At present, Alameda Research, a hedge fund established by Sam Bankman-Fried, holds a bitcoin portfolio valued at over $110 million.

According to a blockchain analysis firm Arkham Intelligence report, liquidators overseeing the asset recovery of the now-disgraced Alameda Research hedge fund, founded by Sam Bankman-Fried, presently possess more than $110 million worth of bitcoin held in various wallets.

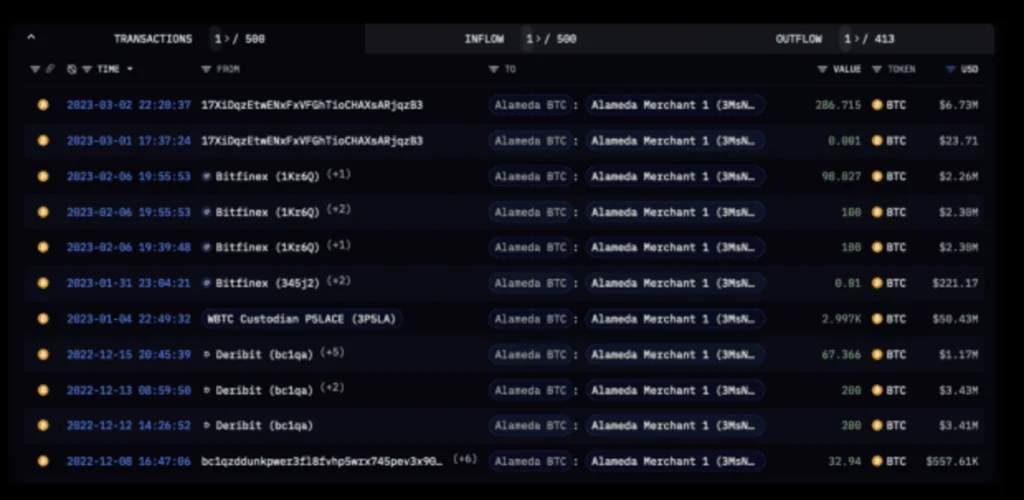

As of March 2023, according to recent findings, these wallets were actively receiving BTC from exchanges and cold wallets.

BTC holdings of Alameda Research

According to the report, Alameda’s liquidators have secured 4,083 BTC (currently worth $110.81 million) from the following sources:

- Other Wallets: 34.94 BTC ($948.27K)

- Deribit: 467.366 BTC ($12.68M)

- WBTC Custodian: 2997 BTC ($81.34M)

- Bitfinex: 298.027 BTC ($8.09M)

- Unlabelled Wallets (possibly an Exchange): 286.7 BTC ($7.78M)”

A screenshot from the provided report depicts Alameda Research’s Bitcoin holdings, as analyzed by Arkham Intelligence.

However, according to the report, this represents only a fraction of the BTC previously controlled by Alameda.

The accumulation of these wallets provides insight into how the liquidators obtained BTC from the company’s assets. In April, a 1 BTC test was sent from Alameda’s Merchant wallet to the ‘Alameda Merchant 1’ holding address controlled by Alameda’s Liquidators. Since the beginning of 2023, this address has acquired 3,581 BTC worth approximately $97.19 million.

Alameda Research, founded in 2017, is a prominent quantitative cryptocurrency trading firm. Sam Bankman-Fried, an American entrepreneur and investor, founded the corporation with its headquarters in Central and Western Hong Kong.

On May 17, FTX filed multiple lawsuits in the U.S. Bankruptcy Court for the District of Delaware to recover funds from former FTX executives, including sam-bankman-fried, and other parties who benefited from Embed Financial Technologies’ acquisition.