Binance Futures, Binance’s derivatives arm, has delisted coin-margined LUNA perpetual contracts, following Terra network’s coins Luna (LUNA) and TerraUSD (UST) collapse.

“To avoid automatic settlement, users are encouraged to cancel any open positions prior to the delisting time,” the site says in a statement.

Binance Futures has also begun to settle contracts automatically, lowering leverage tiers and updating margin tiers for coin-margined LUNA perpetual contracts.

As a result, the 8x leverage tier has replaced the 21-25x leverage tier as the largest leverage tier accessible on Binance for LUNA perpetual contracts. According to the new statistics, 11-20x leverage is reduced to 7x, and 6-10x leverage is replaced by a 6x leverage tier.

Existing roles that were created before the change would not be affected, according to the notice.

Binance also stated that it “reserves the right to adjust the maximum leverage and margin tiers for USDT-margined LUNA perpetual contracts at any time without warning.”

The new Binance Futures trading updates come after Binance stopped LUNA and UST withdrawals on Tuesday due to a huge selloff of tokens on the Terra network, with the UST stablecoin losing its dollar peg and plummeting to $0.67.

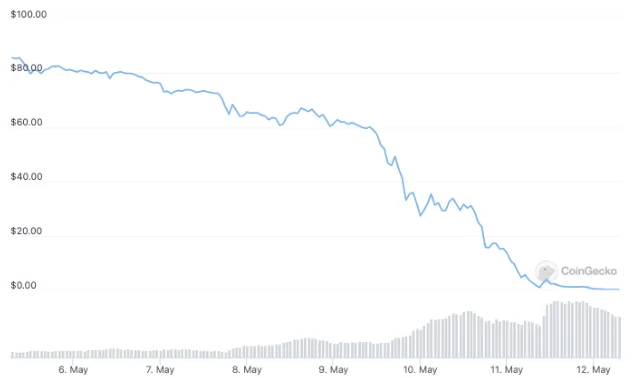

The UST stablecoin, which was supposed to maintain its 1:1 peg with the US dollar, fell as low as $0.30 on May 11, while its sister token LUNA lost more than 99 percent of its value at the time of writing.

The events sent shockwaves through the cryptocurrency industry, with the overall market capitalization plunging by nearly $600 billion.

To preserve the stablecoin’s 1:1 ratio, UST is an algorithmic stablecoin based on a system of swaps between LUNA and UST as well as LUNA token burns.

Unlike the UST stablecoin, significant stablecoins like Tether (USDT) and USD Coin (USDC) are fiat-backed stablecoins, meaning that their value is maintained by equal currency reserves.