After the U.S. CPI, Treasury yields stayed high, which is a reality check for risky assets like cryptocurrencies.

Bitcoin (BTC) made a big comeback late Thursday, even though most people thought it would keep falling after the U.S. consumer price index (CPI) came in higher than expected.

As a knee-jerk reaction to the news, the leading cryptocurrency fell to a four-month low of $18,140 on major exchanges. It then climbed all the way back to $19,500, just like how U.S. stocks drop and then rise. A few hours before press time, prices came close to $20,000.

The “rocket emojis” are back on Crypto Twitter, which is a sign of renewed bullish sentiment, thanks to the unexpected rise in price after the data, which is thought to have been caused by the unwinding of shorts or other bearish trades.

But people in the business world aren’t sure if the overnight recovery will last.

Ilan Solot, a Tagus Capital Multi-Strategy Fund partner, said, “I don’t see any big changes in the world that would point to a sustainable recovery right now.” “Both the macroeconomic and geopolitical outlooks are still very bad, and there are no signs that the Fed will stop tightening in the near future.”

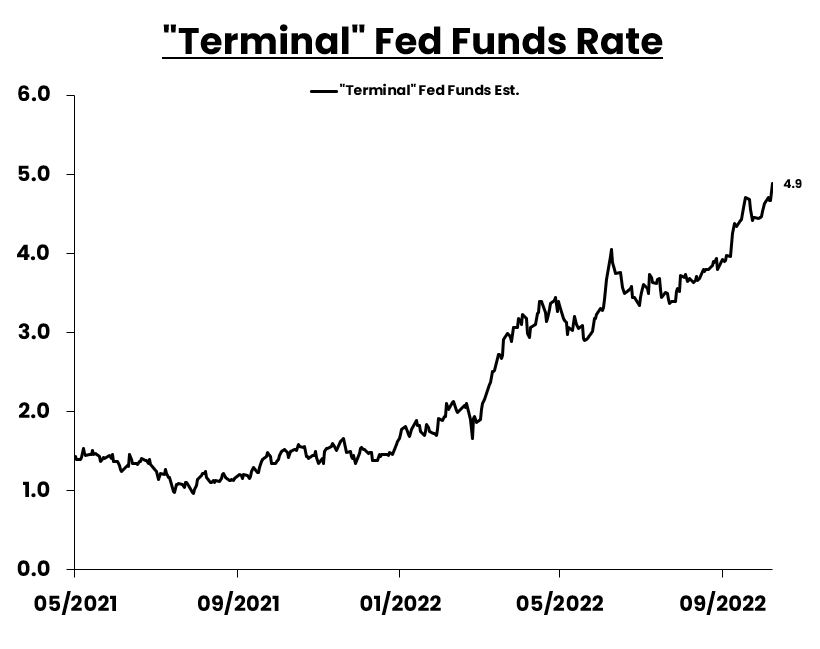

The money markets now think that the Federal Reserve’s (Fed) ongoing cycle of raising interest rates will peak near 5%. This is a big change from the end rate of 4.65%, which was priced before inflation data came out.

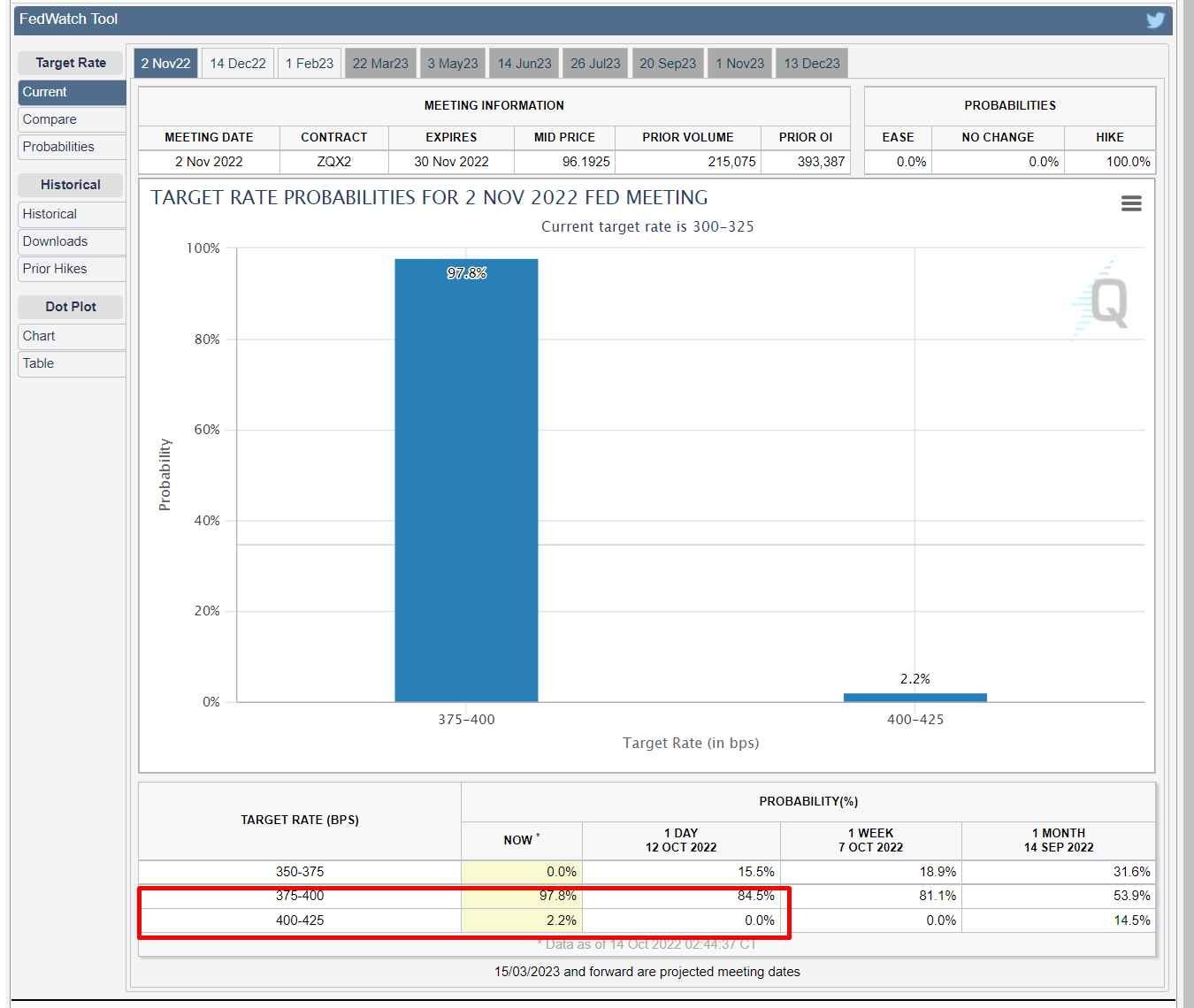

According to ING, Wells Fargo, and other investment banks, Thursday’s inflation data confirms that the rate will go up by 0.75 percentage points on November 2.

Analysts at CIBC said in a note to clients that “broad-based price increases in core service categories and still-strong labor market activity suggest that the Fed could front load rate hikes by more than was thought before at the FOMC meeting in early November.”

So, the rise in both stocks and bitcoin could be short-lived. This year, the Fed has raised interest rates by 300 basis points, but core inflation, which doesn’t include volatile items like food and energy, hit a 40-year high in September. But the so-called “tightening of liquidity” has hurt risky assets, such as cryptocurrencies.

David Belle, the founder of Macrodesiac.com and U.K. growth director at TradingView, said, “Buy the dip mentality remains ingrained.” This is because the Fed is now expected to raise rates more than it did before the CPI report.

In the last three months, buyers of dips haven’t been able to make any money. This is because rising bond yields are a reality check for risky assets that are sometimes boosted by short covering or hopes of a Fed pivot.

And bonds may do so again. The two-year U.S. Treasury note yield, which is sensitive to expectations of rate hikes, went up nearly 20 basis points to 4.48% after Thursday’s CPI report and was still high at press time, around 4.43%.

That’s a sign that the bond market doesn’t think the Fed’s policy or inflation will change in a big way any time soon.

In a daily market view, Michael Brown, head of market intelligence at Caxton, said, “I still can’t find a good reason to buy into this [equity market] weakness, and I have no plans to try to “catch a falling knife” any time soon.” He was referring to the rise in bond yields after the CPI report.

“On the other hand, I still like the USD,” Brown said. The dollar index is one of the things that hurt bitcoin the most.

Matthew Dibb, the COO and co-founder of Stack Funds said that bitcoin needs to break through higher levels of resistance to show that the trend has changed.

Since the middle of August, the bulls have been trying and failing over and over again to get above the 100-day simple moving average and the Ichimoku cloud.

Katie Stockton, the founder and managing partner of Fairlead Strategies, said in an email, “The daily cloud defines resistance.”

So, it might be too soon to call a bottom while these levels of resistance are still in place. At press time, Bitcoin was traded for $19,590.