The new crypto tax policy approved by India is based on its gambling and lottery ticket win tax rules.

The Indian Finance Bill 2022, which includes new 30% crypto tax laws, was approved by Rajya Sabha, the upper house of the Indian parliament, today, and will take effect on April 1.

The law is approved by the upper chamber of parliament within a week after the lower house (Lok Sabha) approves it.

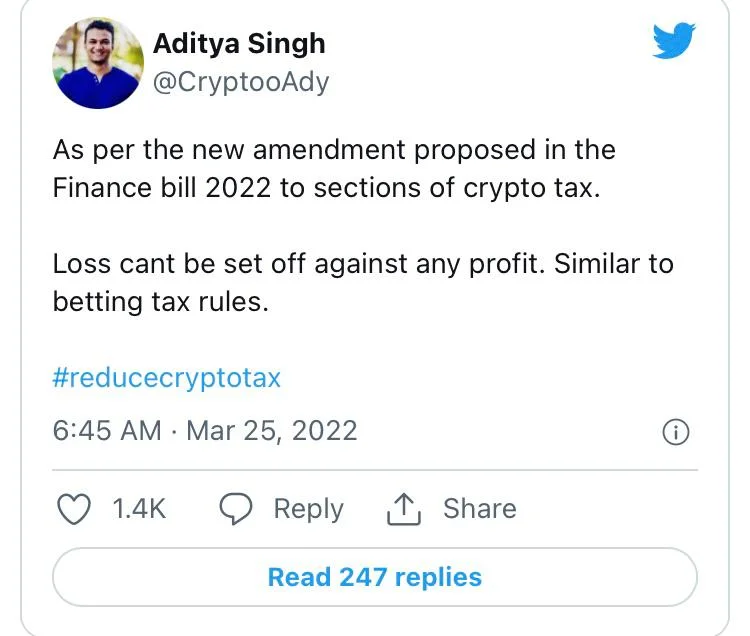

The Finance Bill was introduced in January during the parliament’s budget session 2022-23. The Finance Bill changed tax regulations to levy a 30% crypto tax on holdings and exchanges of digital assets. Aside from that, traders will not be able to credit their losses against earnings, and each trading pair would be treated separately for tax purposes.

As if a 30% tax wasn’t bad enough, the government also imposed a 1% tax deduction at source (TDS) on each trade, stating that this would help them track finances. Exchange operators, on the other hand, have warned that the 1% TDS will dry up liquidity.

Various analysts, dealers, and exchange operators have studied the controversial bill. The government, on the other hand, decided to stick to its regressive policy without consulting the crypto ecosystem’s stakeholders.

The fact that the new crypto tax was substantially inspired by countries’ gambling and horse betting tax legislation is another source of resentment within the crypto community. This means that the Indian government considers the cryptocurrency market to be similar to gambling.

Despite years of assurances, India’s new crypto tax policy was drafted and passed in less than two months, although the Finance Ministry has yet to create a regulatory framework for the young business. Many crypto entrepreneurs in the country believe it will result in a brain drain, with traders turning to decentralized exchanges and outside platforms to conduct their crypto trading.