XRP Whales took advantage of the recent price drop by accumulating a substantial amount over the past weekend. XRP has surpassed $0.50.

After experiencing intense selling pressure last week and falling below $0.50, Ripple’s native cryptocurrency XRP displayed signs of a robust rebound over the weekend. At the time of publication, XRP is trading 1.68% higher at $0.5299 with a market cap just above $28 billion.

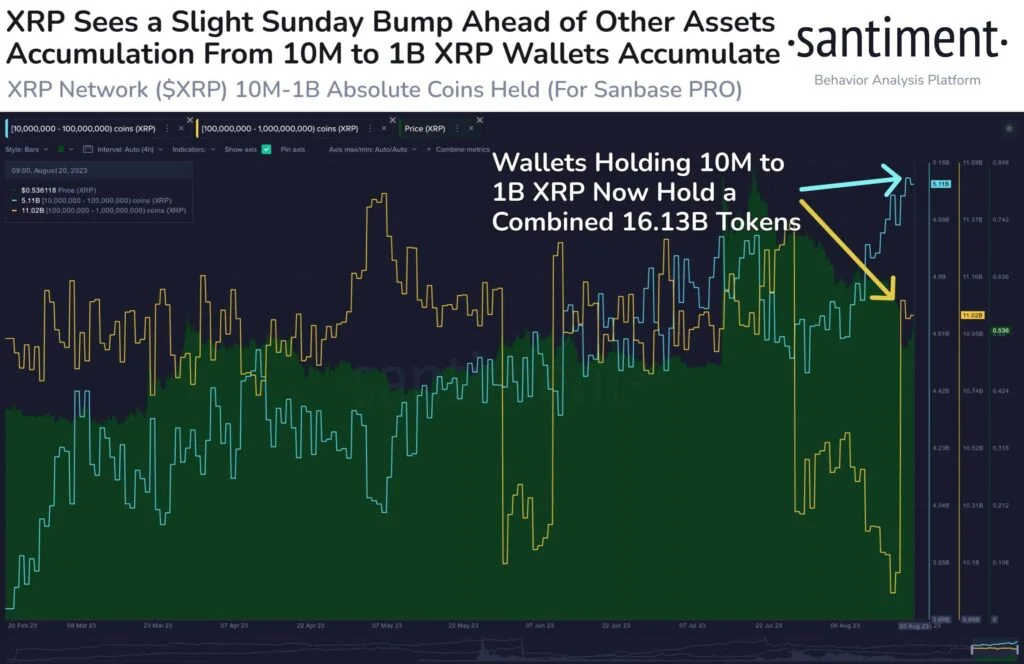

On-chain data indicates that XRP whales have resumed their activities while accruing dips. According to Santiment data, the XRP Network is exhibiting subtle signs of recovery, and the present 4% price increase appears to be supported by many prominent XRP holders.

Two hundred twenty-one addresses hold a significant quantity of XRP, from 10 million to 1 billion tokens. These addresses now possess approximately $8.71 billion worth of 16.13 billion tokens.

Since the SEC filed an interlocutory appeal in the XRP ruling last week, Ripple’s XRP has been under intense selling pressure. Friday’s court filing by the SEC contained an intriguing suggestion that XRP may not be a security.

“The SEC does not seek appellate review of any holding relating to the fact that the underlying assets here are nothing but computer code with no inherent value,” the filing states.

Interesting that even the @SECGov is accepting that digital assets themselves are not inherently securities.

However, not entirely surprising as both Judge Rakoff and Judge Torres came to this conclusion in their respective cases. pic.twitter.com/OhwyzeaJWN

— Eleanor Terrett (@EleanorTerrett) August 18, 2023Amicus Curiae attorney John E. Deaton also commented on the SEC’s concession, stating, “I have to say there is no doubt 75k Ripple holders are a major reason the SEC is conceding this. We fought to have the judge actually write that the token itself is not the security. In fact, it was the first section in our argument in the brief.”

Price Action For XRP

On the Daily Chart, XRP/USD was below the resistance range of $0.5750 to $0.5900. Positive movement over the weekend helped it surpass the 200-day exponential moving average. Nevertheless, the cryptocurrency remained below the 50-day exponential moving average, indicating short-term bearishness but long-term bullishness.

The reading of 34.14 on the 14-Day Relative Strength Index (RSI) indicates a bearish sentiment. This RSI reading corresponds with the 50-day exponential moving average, suggesting a potential decline below the support range of $0.4920 – $0.4780, with a potential target below $0.47.

Nevertheless, if XRP can maintain a position above the 200-day EMA, it could facilitate a bullish attempt to breach the $0.5750–$0.5900 resistance zone and the 50-day EMA.