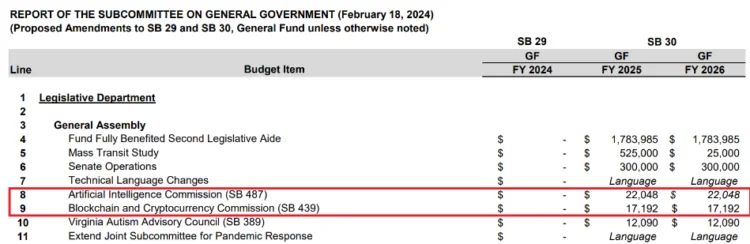

An annual combined fund allocation of $39,240 has been proposed by the Virginia Senate committee for two recently established commissions on cryptocurrency and artificial intelligence (AI).

On February 18, the Senate Finance and Appropriations Committee’s Subcommittee on General Government proposed allocating more than $23.6 million for different legislative departments.

The Blockchain and Cryptocurrency Commission, instituted in January 2024, was given a proposed general fund of $17,192 from the total amount for the fiscal years 2025 and 2026.

Allocated for the same period was $22,048 to the Committee on Communications, Technology, and Innovation, also known as the Artificial Intelligence Commission.

The responsibility of overseeing blockchain technology development and cryptocurrencies and promoting their growth within the state falls on the Blockchain and Cryptocurrency Commission. Appointed “no later than 45 days after the effective date of this act,” its membership will consist of fifteen individuals, eight of whom are legislative and seven nonlegislative.

Likewise, to prevent illegal activities, the Artificial Intelligence Commission seeks to establish and sustain policies that will eventually restrict the application of AI.

January 9 marked the bill’s introduction to amend the Virginia Code and establish the blockchain and cryptocurrency commission. On February 1, the Senate unanimously passed it.

In addition to establishing new legislative commissions devoted to AI and cryptocurrency ecosystems, Virginia has recently enacted legislation that favors businesses and individuals in the crypto mining industry.

On January 9, Senator Saddam Azlan Salim introduced Senate Bill No. 339, which seeks to waive the requirement for miners to possess money transmitter licenses. Additionally, the measure forbids industrial zones from enforcing ordinances specific to mining.

“No license under this chapter shall be required of any person engaging in-home digital asset 37 mining, digital asset mining, or digital asset mining business activities, as those terms are defined in § 38 15.2-2288.9.”

Although the measure does not classify companies that provide mining or staking services as “financial investments,” they must submit a notice to qualify for the exemption.

The proposed legislation allows for the exclusion of a maximum of $200 per transaction from the net capital gains of individuals for tax purposes. Gains obtained through purchasing products or services using digital assets are subject to this exclusion. Consequently, the measure provides tax incentives to promote the adoption of cryptocurrencies for routine transactions.