Price and volume are two separate parts of any successful trade. When the market is volatile, everyone tends to focus on the first factor, which is Cross Chain Aggregation price.

This number is easy to find and make sense of. But it’s mostly just a guess without knowing how much is behind that price. As a trader in cryptocurrencies, you need to know how much is available and how much it costs.

This is what we mean when talking about liquidity (Cross Chain Aggregation). Can the market handle the amount you want to buy or sell at the price you want to buy or sell, and won’t that price move the market in a bad way? It’s a very important part of the markets, but it’s hard to figure out in decentralized finance (DeFi), especially when assets are being swapped.

Market participants are in the difficult position of having to search through different bridges, chains, decentralized exchanges (DEX), and liquidity aggregators to find the execution they need to complete their trade (particularly if the sums involved are large).

People have tried to use multichain liquidity aggregators to get what they want, but they haven’t worked out well. This is because multichain liquidity aggregators have separate bridges between each chain. This means that each pair of chains is connected by a single bridge, making the bridges themselves bottlenecks.

The Cross Chain Aggregation method is much better. This means they have access to a spider web of chains that are all connected. This makes it possible to pull liquidity from multiple chains at the same time for a single transaction.

Chainge is the only real cross-chain liquidity aggregator right now. Its advanced smart router is the only one that pools liquidity from multiple chains for any given swap, no matter which chain(s) your assets are on.

Other aggregators that make similar “cross-chain” claims actually only work with one chain at a time and can only collect liquidity from DEXs on one chain at a time, then bridge the assets after the exchange. Chainge, on the other hand, can automatically split any transaction into pieces that can be sent to multiple liquid chains. This gives users access to the most liquidity and the best prices.

What is Chainge doing? It uses the DCRM technology of the Fusion blockchain to pull liquidity from several chains at the same time. DCRM was made by four of the best cryptographers in the world: Rosario Gennaro, Ph.D., a professor of computer science at CUNY; Steven Goldfeder, Ph.D., a professor of computer science at Cornell University; Louis Goubin, a professor of computer science at the University of Versailles; and Pascal Paillier, Ph.D., the CEO and senior security expert at CryptoExperts.

The DCRM architecture is made so that tokens can be moved between networks and exchanged between all networks. It works like centralized exchanges by putting a layer of clearing between each transaction. The protocol on an outside blockchain already holds different crypto assets in the trust. When users want to move their assets, the Fusion chain will send the money to these external wallets.

Fusion is the only blockchain that can connect to every chain without any problems. It is also the only chain that can support a decentralized exchange (DEX) that can pull liquidity from any chain at the same time. The word “simultaneously” is the keyword here.

Taking a look at the market

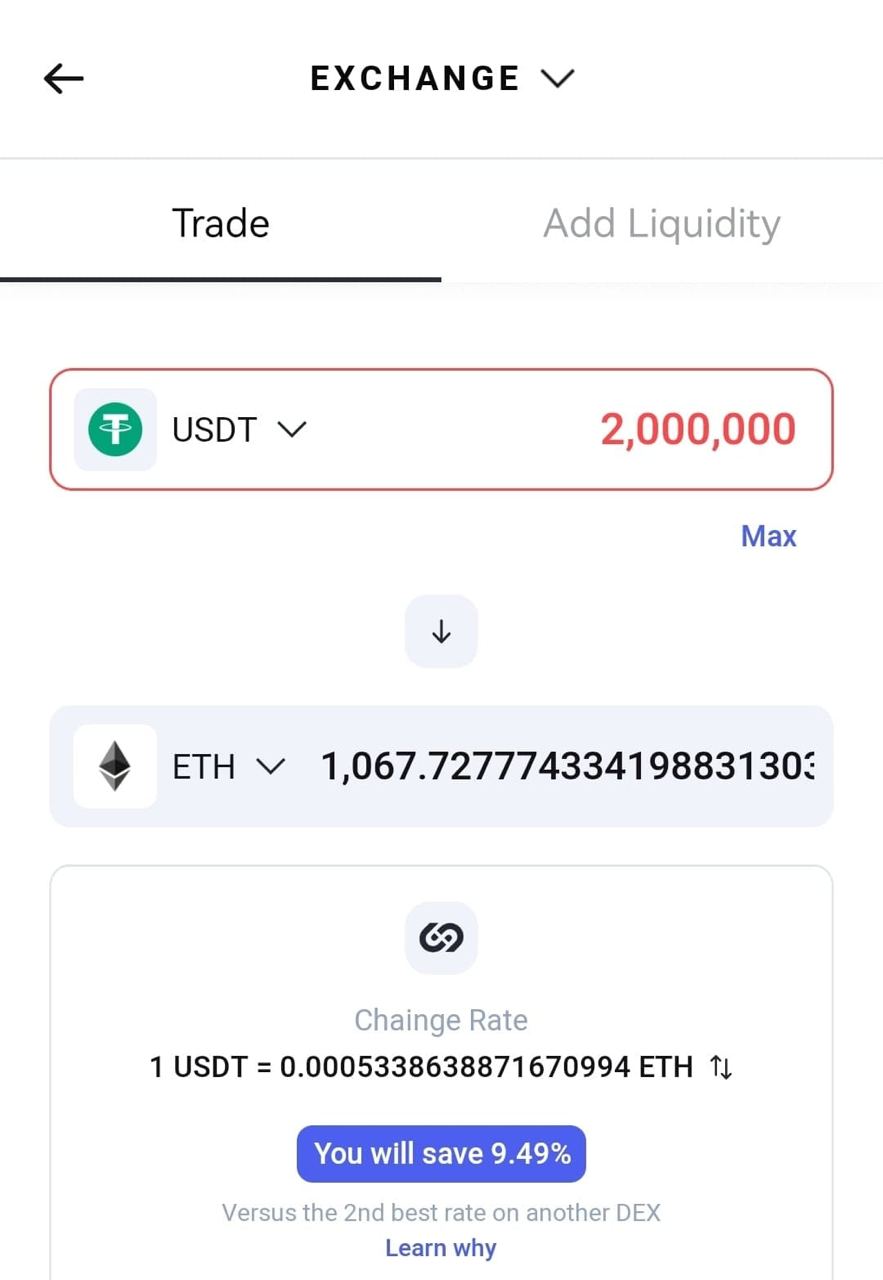

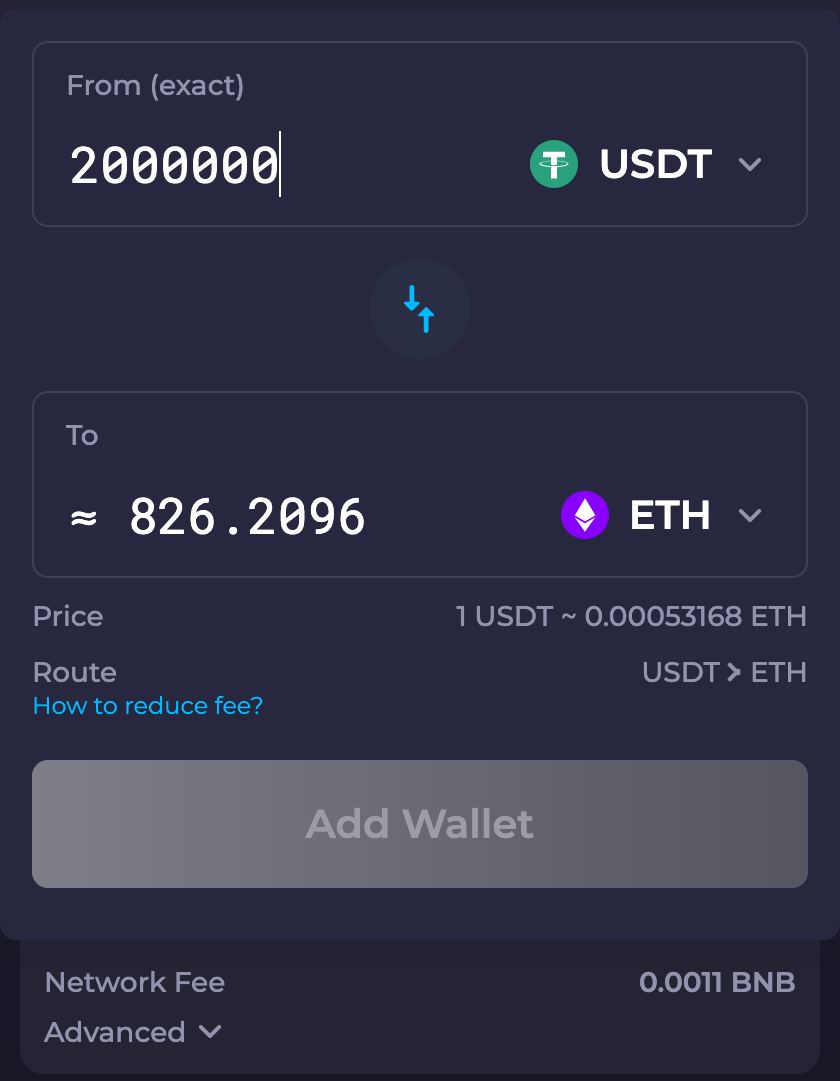

“Multichain” aggregators only collect liquidity from one chain at a time or use a bridge to Cross Chain Aggregation of the assets after the swap. Because of this, the slippage can be very big for big amounts. Look at these two things.

This shows that when exchanging a large amount of USDT for ETH (in this case, the equivalent of $2 million), using Chainge can lead to a much more valuable transaction than using another aggregator. The price gap isn’t always as noticeable when the amounts are small because some alternative platforms can get decent liquidity for small trades from one chain. This makes the difference in returns less “painful.”

Slippage is still there, though, and it is very clear, especially for frequent traders or crypto enthusiasts who are having trouble with interoperability and losing money on their swaps.

Overall, this shows that liquidity and true Cross Chain Aggregation are important for DeFi trading success. They are just as important as the price because they directly affect it. Chainge has access to a much deeper pool of liquidity than other aggregators because it uses cutting-edge technology. This lets it give its users much better results.

Forget high slippage. Forget bridges. The only cross-chain DEX you’ll ever need is the Chainge Finance app.