The recent volatility pressure on Bitcoin’s charts has kept the world’s most valuable cryptocurrency in the spotlight for quite some time.

Another significant metric, on the other hand, has revealed something intriguing in the recent 24 hours. Over the next few weeks, it is possible that the price of Bitcoin will shift significantly from where it is now.

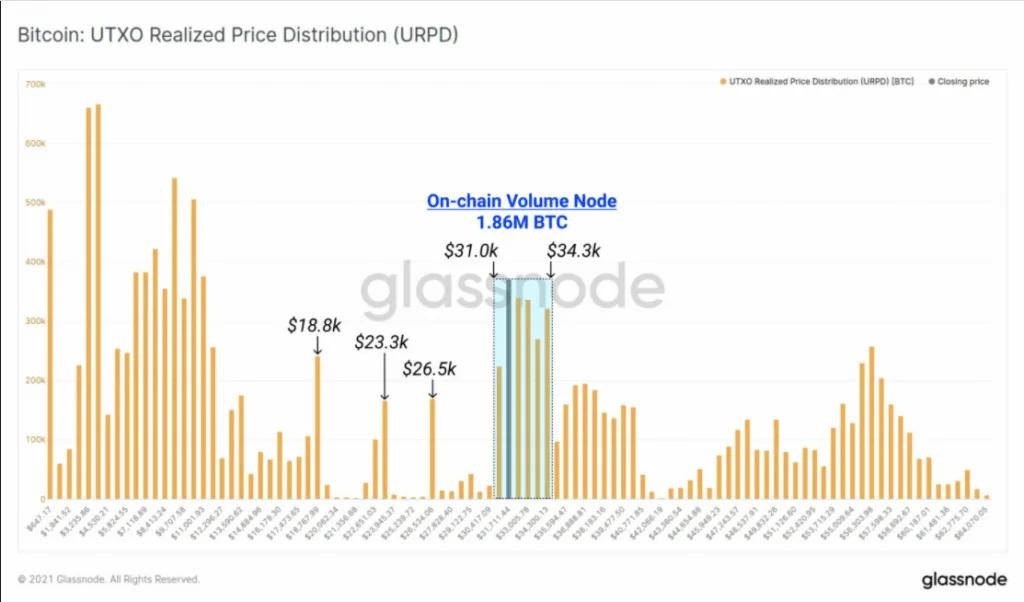

At the time of writing, Bitcoin was trading towards the lows of a significant on-chain volume node, as indicated by the UTXO Realised Price Distribution chart, which also shows that the price of bitcoin is declining.

When this indication was used, it displayed the price at which the current set of Bitcoin UTXOs was generated. In other words, each bar on the chart represented the amount of existing Bitcoin that had moved inside a specific price range at the time the bar was drawn.

Over 1.86 million Bitcoin have been transacted on the blockchain between the price levels of $31k and $34.3k at this point.

Notably, this is 9.93 percent of Bitcoin’s total circulating supply, which is a significant proportion of the total supply. Following $12k, this is by far the highest realised volume cluster, as illustrated in the chart attached.

The fact that almost one-tenth of BTC’s supply is moving at that rate allows for a variety of credible predictions about the cryptocurrency’s future. In the first place, it suggests that this price range has been exposed to a cost foundation that is extremely focused on the costs.

Another reason for Bitcoin’s present strong support at various levels within the aforementioned price band can be traced back to this trend. It should be noted, however, that if the support level is breached, this could result in the formation of an overheated resistance level.

Additionally, anytime huge numbers of coins are transacted in crowded areas, as is the case right now, it is a hint that a significant number of market participants have liquidated their holdings.

In addition, it should be remembered that other players purchased those coins at the same price level as well. At the end of the day, there is still buying interest in the Bitcoin market.

The price consolidating into a narrow range for an extended period of time, once again, signals that a significant move is imminent. Nonetheless, without setting the bar too high, one of the following scenarios could play out over the next few days, depending on the circumstances.

In the first instance, if the price of Bitcoin rises, investors will be able to cash out and enjoy their gains. Now, that would imply a lack of conviction in HODL, which is ultimately not a positive indicator for the stock.

If Bitcoin’s price continues to fall and market players begin to sell their holdings, the price of Bitcoin will fall even further, causing it to fall even further.

However, regardless of the direction of the price change, if investors continue to HODL, the chances of the bearish narrative being gradually wiped out will increase.

Well, the likelihood of this scenario unfolding itself appears to be the highest at the moment, owing to the increase in HODLings in the ‘millionaire tier,’ notwithstanding the decline in the price of real estate. A recent tweet from Santiment drew attention to the same pattern of behaviour.

One thing is certain for the time being, regardless of other assumptions. Coins are changing hands and migrating from the hands of the weak to the hands of the strong.

If the aforementioned trend continues in the same direction, a reversal in the price of Bitcoin would become nearly unavoidable in the near future.