More than $10 million in investor monies were allegedly taken by the brains behind the suspected cryptocurrency Ponzi scheme known as Bitstream Circle. On March 13, 2022, some of the scheme’s investors began experiencing withdrawal issues, which is when the alleged theft was discovered.

Withdrawals Blocked

Investors in an alleged crypto Ponzi scheme, Bitstream Circle, are reportedly unable to withdraw funds following the scheme’s collapse, according to reports from Kenya. According to the claims, the scheme’s masterminds may have made off with over $10 million in digital assets from investors.

According to one report, the suspected Ponzi scheme was registered as Bitstream Circle Limited in the United Kingdom in November 2021, with Chinese national Quin Yang identified as the director. In less than four months, the plan had gathered over 11,000 participants from seven nations, according to the study. According to the research, the majority of the victims were enticed by the promise of a daily return on investment of between 5% and 8%.

Kenyans may have lost millions in yet another cryptocurrency fraud, according to new claims, which come after a Kenyan government official estimated $120 million had been lost in similar schemes in the previous fiscal year. While many of the scheme’s investors now consider Bitstream Circle to be a fraud, the platform’s early investors initially ignored the claims.

However, as a post released on Linkedin by Kimani Capital reveals, many investors began having trouble withdrawing funds on March 13, 2022. Initially, a statement from the administrator of Bitstream Circle’s telegram channel suggested that the issue was caused by a network update. Despite the completion of the so-called five-hour network update, investors were still unable to withdraw their monies.

The Lure Of Huge Returns

Meanwhile, authors of research released by Kimani Capital point to more than 10 million USDT stablecoins received by an address purportedly owned by scammers to buttress claims criminals may have stolen millions from naive investors.

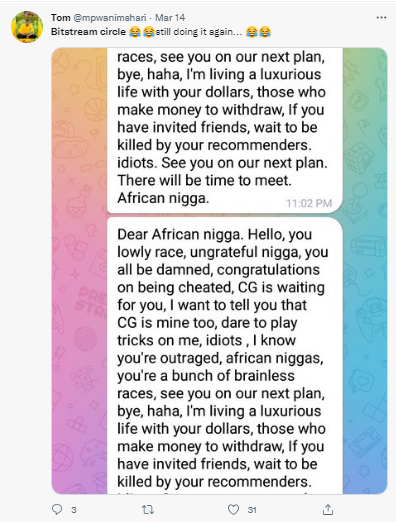

Users have been posting a screenshot that purports to show one of the masterminds mocking the victims on Twitter. Other commenters bemoaned how young investors, in particular, are still being deceived by promises of extremely large returns in a short period.