Despite the government crackdown, cryptocurrency adoption in Nigeria continues to grow, with peer-to-peer (P2P) trade volume for Bitcoin posting its second-highest week on record last month.

Nigeria continues to rank first in terms of search interest for the keyword “Bitcoin” according to Google Trends as of this writing.

According to Useful Tulips, P2P Bitcoin trading in Nigerian Naira has steadily increased in 2021, with Nigeria ranking second only to the United States as the second-largest market for peer-to-peer BTC trading.

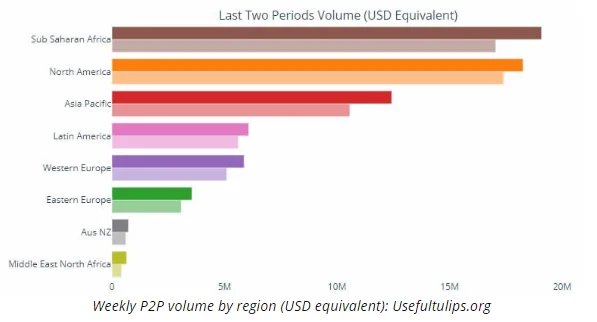

Growing Bitcoin adoption in Nigeria has helped Sub-Saharan Africa overtake North America as the leading region in terms of P2P volume, with the region posting $18.8 million in weekly volume this week, beating out North America’s $18 million.

Local crypto adoption has been sparked by a slew of political and economic crises, including social repression, currency controls, and rampant inflation.

Tensions in Nigeria have been rising since October when the country was swept by massive public protests against police brutality and the infamous “Sars” police unit.

During the EndSars protests, protestors were attacked with tear gas and water cannons, resulting in the deaths of more than 50 civilians, including a dozen who were shot dead by police using live ammunition on October 20.

Economic repression accompanied the government crackdown, with social organizations providing food and medical aid to protestors quickly having their bank accounts frozen.

In the midst of the violence, protestors have increasingly turned to cryptocurrency to keep their financial activities out of the hands of the government.

According to Adewunmi Emoruwa, the founder of Gatefield, a public policy organization whose accounts were suspended for providing grants to journalists covering the protests, Nigeria’s recent hostility toward crypto-assets can be traced back to October protests.

“I think that EndSars is like the key catalyst for some of these decisions the government is making. It caused fear. They saw, for example, that people could decide to bypass government structures and institutions to mobilize.”

Despite the financial embargo, an anonymous source claiming to represent a social organization whose bank accounts were targeted during the turmoil told the publication that their organization has been able to pay members’ salaries with crypto.

“We keep some securities in crypto – not too much, but enough to cover us,” they explained. “Thankfully, we were able to pay salaries when the ban was imposed.”

In an attempt to discourage the use of digital assets, the government forbade licensed banks from handling cryptocurrency transactions in February.

Nigeria’s constantly rising P2P Bitcoin volumes, on the other hand, show that the country’s growing crypto user base has been mostly driven underground in order to access crypto assets outside of the government’s supervision.

The restriction has only made cryptocurrency trading tougher to control, according to Marius Reitz, the Africa general manager of crypto trading platform Luno, who told The Guardian:

“A lot of trading activity has now been pushed underground, which means many Nigerians are now depending on less secure, less transparent over-the-counter channels, as well as Telegram and WhatsApp groups, where people trade directly with each other.”

Internally, the government’s efforts to suppress crypto have been criticized, with Vice-President Yemi Osinbajo publicly criticizing the ban in February.

Despite its opposition to decentralized crypto assets, Nigeria is investigating the creation of a central bank digital currency (CBDC).