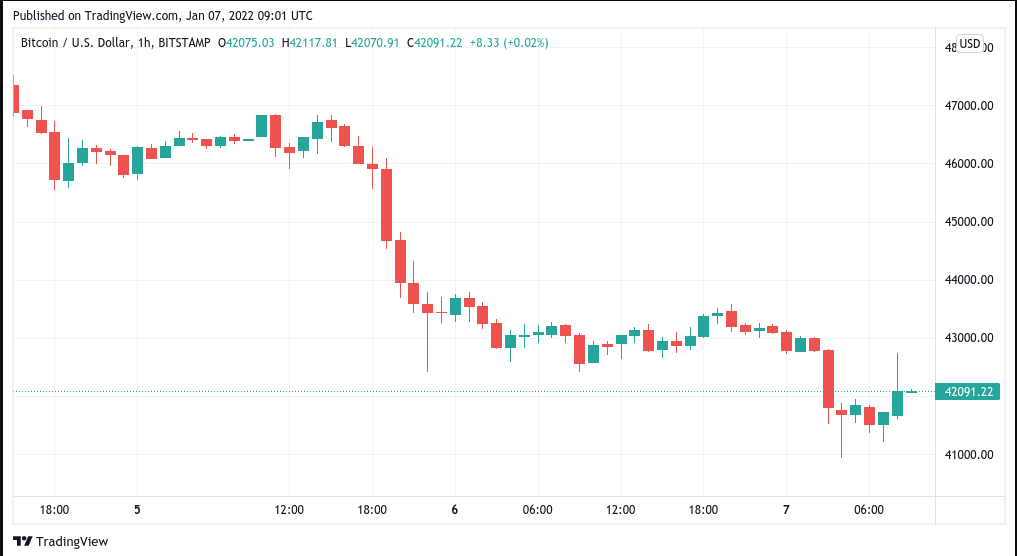

BTC/USD fell to $40,938 on Bitstamp overnight, according to TradingView data – its lowest level since September.

Bitcoin could be aiming for a price over $42,400,000

The pair temporarily recovered at $42,000 but then continued to fall, surpassing the December liquidation cascade’s floor.

Traders discussed the possibility of a similar crisis occurring, with specific objectives including a drop below September’s $30,000 lows.

“Could possibly fall below September lows with a liquidation wick,” famous Twitter trader Crypto Ed cautioned in his latest forecast.

Thus, Bitcoin’s present price level also threatens to disappoint trader Anbessa on daily timeframes.

#Bitcoin price action explained (3/4)Zoomed in: Bearflag channel support hit after fakeout ✔️Inv H&S support hit again (2nd time) ✔️While I would tolerate a fakeout to $39.333 intradaythis support right now $42,4k should hold DAILY pic.twitter.com/Qv69dekie9— AN₿ESSA (@Anbessa100) January 6, 2022

Commentators suggested that macroeconomic odds were stacked against Bitcoin and crypto, with headwinds emanating from, among other places, developments in Kazakhstan, which hosts an estimated 18 percent of Bitcoin hash rate.

Following widespread internet outages this week, hash rate estimates began to show a sharp decline of roughly 20 exahashes per second (EH/s) from previously all-time highs of 192 EH/s – echoing last year’s Chinese miner exodus.

Others, though, have remained pessimistic about the crypto market’s future prospects due to macroeconomic policy.

Among them was Arthur Hayes, the former CEO of derivatives exchange BitMEX, who cited the US Federal Reserve’s upcoming rate hikes and reduced asset purchases as reasons for risk-asset investors to avoid risk assets.

The money printer ain’t going BRRR, so #crypto is about to get bludgeoned with a two-by-four studded with rusty nails. Read my essay “Maelstrom” to find out why.https://t.co/qUPq90W4qz pic.twitter.com/sKUA4i9dF5— Arthur Hayes (@CryptoHayes) January 6, 2022

“Given the law of large numbers, a simple resumption of the previous trend in asset purchases will not cause the growth of the money supply to suddenly and sharply accelerate. Therefore, while risky assets would rejoice — crypto included — the best case is that asset purchases slowly grind higher towards their previous all-time highs,” he claimed.

“Even if that happens, the only way the crypto markets would move up is if the Fed publicly turned on the taps, and then fiat flowed into crypto.”

The Fed has yet to announce a date for raising rates, despite the fact that purchase cutbacks have already begun.