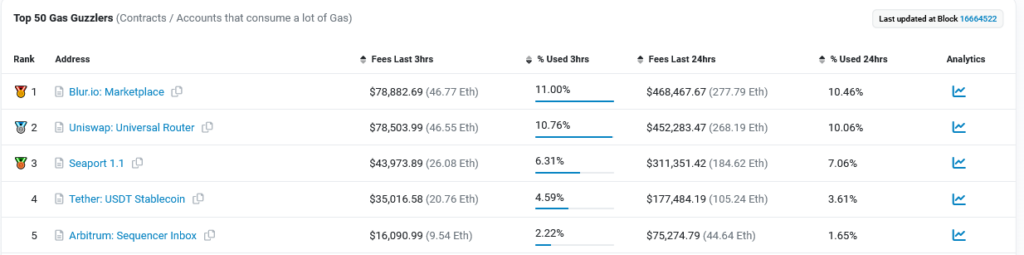

Blur, an NFT marketplace, is the top “Gas guzzler” on Ethereum, which surpasses UniSwap and Seaport.

BLUR has eclipsed UniSwap and Seaport in terms of daily Ethereum trade volume, according to Etherscan.io, which explains why the platform’s activity is using a significant amount of resources on the smart contracting network. Generally, the fees a network produces for validators increase with network activity.

Within the last 24 hours, it has racked up fees of $457,006.19, or about 9.91% of all fees paid to the Ethereum network. The airdrop this week has resulted in the burning of more than $4 million worth of Ethereum over the last seven days.

Blur’s increasing sovereignty

Over the past 48 hours, BLUR’s total value locked (TVL) has dramatically grown, hitting $121.42 million. As a result, it became an even more popular aggregator in the NFT ecosystem. It was the largest in the ecosystem, according to data, with a market dominance of almost 70%.

The day after the company advised NFT project developers to steer clear of OpenSea trades, about 100,000 NFT traders acquired BLUR tokens through airdrop.

For artists, using the market place is free. As previously announced, Coinbase will begin trading the BLUR-USD pair as soon as there is sufficient liquidity.

The cost of BLUR increased today from $1.30, up 11.34% from yesterday. Its market capitalization is $504,594,132, and its 24-hour trading volume has risen by 18.83%.

It presently contains $686,428,266. The current circulating supply of BLUR is 386,316,751 according to CoinMarketCap’s cryptocurrency market tracker.