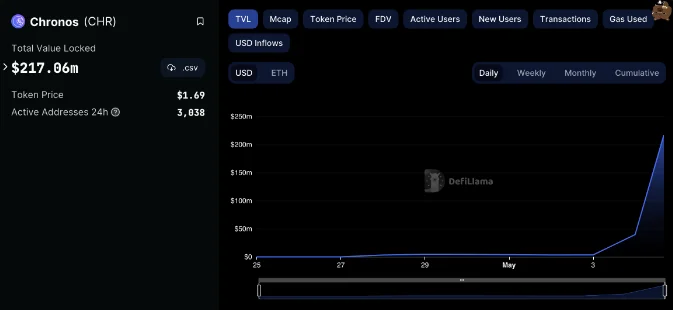

Seven days after its launch on the Arbitrum blockchain, decentralized exchange (DEX) Chronos reached a new milestone, exceeding $217 million in total value locked (TVL) to become the 8th Largest DEX.

According to DefiLlama, with the new TVL figures, Chronos rates eighth among the most prominent decentralized exchanges. TVL represents the funds held or staked in a protocol in DeFi.

The TVL milestone was reached within the first hours of the day following the launch of Epoch 1, which facilitated the emission of Chronos (CHR) tokens to liquidity pools. The beginning of Epoch 1 permitted investors to begin collecting rewards.

Chronos debuted on April 27 to serve as a liquidity provider and automated market maker for the Arbitrum network, hosting core pools such as Chronos-Ether (CHR/ETH) and Chronos-USD Coin (CHR/USDC), both seeded with 2 million CHR tokens, along with Arbitrum-Ether (ARB/ETH), Ether-USD Coin (ETH/USDC), USD Coin-Tether (USDC/USDT) and Wrapped Bitcoin-Ether (WBTC/ETH) pools.

Decentralized exchanges are central to DeFi and exhibit evidence of growth and maturity following the crypto winter of 2022. “After the insolvency of FTX, the industry realized the value of DEXs.

Charles Wayn, the co-founder of the Web3 community platform Galxe, remarked that DEXs and wallets would be the pillars of gaming adoption in the future, citing the importance of DEXs’ decentralization.

Similarly, Maverick Protocol’s chief technology officer Bob Baxley said the past year served as a proof-of-concept for DEXs and DeFi. “After all, if you look at some major DEXs, on some days they’re doing more volume than Coinbase,” he said, noting that the tightening regulatory environment in the U.S. is likely to benefit DEXs:

DEXs are peer-to-peer marketplaces where crypto merchants can transact without transferring funds to intermediaries or custodians. Smart contracts power these self-executing transactions. However, as we have observed over the past few years, hacks and bugs are among the most significant dangers associated with trading on DEXs.

Brent Xu, the founder of Web3 bond-market platform Umee, said, “I suspect volumes for a wide variety of DEXs will eventually grow exponentially, especially as underlying blockchains like Ethereum continue to scale and offer more throughput for lower gas prices.”