Gurbir Grewal, who is in charge of enforcement, defended the SEC against claims that it kills new ideas.

Gurbir Grewal is in charge of getting things done at the U.S. SEC, said that his agency can’t turn a blind eye to the fact that the cryptocurrency industry is breaking securities laws.

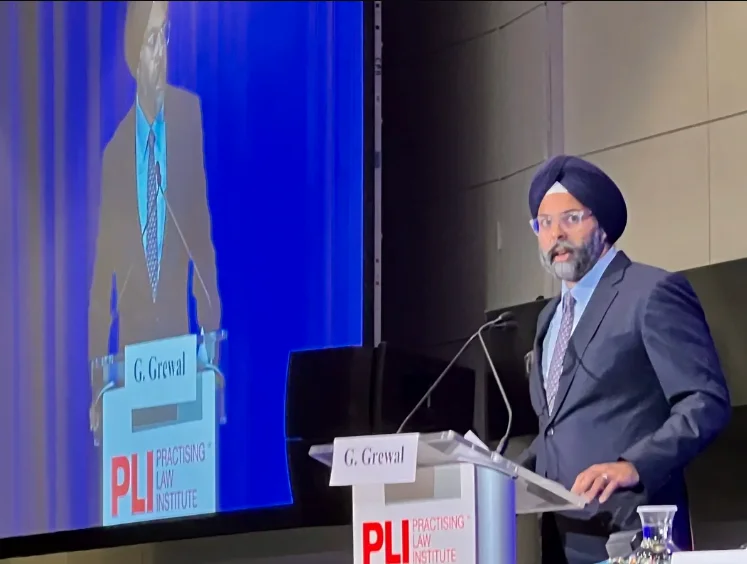

Grewal said at a Practising Law Institute conference in Washington, D.C. on Friday, “It often seems like critics are upset that we’re not letting crypto off the hook.” The fact that crypto was the only industry he specifically talked about shows how much the agency is thinking about digital assets right now.

He said that the SEC needs to “fairly enforce the laws that are on the books” and that ignoring them “would be a betrayal of trust, and we can’t do that.”

He also said that crypto has hurt people with low incomes and people of color in a big way.

This week, SEC Chair Gary Gensler made a number of comments and gave interviews. His comments and the more detailed comments of the division’s new crypto chief follow these. Gensler also gave a strong warning to the digital assets industry that his agency would not wait to enforce U.S. laws against unregistered exchanges and tokens that don’t register as securities.

David Hirsch, the incoming head of the SEC’s crypto enforcement effort, also said at the PLI conference that “registration is key in this area, especially for issuers.” The agency wants to see a culture of compliance in crypto, with accountants and specialized lawyers who keep the “wellbeing of their investors in the forefront of their minds.”

He said that crypto platforms need to register and set up “robust systems” to stop market manipulation, wash trading, and other types of wrongdoing.

Hirsch said that a big worry is decentralized finance (DeFi).

“If you only use pseudonyms and don’t ask permission for anything, it’s hard to be compliant with the law,” he said. “Insofar as you have a very low-accountability financial system, I’m not sure there are many examples in history of that being good for retail investors or working well over a long period of time.”

Hirsch warned that DeFi operations need to be able to hide themselves from known fraudsters, which is hard to do if they don’t have any permissions.

Commissioner Mark Uyeda also spoke up about what he said was the agency’s tendency to rely on enforcement instead of making new rules to deal with crypto.

Uyeda, a new member of the commission, said, “The commission should think about proposing rules if crypto assets raise issues that aren’t covered elsewhere in the rulebook.” Uyeda, who used to work for the SEC and was once assigned to work with the Republican staff of the Senate Banking Committee, has never spoken out about cryptocurrency issues before.