FTX US subsidiary as part of a deal aimed at “improving” the company’s stock offering has purchased Embed Financial Technologies.

FTX US said in a statement on Tuesday that it will buy Embed Financial Technologies and its subsidiary, clearing firm Embed Clearing, for an undisclosed sum “subject to usual closing conditions and regulatory approval.”

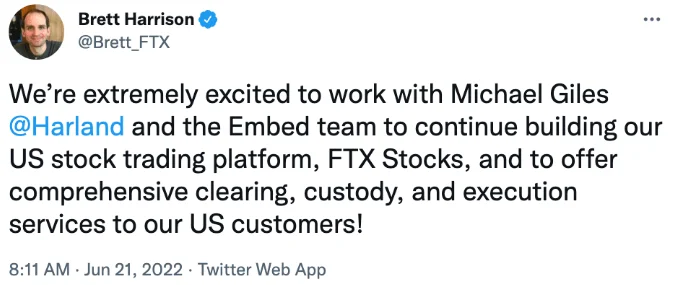

FTX Stocks partnered with Embed Clearing to “execute, clear, and custody” user accounts and trades, following the crypto firm’s announcement in May that it will establish a stock trading platform.

The acquisition of the clearing firm, according to FTX US president Brett Harrison, will provide the technology and infrastructure needed to facilitate the crypto exchange’s stock offering.

Since May, the FTX Stocks platform has been in beta testing for a restricted group of US consumers, with the exchange announcing on Tuesday that it will be available to all domestic users sometime this summer.

The Financial Industry Regulatory Authority, Depository Trust Company, National Securities Clearing Corporation, Nasdaq, and Investors Exchange are all members of Embed Clearing.

In August 2021, FTX US bought LedgerX, a crypto derivatives platform, as part of a plan to provide options and futures contracts on Bitcoin (BTC) and Ether (ETH) (ETH). In contrast to crypto firms like Coinbase, Crypto.com, and Gemini, who have all announced workforce cuts, FTX CEO Sam Bankman-Fried stated that the exchange will continue to hire new employees.

Following the announcement of the acquisition, FTX raised $400 million in a January investment round, valuing the company at $8 billion. BlockFi also announced on Tuesday that it has agreed to a $250 million revolving credit facility with parent company FTX.