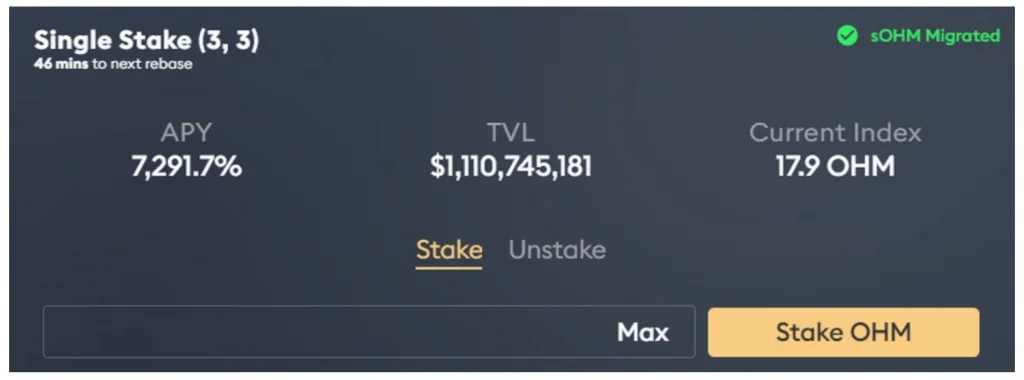

Olympus (OHM) is a rebase project that has piqued the interest of many in the crypto community in recent months, owing to the enormous return given to OHM stakers, which is now above 7,000 percent.

Unlike other protocols on the market, including rebase initiatives like Ampleforth (AMPL), Olympus uses an algorithmic reserve currency backed by a portfolio of assets such as DAI or FRAX that provide OHM an inherent worth that it cannot go below.

Bonding and staking games

Olympus users may improve their portfolio worth by staking OHM on the protocol to gain rebase incentives.

This depends on the amount of bonds sold, the reward rate established by monetary policy, and the number of OHM staked.

Leverage of staked OHM should ultimately outstrip price declines, resulting in a gain in overall value.

Olympus bonding is a hybrid of a fixed income instrument, a futures contract, and an option. Bonders are stated terms for a future trade that contain a predetermined amount of OHM upon vesting.

More POL guarantees that there is always locked exit liquidity in trading pools, which helps to ease market operations and safeguard token holders.

The project began with a $500 initial Discord offering (IDO) and soon climbed to $1,487 before the market meltdown in the second week of April brought the price back to about $163. Even when the price hit a swing low, OHM holders piled coins for a month.

The $OHM presale is now worth $2.5m if you held itThere are less than ~5 people that did pic.twitter.com/ruYiLKgJ92— Jawsus Christ (@sayinshallah) October 8, 2021

IDO participants who never unstaked their original shares would be sitting on an OHM war chest worth over $1 million, according to Olympus DAO team members.

Growing treasury and plans

Profits from the Olympus market are placed into the project’s treasury. The Olympus DAO treasury currently houses over $100 million in assets, making it DeFi’s second largest after Uniswap.

Olympus has also recently conducted office hours to debate two ideas before the community, including adding LUSD to the treasury and whether or not Olympus should deploy to the recently launched Ethereum (ETH) layer-two solution Arbitrum.

The TokeMAK community just decided to incorporate Olympus DAO in its reactor network, and an OHM/TOKE staking pool is anticipated to open next month.

It’s too early to tell how rebase projects like Olympus and Ampleforth will do in the long run, but a quick look at the daily chart indicates that OHM is now trading at $1,286 and is on the approach of printing a new all-time high.

While the notion is one of the most recent to arise in the crypto ecosystem, it is a trend that is gaining traction as the global financial system looks to be moving toward a new currency standard.

The author’s thoughts and opinions are purely his or her own and do not necessarily reflect those of Cointelegraph.com. Every investing and trading decision entails risk, so do your homework before making a decision.

The author’s thoughts and opinions are purely his or her own and do not necessarily reflect those of coinscreed.com. Every investing and trading decision entails risk, so do your homework before making a decision.