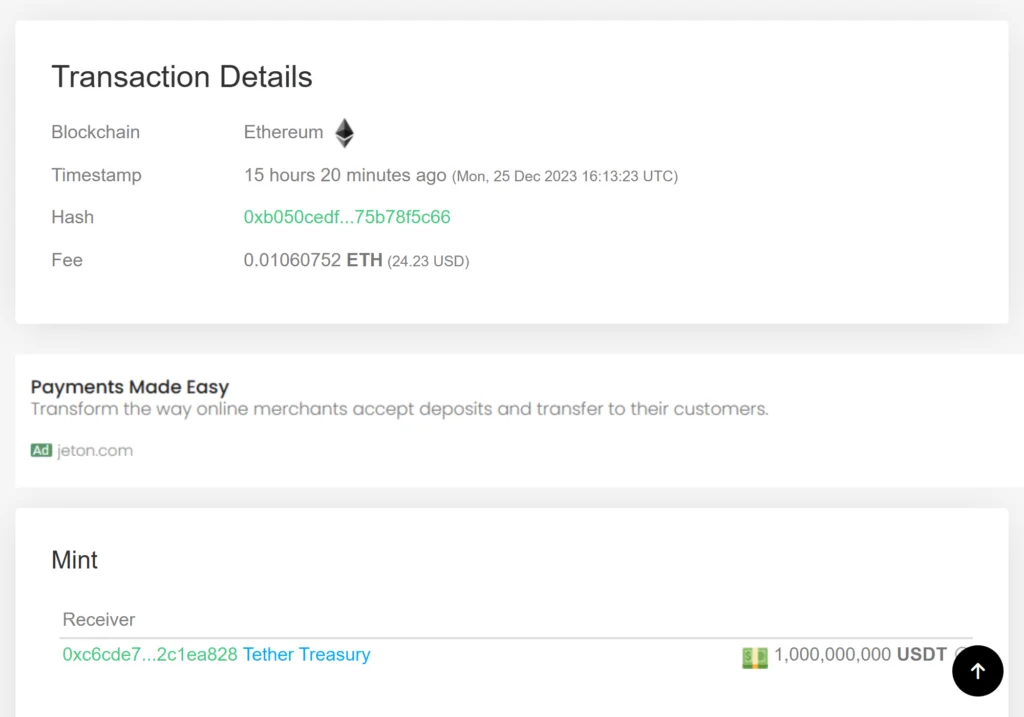

Tether has minted an additional 1 billion USDT on the Ethereum network as part of its liquidity management strategy. The funds are authorized but not issued and will be used for future demand and chain swaps.

According to Whale Alert, a blockchain tracker and analytics system, the leading stablecoin has minted an additional 1 billion USD. The transaction, executed on the Ethereum network, substantially increases Tether’s circulating supply, which now stands at over 77 billion USD.

The minting operation was addressed by Paolo Ardoino, the CEO of Tether, on a social media platform. Arduino explained that the move was aimed at “inventory replenishment” on the Ethereum network, meaning that the funds are reserved for future issuance requests and chain swaps. He emphasized that these funds are “authorized but not issued transactions,” indicating a strategic approach rather than an immediate influx of new currency into the market.

This careful management of minting and issuance plays a critical role in maintaining the balance in the volatile cryptocurrency landscape, where supply and demand can fluctuate rapidly and unpredictably. By minting the funds in advance, Tether ensures that it can meet the market needs and provide liquidity and stability for its users.

Tether, known for its stability, is often used as a haven during the frequent high volatility in the crypto market. It is a stable intermediary for traders, enabling them to secure profits or transition into new positions without leaving the cryptocurrency ecosystem. This utility of USDT is particularly significant in recent market trends, which have seen a surge in crypto trading activities.

Tether is pegged to the US dollar, meaning that one USDT is always equivalent to one USD. This makes it easy for traders to exchange USDT for other cryptocurrencies or fiat currencies, as well as to hedge against market risks. The stablecoin also supports multiple blockchain networks, such as Ethereum, Bitcoin, Tron, and Solana, making it compatible and interoperable with various platforms and applications.

Tether’s market capitalization stands impressively at $91.3 billion, a remarkable growth from its previous $65 billion, according to data from CoinMarketCap. This growth underscores the coin’s dominant position in the market, significantly outpacing other stablecoins. USD Coin (USDC), the closest competitor, holds a market capitalization of $25 billion, ranking seventh overall.

Tether’s commanding lead in the market is a testament to its role as a key player in the cryptocurrency ecosystem. The recent minting of 1 billion USDT on the Ethereum network is a strategic move to bolster its liquidity management capabilities. With clear communication from Tether’s CEO Paolo Ardoino, the market is assured that these funds are for future demand and not immediate circulation.

Tether (USDT) is constantly working on improving its services and features, as well as expanding its network and partnerships.