USDT’s supremacy on the Ethereum network may be coming to an end, as USDC’s real-time volume has nearly doubled that of USDT in the last 24 hours.

USDC is challenging Tether’s USDT for the title of best stablecoin in crypto after its daily real volume’ on the Ethereum network doubled on Tuesday.

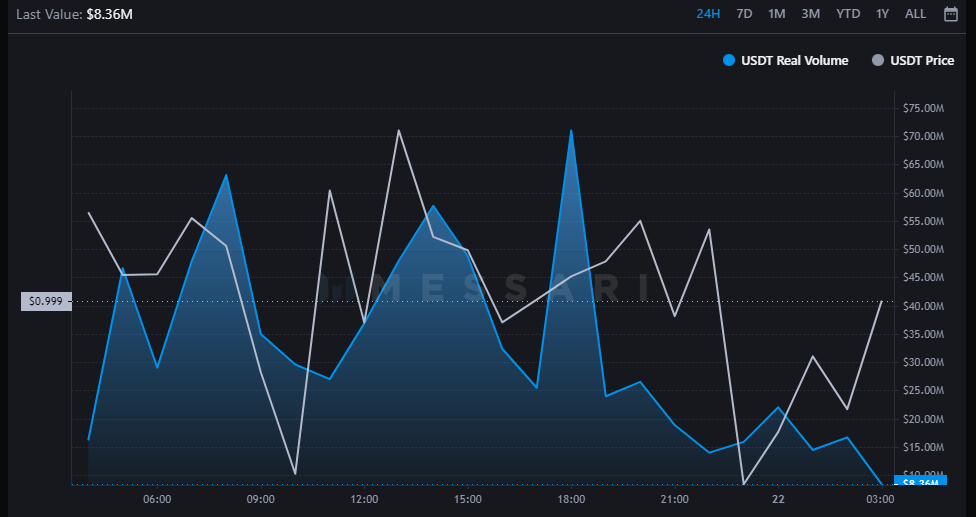

Circle’s USDC had $1.1 billion in daily real volume on the Ethereum network on June 21, which was double USDT’s real volume of $579 million, according to crypto market analytics tool Messari.

Messari’s actual volume measure differs from the more generally recognized “total volume” statistic in that it is created by aggregating data exclusively from exchanges that it feels have “substantial and legitimate crypto trading volumes.”

Messari’s Real Volume statistic includes exchanges like Binance, Bitfinex, Bitflyer, Bitstamp, Bittrex, Coinbase Pro, Gemini, itBit, Kraken, Poloniex, and those tracked by OnChainFX.

USDC Supply Increases

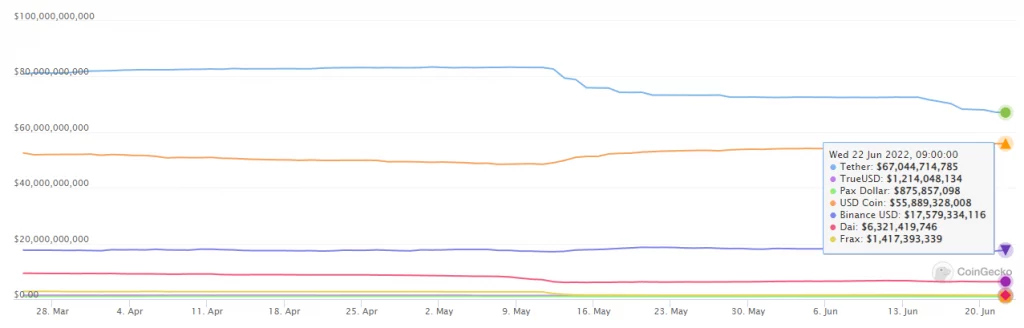

Tether’s circulating supply has dropped nearly 20% since its all-time peak on May 11, from 83.1 billion coins in circulation to an eight-month low of 67.9 billion at the time of writing.

USDC, on the other hand, has increased its supply by 13% since May 11 to 55.9 billion. If current trends continue, Tether’s supremacy in the stablecoin industry may come to an end.

The failure of layer-1 blockchain Terra, as well as the possibility of contagion from the failure of crypto lending platform Celsius, have raised concerns among investors, which have been exacerbated by a recent market meltdown. Tether redemptions have increased dramatically in the aftermath, causing a reduction in supply.

Tether has been attempting to boost confidence in its stablecoin, including claiming on June 13 that the continuing crypto market disasters involving Terra and Celsius will not affect its reserves. Despite this, it appears that investors are shifting to USDC.

Of course, Messari’s true volume metric does not reflect the entire story. According to CoinGecko, USDT still has the highest daily volume across all blockchains and exchanges, at $44 billion, compared to $5 billion for USDC.

However, how much of the volume is due to USDT being used in wash trade to inflate the numbers for coins or exchanges is unknown, which is why the imperfect real volume metric was devised.

Tether CTO Paolo Ardoino told Euromoney on June 15 that his company intends to acquire a full audit from a top-12 auditing firm to address ongoing redemptions and suspicions about the makeup of its reserves. While he would want one of the top four firms to undertake the audit, Ardoino stated that “the big four are a bit more wary about offering a complete suit when the rules are not clear” in the case of stablecoins.