Three U.S. Senators proposed a bill dubbed Accountability for Cryptocurrency in El Salvador Act (ACES) that aims to “mitigate potential risks to the U.S. financial system” such as money laundering and terrorism funding. The development has sparked a backlash from El Salvador’s president urging them to stay out of his country’s business.

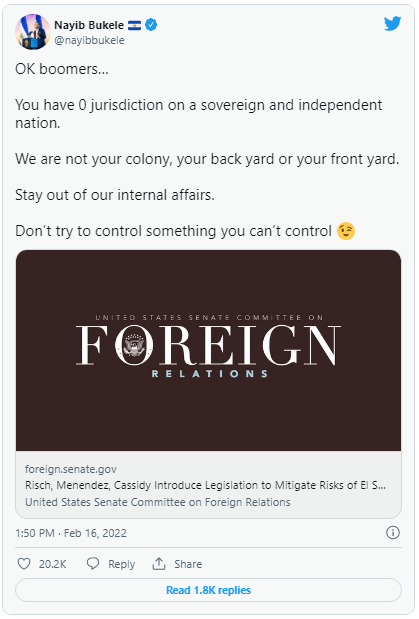

El Salvador’s President, Nayib Bukele, issued the following statement after US Senators submitted fresh legislation to probe the Central American country’s Bitcoin law. “We are not your colony, back yard, or front yard,” says the narrator. “Don’t meddle in our domestic matters.“

Since El Salvador’s government implemented the Bitcoin Law in 2021, governments around the world, as well as some of the world’s most powerful financial organizations, have voiced strong opposition to cryptocurrency.

President Bukele reacted angrily to the new suggestion by a bipartisan group of senators – Republican Senators Jim Risch and Bill Cassidy and Democratic Senator Bob Menendez.

He stated that the United States has no authority over a sovereign and independent nation, and urged Senators to “keep out of the internal affairs” of other jurisdictions.

El Salvador’s use of Bitcoin as legal cash, according to Risch, raises serious worries about the country’s economic stability and financial integrity as a “sensitive US trading partner” in the Central American region.

El Salvador’s new strategy, according to the Senator, has the “potential to undercut” US sanction policies, so encouraging harmful actors such as China and organized criminal groups. He continued,

“Our bipartisan proposal seeks more clarification on El Salvador’s policies and urges the administration to manage any financial system risk in the United States.”

El Salvador’s Bitcoin Law, according to Cassidy, will facilitate money laundering cartels and harm US interests.

About the Bill

If the bill passes, federal agencies will have 60 days to submit a report to Congress’s proper committees evaluating various elements of El Salvador’s technical capacity.

The report will detail the steps taken by Salvadorean policymakers to develop and enact the Bitcoin Law, as well as an assessment of its regulatory framework and how it would address financial integrity and cyber security risks associated with virtual currencies, as well as whether it meets FATF requirements

Furthermore, the influence on individuals and enterprises, as well as the economy’s impact on Bitcoin as a legal tender. The study would also cover a number of additional potential ramifications for El Salvador’s macroeconomic stability and the state budget.

The unbanked population, the flow of remittances from the United States, the country’s interactions with international financial institutions, the bilateral economic and commercial relationship with the United States, and the possibility of El Salvador using the dollar less, are just a few examples.

The next section would examine El Salvador’s internet infrastructure, as well as “the extent to which cryptocurrency is employed” in the country.