Despite crypto prices’ range trading digital asset investment products saw inflows totaling $100 million last week

Key Points

1. Despite cryptocurrency prices fluctuating, inflows into digital asset investment products totaled $100 million last week.

2. Last week, Bitcoin received $126 million in inflows, increasing the total year-to-date inflows to slightly over half a billion dollars, or $506 million. Inflows into short-term bitcoin totaled $1.3 million last week.

3. Ether is still losing money, with another $32 million in outflows this week. Ether has had outflows for nine weeks in a row, indicating persistently poor market sentiment.

Digital Asset Investment Products Total $100 Million

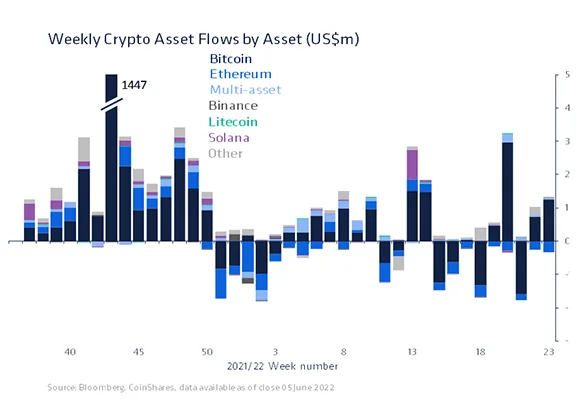

Despite digital asset fluctuating, inflows into digital asset investment products totaled US$100 million last week. Total assets under management (AuM) now stand at $39.8 billion.

The flows were primarily from the Americas, totaling $88 million, while European flows were only $11 million, with year-to-date inflows of $570 million and outflows of $41 million, indicating that European investors have been significantly more negative this year.

Weekly Digital Asset Flow By Asset, Institution

Last week, Bitcoin experienced inflows of US$126 million, increasing the total year-to-date inflows to a little over half a billion dollars, at US$506 million. Inflows into short Bitcoin totaled US$1.3 million last week.

Despite their tiny size, year-to-date inflows account for 30% of total AuM (US$55 million), second only to Solana inflows.

Inflows totaling US$4.3 million were reported in multi-asset investment products, which have seen continuous inflows during this period of unfavorable market action.

Last week, altcoins saw almost no inflows, indicating that investors are fleeing to Bitcoin’s relative safety.

Ethereum Investment Products

Ethereum is still losing money, with outflows totaling US$32 million in the last week. ETH has seen outflows for 9 weeks in a row, indicating persistently poor investor sentiment. However, after December 20, 2021, the outflows have only accounted for about 7% of total AuM.

Ethereum investment products continued to be the worst-performing for institutional investors in 2022. So far this year, the world’s second-most popular digital asset products have lost nearly $169 million in institutional investment, compared to $252 million in Bitcoin products.

Crypto Investment Products

Due to a market correction in the first quarter of 2022, the total number of crypto investment products launched fell dramatically compared to the same period last year.

“The overall number of investment product launches has cooled, with only 11 in Q1 2022 versus 24 in Q4 2021. Of the 23 different investment products by asset type, 10 were launched this year. There has been a focus on altcoins, most notable of which were Avalanche, Tezos and Terra with US$49m, US$30m and US$16m of assets under management respectively.”

Coinshare Research