Coinbase, among the chief investors in the cryptocurrency sector, has reportedly reduced its startup funding.

According to Bloomberg, Coinbase is the most recent firm to stop funding cryptocurrency-related companies as investor opinion has shifted toward caution.

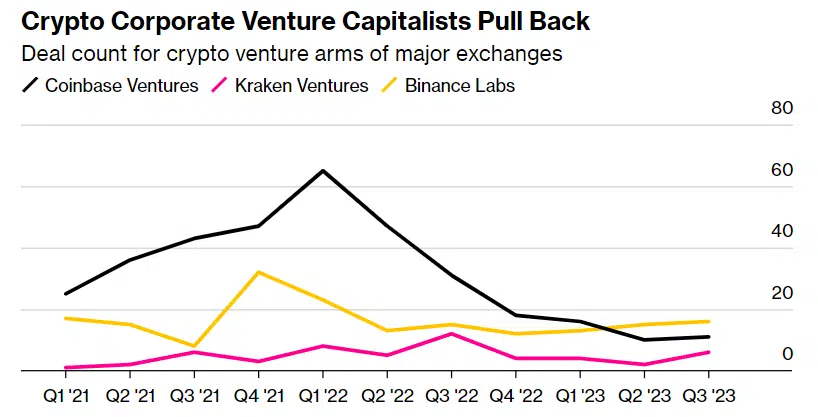

Coinbase Ventures, the U.S.-based cryptocurrency exchange’s investment arm, completed just 11 fundraising agreements in Q32023, down 64.5% from the same quarter the previous year when it completed over 30 funding deals, according to data from PitchBook.

Through its division Kraken Ventures, another American cryptocurrency exchange, Kraken, has likewise reduced the amount of money it provides to startups. In Q3 2023, there were only six deals, compared to 12 in Q3 2022.

While this was going on, Binance Labs, the company’s funding incubator, upped its investment activity by 6%, closing 16 agreements in Q3 2023 compared to 15 in Q3 2022.

According to Robert Le, a crypto analyst at PitchBook, investors are becoming “more cautious” in light of the present climate and “want to focus on their core business.”

Coinbase stated that funding businesses abroad using a “pin-point” strategy has not stopped helping cryptocurrency companies. According to Bloomberg, Coinbase’s Hoolie Tejwani, Corporate Development & Ventures, the exchange sees some founders and firms with “great ideas.”

However, they want to “extract” the U.S. from their business strategy and not cater to local clients. As more tech professionals move abroad, Coinbase has stated time and time again that it wants to see the U.S. become a more crypto-friendly economy.

As per the exchange’s latest research, the enforcement strategy of regulation in the United States is resulting in a “disappointing trend for crypto development in the U.S.”