HTX, a cryptocurrency exchange that was once known as Huobi, abruptly disabled its proof-of-reserves function.

Popular fintech analyst Adam Cochran, Managing Partner at Cinneamhain Ventures, made this statement. This comes at the same time as the stablecoin TrueUSD (TUSD), which has been connected to HTX shareholder Justin Sun, has reportedly been having trouble maintaining its $1 value for more than two weeks.

Cochran also pointed out that, despite the most recent audit reporting close to $300 million, HTX only had $120 million in ETH holdings according to real-time data from DefiLlama.

The proof-of-reserves page for HTX did not show any details about the exchange’s cryptocurrency holdings earlier. Important information needed to be momentarily added to the screen, including reserve ratios, wallet balances, and user asset totals.

The timing of this brief outage is dubious, especially considering the current issues with TUSD, even though the page has now been restored.

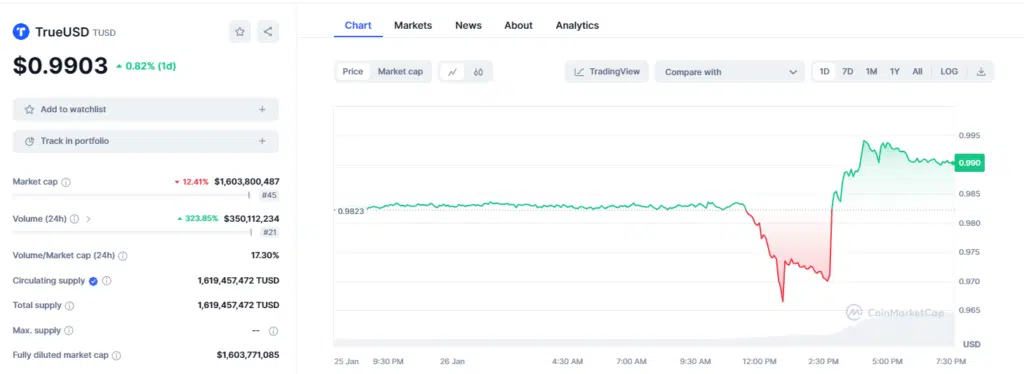

This incident comes after TUSD was under increased investigation, mainly because of its alleged lack of complete backing. According to CoinMarketCap, TUSD’s market value has fallen below $1 since January 7th.

Worries grew earlier in the month when TrueUSD could not provide prompt attestations confirming that it had sufficient US dollar holdings to support the stablecoin. This lack of transparency led to speculation that TrueUSD might not be fully collateralized.