Recent analysis says less than 1% of holders own 90% of the voting power in DAOs, emphasizing how concentrated decision-making authority is.

To create a proposal, a user must own between 0.1 percent and 1 percent of the total amount of tokens in circulation, and to pass it, they must hold between 1 percent and 4 percent.

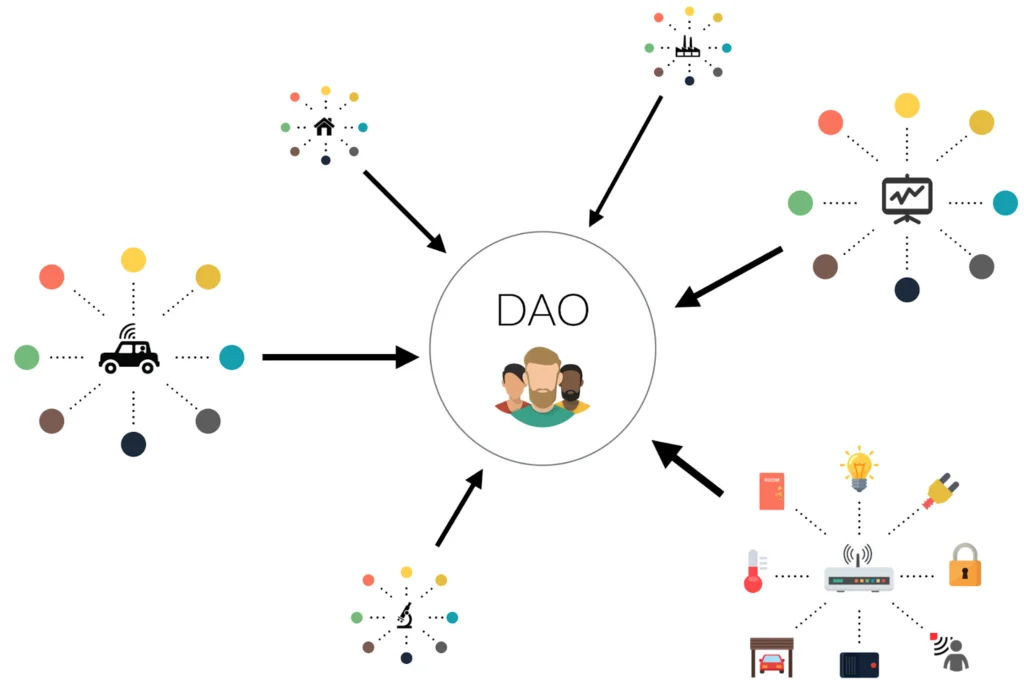

The popularity of decentralized autonomous organizations (DAOs), which are frequently viewed as the future of decentralized business governance, has grown in the constantly increasing crypto ecosystem.

DAOs are organizations designed to operate in a bottom-up way, where the community collectively owns and contributes to an organization’s decision-making process. They lack a centralized structure. Recent study findings, however, imply that these DAOs may not be as decentralized as they were supposed to be.

Less than 1% of all holders own 90% of the voting power, according to a recent Chainalysis analysis that examined the operations of ten significant DAO initiatives. The discovery emphasizes how concentrated decision-making authority is among a small group of people, a problem that DAOs were intended to address.

The Solana-based lending DAO Solend was a prime example of this concentration of power. To prevent liquidations from spreading over the DEX books, the Solend team attempted to take over a whale’s account and carry out the liquidation themselves via over-the-counter (OTC) platforms.

With 1.1 million “yes” votes and 30,000 “no” votes, the takeover plan was approved. However, of the total “yes” votes, 1 million were cast by a single user who had a significant number of governance tokens. The decision was later reversed following a strong backlash.

The Chainalysis research made clear that while all holders of governance tokens have the ability to vote, it can be difficult for everyone to put forth a new proposal for the community and get it approved given the quantity of tokens needed to do so.

According to the study, between 1 in 1,000 and 1 in 10,000 governance token owners possess a sufficient number of tokens to formulate a proposal. Only between 1 in 10,000 and 1 in 30,000 token holders have enough tokens to pass a proposition.

The Decentralized Finance (DeFi) ecosystem is responsible for 33% of all DAOs and 83% of all DAO treasury value. In addition to DeFi, other ecosystems that have witnessed an increase in DAOs include those for venture capital, infrastructure, and NFTs.