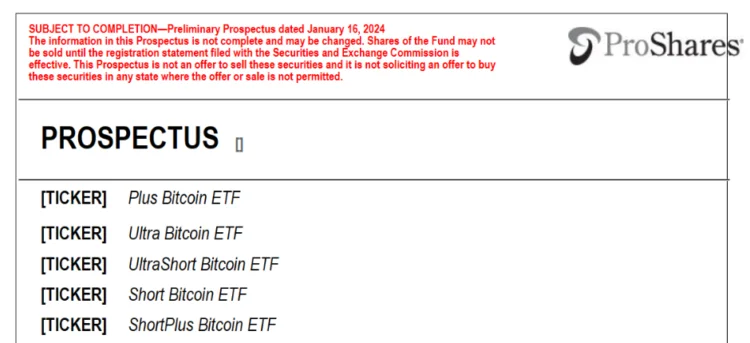

ProShares, is in the preliminary stages of establishing 5 Bitcoin (BTC) ETFs (two long and three short) that will provide indirect BTC exposure during the first days of spot Bitcoin ETF trading on local stock exchanges.

ProShares wishes to introduce leveraged and inverse Bitcoin ETFs, according to a filing with the U.S. Securities and Exchange Commission (SEC) dated January 16. By the daily performance of the Bloomberg Galaxy Bitcoin Index (BGCI), the ETFs aim to generate daily investment returns from Bitcoin price volatility.

Plus, Bitcoin ETF, Ultra Bitcoin ETF, UltraShort Bitcoin ETF, Short Bitcoin ETF, and ShortPlus Bitcoin ETF are the five new Bitcoin ETFs that ProShares intends to introduce within its prospectuses.

The remaining three funds, ProShares UltraShort Bitcoin ETF, ProShares Short Bitcoin ETF, and ProShares ShortPlus Bitcoin ETF, aim to generate daily investment returns equal to -2x, -1x, and -1.5x, respectively, the inverse of the daily performance of the BGCI.

According to the filing by ProShares, the funds do not engage in direct Bitcoin shorting. Instead, they aim to capitalize on declines in the price of Bitcoin.

Bitcoin was trading at approximately $43,000 at the filing, having experienced a substantial decline after the introduction of spot Bitcoin ETFs in the United States.

Confident industry investors, including the CEO of ARK Invest, Cathie Wood, have previously forecasted that the market may experience a brief decline as investors seek to liquidate their holdings in response to favorable developments.

A few days after the U.S. SEC authorized the initial ten spot Bitcoin ETFs on January 10, the filling occurred, with the first trades commencing on January 11. However, ProShares did not issue any of the initial batches of spot Bitcoin ETFs.

ProShares, which has been concentrating on futures-based crypto ETFs, will introduce in October 2021 one of the first Bitcoin futures-linked ETFs in the United States.

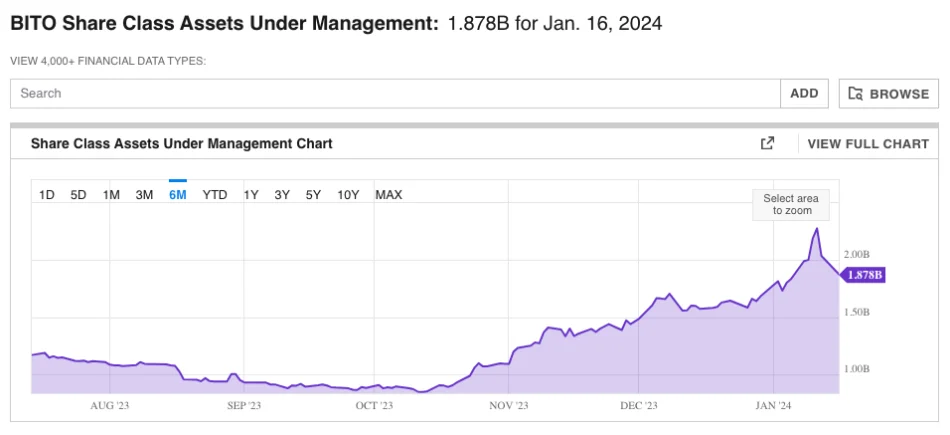

Bitcoin Strategy ETF (BITO), the firm’s primary futures-based product on BTC, has experienced substantial expansion in recent months, temporarily surpassing $2 billion in assets under management (AUM) in January 2024.

At this time, ProShares provides the Bitcoin & Ether Equal Weight Strategy ETF (BETE), Ether Strategy ETF (EETH), and Bitcoin & Ether Market Cap Weight Strategy ETF (BETH), in addition to BITO.