If you’re new to NFT, you’ve likely been told to research the floor price. The concept of NFT floor price is quite easy to understand. However, when the floor price fluctuates, it can be difficult to work around it.

Before we delve into what NFT floor price is all about, let’s go over what the meaning of NFT is. NFTs is an abbreviation for Non-Fungible Tokens. They are cryptographic assets based on blockchain technology. Every NFT is different and has its own qualities that make it rare or valuable. Because of these factors, it’s also hard to figure out the exact value of an NFT.

While tangible assets like artwork or physical collectibles like playing cards have clear values, collectors and investors who want to buy NFTs may have a hard time deciding if an NFT is worth their money. It is in cases like this that NFT metrics like the floor price come into play.

What is an NFT floor price?

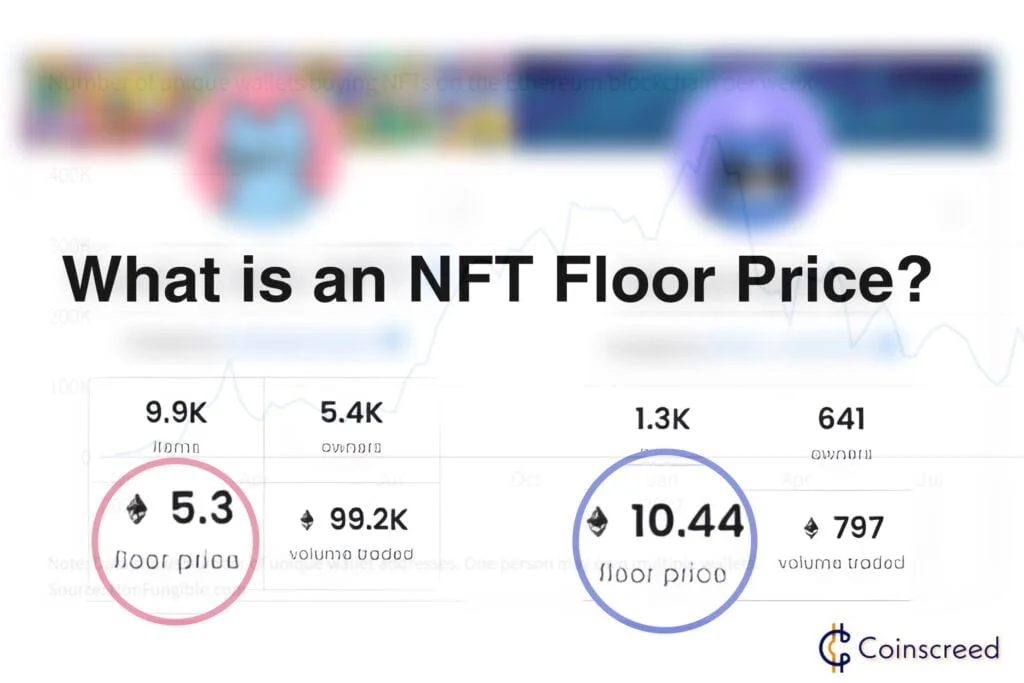

The floor price is the least amount of money you can pay to own an NFT (join a project) on the NFT market. The person who owns an NFT in a certain project and lists it for sale at a price lower than all other sellers in that project sets the floor price.

Economists often used the term “floor price” to talk about how low a price could go for a certain commodity, good, or service. In the NFT market, it is one of the most common ways to figure out how much a project is worth.

An NFT floor price is the price below which no one on an exchange can sell an NFT. This system protects people who want to buy NFTs from people who want to sell them for less than they are worth.

It makes sure that people don’t overpay for NFTs and that people selling tokens get a fair price for them.

Different players may be able to set the floor price for an NFT. Crypto finance sometimes works like traditional finance, so exchanges can set this threshold.

Before buying an NFT, it is always important to do research on the item. This search looks at the price of the NFT on different exchanges and at the floor price of the NFT.

By doing this, you can be sure you’re getting a fair deal on what you’re buying.

How to figure out the floor price for an NFT

The floor pricing of an NFT might change depending on a number of different factors. When setting the floor price, some factors that should be taken into consideration include:

- The Reputation of the Brand

- The Demand for NFT

- Collaborations

- Added Utility or Offering

The Reputation of the Brand/ Creator

When a market figure of prominence releases an NFT, demand rises and the price rises with it.

That’s because there’s already established mutual trust between the creator and the audience. In contrast, newcomers to the market have the uphill battle of establishing their credibility from scratch.

However, this does not imply that well-known companies or artists will actually start selling NFTs at the new, higher minimum price.

Demand for the NFT

When there is a rise in demand for a certain NFT collection, the floor prices of that collection correspondingly rise. In a similar vein, if there is a low level of demand, you can anticipate that the market will establish a lower price.

Collaborations

When influential people work together to start a project, the NFT’s value pretty much doubles.

These NFT releases have even higher floor prices, and because they are so popular and have famous people attached to them, they continue to sell for a premium on secondary markets.

Added Utility or Offering

The floor price of many NFT projects keeps going down since they provide no real value to holders. On the contrary, those who have utilized NFTs to create prosperous companies and ecosystems around them have offered genuine value and practicality to the holders of these tokens. The result is a higher floor price.

In most cases, it is prudent to establish the floor price for your NFT at a level that is lower than its current market worth. Using this method, you may safeguard yourself against the possibility of incurring any financial losses while yet leaving room for future expansion.

When determining the minimum acceptable price for an item, it is necessary to take into account the costs that are involved in both purchasing and selling the asset. Because these fees have the potential to affect your profitability, you should account for them in your calculations.

You may wish to speak with a professional appraiser or an expert in the field if you are unsure how much your NFT should be sold for. They will be able to assist you in determining a price that is both fair and reasonable for your item.

Types of NFT floor price

There are basically three types of NFT floor prices and they are:

- Real-time Value

- Increasing Floor Price

- Decreasing Floor Price

Real-time Value

The floor pricing has a propensity to consistently shift around from time to time, generally based on the value of the market at the moment. Therefore, real-time updates on prices are carried out in the market, which most individuals use as the primary basis for their decisions to purchase or sell.

The vast majority of crypto players consult NFT floor price charts in order to keep track of NFT collections. Among the most well-known NFT floor price monitors are cryptoslam.io, niftyprice.io, nftpricefloor.com, icy. tools, and nftcharts.io.

Increasing floor price

If the price of an NFT is going up quickly, don’t buy it on a whim. The increasing floor price of NFT is usually a good thing for a number of reasons. But it can also be done to create a false sense of excitement in order to get more people to invest in the project.

In both cases, you need to do the right research, especially when the floor prices change a lot. The reasons are still the same as when floor prices went down. These include new developments, partnerships with influential people, more useful features, or a promising road map.

Make sure that whatever is making the price go up is real and not just a fad if you don’t want to sell the NFT right away for a profit.

Keep in mind that when the floor price goes up, it’s not always the best time to buy an NFT, since you’re paying more. Usually, you want to buy into a project when the price goes down, as long as the price drop isn’t caused by something bad.

Decreasing floor prices

If you are part of an NFT project whose floor price is going down, there is no need to panic or sell your digital asset on a whim. It’s not always a bad thing, and in fact, a lot of people do it. There are a number of things that affect the value of an NFT, and these things change over time based on things like new developments in the project, new holders, and new uses.

Basically, floor prices are hard to predict, so take the time to find out why the project is worth investing in before diving into it. You never know when a new NFT project will take over, but that doesn’t mean it won’t fail in the future.

Even though NFT’s floor prices are a good way to figure out where a project will go, you can’t depend on them completely.

If something bad has happened and people aren’t sure if they want to keep their money in a certain NFT project, you might want to sell your NFT before it becomes useless.

Also, if there are no signs that an NFT project has done something to hurt its reputation, it could be because people are impatient and are pulling their money out to invest in other projects. These individuals are frequently referred to as “paper hands”.

Conclusion

You can get NFTs at their cheapest feasible price (the floor price) and then resell them for a profit (the market price). However, once an NFT project is sold out, the floor price typically drops much lower. Thus, if you don’t intend to keep your NFT, you will be forced to sell it at a loss.