Here is all you need to know about the recent crypto crash resulting from the dropped price of Bitcoin (BTC)

Since its peak in November 2021, Bitcoin’s value has dropped by more than half, causing the whole cryptocurrency market to crash. The fall had an impact on TerraUSD, a linked token that is generally steady.

According to Coinscreed, Terra’s native LUNA token nearly collapsed to zero and traded at $0.00005. Just over a month ago, LUNA was trading at $119.18.

And, as a result, investors are fleeing key crypto-currencies, sending prices crashing. Stablecoin firms want to keep their tokens at parity with assets like the US dollar, with one token equaling $1.

Crypto Crash: “The Panic”

On Twitter and Google Search, the term “crypto crash” has been trending.

And the total market value of all cryptocurrencies is now estimated to be $1.12 trillion, down over a third from November, with more than a third of that loss occurring this week.

Bitcoin is now worth around $30,000 at the time of writing, down from a high of roughly $70,000 late last year and its lowest value since December 2020.

Ethereum, the second most valuable cryptocurrency, has lost 20% of its value in the last 24 hours.

Terraform Labs, the firm behind TerraUSD and Terra Luna, stopped trading on its blockchain on Friday, an unprecedented and contentious move.

The relocation was necessary, according to the corporation, in order to “come up with a plan to rebuild it.”

Do Kwon, the founder of Terraform Labs, had previously tweeted:

“I understand the last 72 hours have been extremely tough on all of you – know that I am resolved to work with every one of you to weather this crisis and we will build our way out of this.”

— Do KwonA proposal to shore up Terra Luna by producing extra tokens was described, however, many Twitter users are pleading with the corporation for assistance after losing big sums.

Meanwhile, the company’s Discord server, a platform where investors gather to discuss concerns, announced that it had been “shut down” so that “new people can’t come in and create fear, worry, doubt, and disinformation.”

What Caused The Crypto Crash?

1. Bitcoin (BTC) Crash

A cryptocurrency that advertised itself as a reliable medium of exchange has gone bankrupt. Since Monday, a drop in cryptocurrency values has wiped away more than $300 billion.

Bitcoin’s price dropped to its lowest level since 2020. The value of Coinbase, a big bitcoin exchange plummeted.

This week, the crypto world fell into a complete breakdown, illustrating visually the perils of the experimental and unregulated digital currency.

Even as celebrities like Kim Kardashian and tech billionaires like Elon Musk tout crypto, the increasing falls of virtual currencies like Bitcoin and Ether indicate that two years of financial gains can vanish in an instant.

The fear triggered the worst cryptocurrency reset since Bitcoin fell by 80% in 2018. However, because more people and institutions own the currencies this time, lowering prices has a larger impact.

Some traders compared the worry and fear to the commencement of the 2008 financial crisis, as critics suggested the collapse was long overdue.

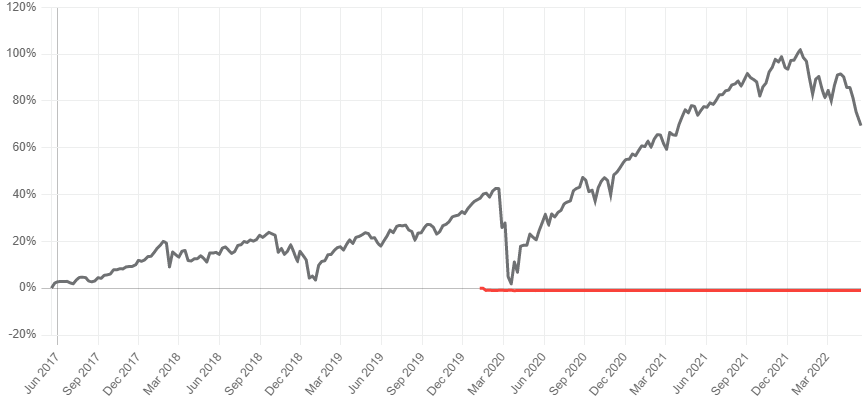

Bitcoin Recorded Weekly Fall For Sixth Week

Last week’s negative price movements resulted in bitcoin’s weekly closing falling for the sixth week in a row, a first for the asset in nearly eight years. The last seven days, though, have been considerably more brutal.

The worst trading day was May 12, when Bitcoin fell from just over $30,000 to $25,300, its lowest price since late December 2020.

Despite rebounding quickly and regaining thousands of dollars in a matter of days, the cryptocurrency ended the weekly candle lower than the previous one.

With seven successive candles in the red, it had created its longest bearish weekly stretch (on Bitstamp).

2. Terra (LUNA) Crash

Terra’s native LUNA token nearly collapsed to zero, currently trading at $0.00005. Just over a month ago, LUNA was trading at $119.18.

Despite the fact that the circulating supply of LUNA has now reached 6.5 billion tokens, the UST stablecoin has been rendered virtually worthless, trading at only $0.18.

What Is Behind LUNA Fall In Price?

The reason for LUNA’s free fall is that it was paired with UST.

UST is a stablecoin based on an algorithm. Unlike stablecoins like USDC and USDT, which are backed by real-world assets, algorithmic stablecoins are not. Instead, this type of stablecoin is run by smart contracts that run themselves.

With this arbitrage between the stablecoin and LUNA, there was pressure to sell LUNA, which made the token crash happen faster.

The Terra token is designed to help stabilize UST at its dollar peg with a “mint-and-burn” mechanism.

Users could swap $1 worth of LUNA for UST, and vice versa. Each time Terra’s token is swapped for the algorithm stablecoin, that LUNA is also burned.

Last week, though, this mechanism was put under a lot of pressure, and UST’s dollar peg began to slip quickly.

What Are Stablecoins?

Stablecoins are digital assets whose value is linked to the value of another currency, commodity, or financial instrument. A stablecoin is a type of cryptocurrency that helps to keep its value consistent.

Bitcoin and Ethereum, for example, lost a significant chunk of value last week. The coins were supposed to be saved with stablecoins. Everything, however, went wrong.

Stablecoins are designed to be an alternative to the excessive volatility of the most popular cryptocurrencies, such as Bitcoin (BTC), which has made such investments unsuitable for widespread use in transactions.

A Failed Attempt

Any of the Stablecoins are supposed to hold their value over time. Fiat currencies such as the US dollar, gold, and even other cryptocurrencies back them up.

The demise of Bitcoin had a significant impact on Terra and TerraUSD. Terra’s functioning is to blame for this.

Terra (LUNA) and TerraUSD (UST) are the Terra network’s native tokens. TerraUSD uses algorithms to keep its peg to the US dollar.

So, in order to mint UST, one must burn the same number of LUNA in dollars. It operates in the opposite direction as well. This is how the protocol keeps the UST price stable.

As reserve backers, many stablecoins are used. Terra USD, the fourth-largest of them, fell from $1 to 30 cents last week.

Although their purpose is apparent, Stablecoins failed when no one expected them to. Stablecoins should have maintained strong during the fall, according to experts, putting the asset class back into focus.

2 Cryptocurrencies That Stood Out In Recent Crypto Crash

Unsurprisingly, both are Stablecoins

1. USD Coin

Stablecoins, unsurprisingly, outperformed all other cryptocurrencies. During the recent upheaval, USD Coin (USDC-0.10 percent) stood out as one of the most stable of the stablecoins.

With a market capitalization of approximately $51 billion, it is the fourth-largest cryptocurrency.

What Makes The USD Coin So Consistent?

All of the company’s tokens are fully backed by a mix of cash and short-term US government bonds. This means that the stablecoin can be redeemed in US dollars for one dollar.

It also helps that the business behind USD Coin, Circle, a global financial technology firm, strives for transparency. Circle has money-transfer licenses in 46 states, Washington, D.C., and Puerto Rico.

Monthly attestation reports, prepared by accounting firm Grant Thornton, detail the reserve amounts that back up USD Coin.

Visa, the world’s largest payment processor, has chosen USD Coin as the first cryptocurrency to be approved as a settlement alternative. This decision by Visa, which was announced in March 2021, gives USD Coin even more credibility.

2. Binance USD

You won’t be surprised to learn that another popular stablecoin scarcely moved throughout the crypto crisis. While other digital tokens were falling, Binance USD (BUSD -0.05%) remained stable.

With a market cap of about $17.8 billion, it is the world’s tenth-largest cryptocurrency.

Binance USD, like USD Coin, is backed entirely by US dollars. The stablecoin’s official website even refers to it as “digitized [sic] US dollars.”

Binance USD was created in 2019 by Binance, a large cryptocurrency exchange, and Paxos, a financial technology firm focused on blockchain solutions.

The New York State Department of Financial Services has approved the stablecoin. Paxos makes monthly attestation reports for Binance USD available online, which are generated by accounting firm Withum.

Binance USD can be traded on Binance’s exchange, as expected. The stablecoin is, nevertheless, supported by over 20 different cryptocurrency exchanges.

How To Make Profit From Possessing USD Coin, Binance USD

You wouldn’t have taken the beating that practically every other cryptocurrency has endured in recent days if you held USD Coin or Binance USD. However, simply possessing stablecoins would not have resulted in any profit.

There is a way to profit by staking both cryptocurrencies. Staking entails pledging your tokens to the underlying blockchain to support transaction completion.

Annual rewards for staking USD Coin are currently as high as 12%. Staking Binance USD might yield you up to 13.3 percent. Yields vary depending on the exchange and how long you stake your tokens.

Bottom Line

Crypto crash taught lessons this week. Top altcoins like Terra can lose value overnight and struggle to exist.

The notion behind decentralized algorithm stablecoins like TerraUSD is intriguing, but it requires a stronger strategy. For their low currency reserves, centralized stablecoins like Tether (USDT) appear powerless.

This recent incident will go down as a momentous milestone in the crypto business and serve as a wake-up call for crypto fans.