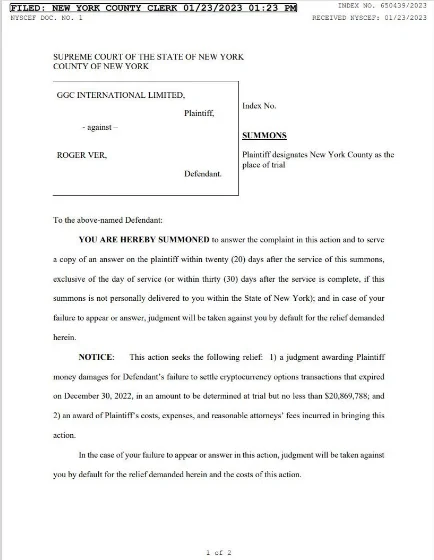

A division of the cryptocurrency lending company Genesis has filed a lawsuit against Roger Ver commonly known as “Bitcoin Jesus,” for unsettled crypto options worth $20.8 million.

On January 23, GGC International, a component of the insolvent cryptocurrency lender, filed a lawsuit against Ver in the New York State Supreme Court, alleging that the proponent of BCH had neglected to settle expired crypto options contracts.

Ver has 20 days in all to respond to the summons. The BCH advocate will be required to pay the whole cost if he doesn’t respond within that time limit. The BCH supporter has not yet reacted to the lawsuit as of this writing.

According to the Genesis website, GGC International is a business with its headquarters in the British Virgin Islands. Genesis Bermuda Holdco Limited, a division of Genesis Global Holdco, which is a party to the bankruptcy case, is the company’s owner.

A debt default accusation against Ver made news last year. Ver was allegedly bound by a written contract and pays CoinFLEX $47 million USD, according to CEO Mark Lamb. Ver also refuted similar allegations on June 28 without specifically citing the organization.

The crypto lender filed a Chapter 11 bankruptcy petition to the Southern District of New York on January 20. To advance the business, the company started a reorganization under court supervision. A dedicated committee will oversee the procedure with the goal of producing a result that benefits both Genesis customers and Gemini Earn users.

The parent firm of Genesis Global, Digital Currency Group (DCG), is the target of creditors from Genesis. Genesis’ creditors filed a securities class action lawsuit against DCG and Barry Silbert, the company’s founder and CEO, on January 24.

The company allegedly offered unregistered securities in violation of federal securities regulations, according to the creditors.