Last Monday, Facebook unveiled Novi, its long-awaited digital wallet, a blockchain-based platform aimed at disrupting the remittances market.

Novi, which is now in beta, will let users transmit money from the United States to Guatemala using the stablecoin digital currency Pax Dollar, which they can store in a digital wallet and change into local currency. Facebook eventually aims to utilize its own cryptocurrency, Diem, for the service, but it won’t be able to do so until it has regulatory permission in the United States.

While the first trial limited Novi to this one route, the firm is anticipated to grow to other corridors — and some investors are already concerned about the impact it would have on more established remittances providers.

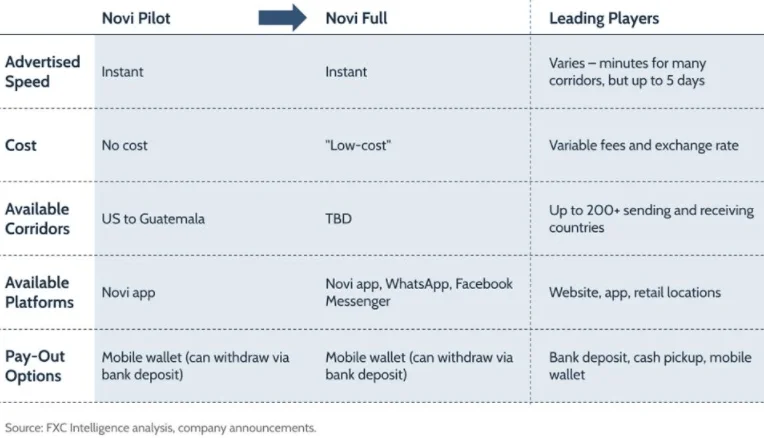

Novi from Facebook: How does it compare to remittance competitors?

On hearing of the pilot’s debut, the stock prices of Novi’s main publicly-traded competitors, Remitly, Western Union, and MoneyGram, all plummeted, with the mobile-first Remitly suffering the greatest decline. However, the initial trial has severe restrictions, and doubts remain regarding Novi’s remittance service in its ultimate form.

The usage of the Pax Dollar for the pilot severely restricts the number of users who may either retain the digital currency or deal with it on a given day, with a total restriction of 200,000. As a result, Facebook has created a backlog for Novi and imposed a number of restrictions, including a $300 transaction cap, a $1,000 daily send limit, and a $2,500 daily maximum on depositing or withdrawing funds from each account.

Novi is now offering its remittance service without any fees or FX margin, as would be expected in a test and comparable to many other money transfer service start plans. However, the fact that a service is provided for free does not ensure its success. While Revolut is a fantastic example of a firm that built its user base by giving a free foreign exchange, PagoFX, a Santander subsidiary, tried the same thing and failed to gain traction in the market.

While there is some anxiety in the market that Facebook’s free model is a long-term strategy, the company’s own terminology suggests that this is most likely a one-time scenario. The firm’s website expressly declares that it is free “today,” and job postings characterize the company as seeking to provide a “low to no cost” service.

Facebook takes on remittances: Novi’s offering

Beyond remittances: Long-term plans

In the long run, Facebook appears to be aiming to use Novi for purposes other than remittances, citing in job postings:

“As time goes on, Novi will offer more use cases including commerce transactions and other financial services.”

Rather than competing in the core remittances industry, this suggests a goal to make the digital wallet a rival to super-app PayPal. However, Novi must be accessible in its ultimate version — that is, running on the Diem blockchain and cryptocurrency rather than the existing Pax Dollar stablecoin – in order to reach this point.

The commencement of the Novi pilot implies that Facebook is optimistic that Diem will be allowed by authorities shortly, despite the fact that it is not without critics.

The pilot, for example, prompted a group of Senate Democrats, including Brian Schatz and Elizabeth Warren, to write an open letter to Facebook CEO Mark Zuckerberg, expressing concerns about the pilot’s “aggressive timeline” and arguing that Novi was “incompatible with the actual financial regulatory landscape” and posed risks to the US’s financial stability.

Overall, there’s no doubt that Facebook has the user base, product, and strategic acumen to execute and capture remittance market share. What’s more difficult to predict are the political and regulatory obstacles that Facebook may continue to confront, some of which are exclusive to Facebook and others that affect the whole business.

Furthermore, there are tough considerations about whether US dollar stablecoins should be considered the same as fiat US dollars, not only in the United States, but in any foreign area where Novi operates.