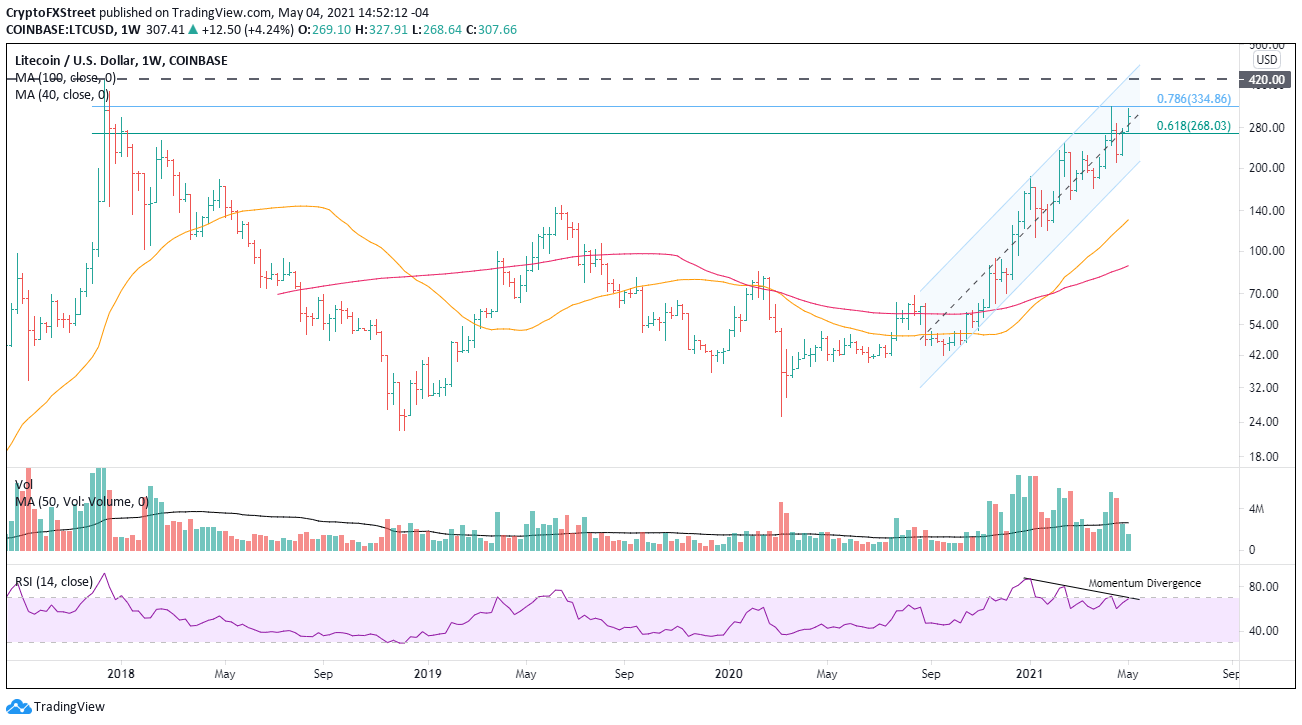

Litecoin’s today vital Fibonacci market setback is the second time since mid-April and reduces LTC chances of overcoming opposition and launching an all-time high test at $420.00.

Price for a dominant catalyst Litecoin

The IOMAP data indicates almost no resistence of the new Litecoin price up to $350.24, somewhat below the above stated 78.6% retracement mark.

Also, until a cluster of between $ 259.85 and $ 269.27 there is limited support from Litecoin. The average price is $125.07, a small step below 61.8 percent retracement of the bear market 2017-2018 at $268.03, for total of 103.49k addresses.

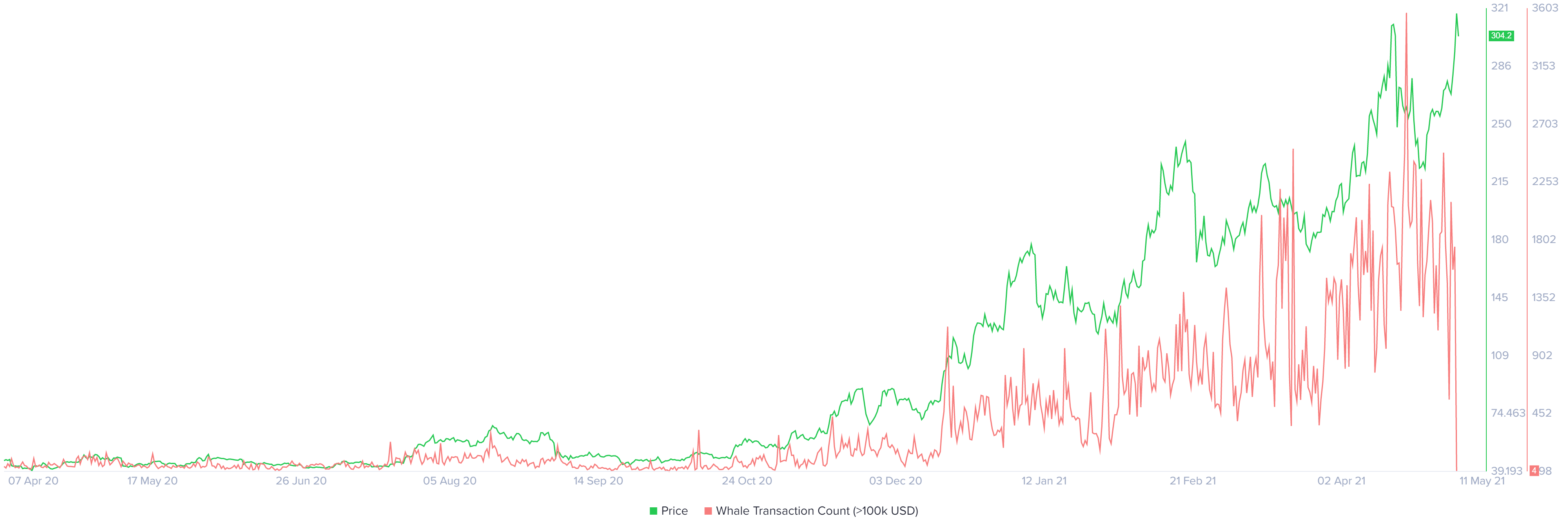

However, from yesterday’s high 2.501 to 4, the number of whales transactions has decreased. The reading is close to that of October 2020, which followed the long rally.

A new source of purchasing power is indicated by the minimum whale level (transaction count of > 100 k USD), if the Litecoin price can get off the mat.

The chain metrics offer Litecoin an optimistic outlook, but a resilience of 78.6 per cent to $334.86 is a major barrier to overcoming at $420.00 before the all times.

If the 61.8 percent trace is not held at $268.04, a 10-week SMA test of $231.47 will be given and a possible fall in the lower trend line of the channel at $189,65 is planned.

The negative divergence between RSI and the price since the middle of February has been added to the bearish perspective. When a new rally is printed, the momentum index must be confirmed.

Just one weekly closure above 78.6 percent would stimulate a re-evaluation of the bay outlook and increase the likelihood that new highs will succeed in the next few days or weeks.