According to ESMA, MiCA-based crypto investor protections will only take effect from at least December 2024, meaning that investors must be prepared to lose all their money if they invest in cryptocurrencies.

European Union cryptocurrency asset market regulations still need to protect cryptocurrency investors, and the protections will take some time.

The European Securities and Markets Authority (ESMA) released a statement on October 17 regarding the transition to the European crypto regulations known as Markets in Crypto-Assets Regulation (MiCA).

The European Securities and Markets Authority (ESMA) emphasized that MiCA-based crypto investor protections will only take effect at least December 2024, meaning that investors must be prepared to lose all their money if they invest in cryptocurrencies. The official added:

“Holders of crypto-assets and clients of crypto-asset service providers will not benefit during that period from any EU-level regulatory and supervisory safeguards […] such as the ability to file formal complaints with their NCAs [National Competent Authorities] against crypto-asset service providers.”

Even after December 2024, there is no assurance that MiCA will provide investors with complete protection until 2026. After MiCA becomes applicable to crypto asset service providers in late 2024, member states may grant an additional 18-month “transitional period” permitting them to operate without a license, also known as a “grandfathering clause.”

“This means that holders of crypto-assets and clients of crypto-asset service providers may not benefit from the full rights and protections afforded to them under MiCA until as late as July 1, 2026,” the ESMA wrote. Depending on municipal laws, most NCAs will have limited authority over those who benefit from the transitional period.

“These powers are typically limited to those available under existing anti-money laundering regimes, which are far less comprehensive than MiCA,” the ESMA added.

Even after the implementation of MiCA, there will be no such thing as a “safe” crypto asset, the authority emphasized, stating:

“ESMA reminds holders of crypto-assets and clients of crypto-asset service providers that MiCA does not address all of the various risks associated with these products. Many crypto-assets are by nature highly speculative.”

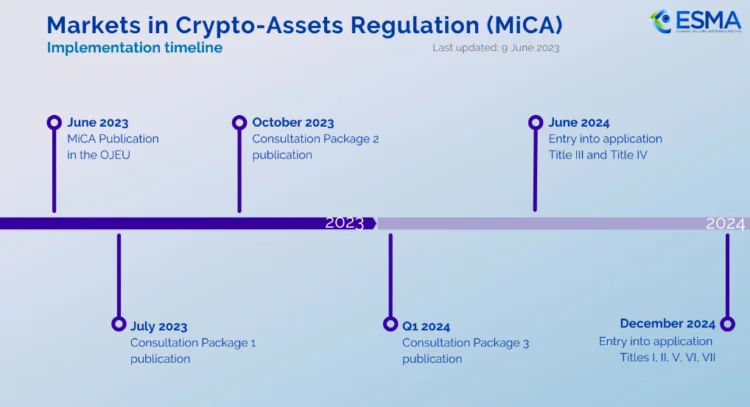

The most recent warnings from the ESMA came shortly after the regulator published a second consultative document on MiCA on October 5 after implementing the regulations in June 2023.

During the implementation phase of MiCA, the ESMA and other relevant authorities are responsible for conducting public consultations on various technical standards expected to be published in three packages in sequential order.

MiCA seeks to provide legislation to regulate crypto assets in Europe by amending existing laws, specifically Directive 2019/1937. Due to the expanding public interest in cryptocurrency investments, MiCA’s foundational work began in 2018.