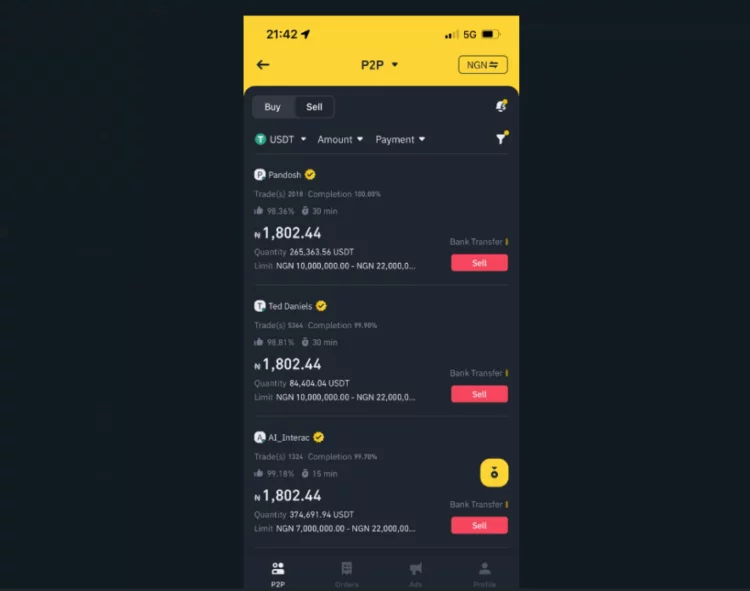

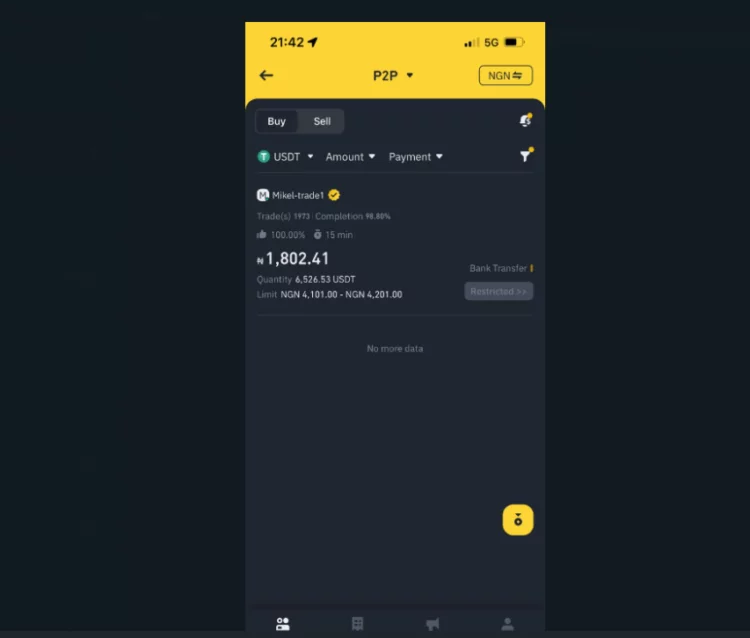

To ensure conformance with local authorities in Nigeria, Binance has imposed a price cap on the sale of Tether tokens on its peer-to-peer (P2P) platform. A USDT price of 1,802 Naira prevents Binance traders from selling USDT now.

Announcing to its Nigerian clientele, the cryptocurrency exchange emphasized its dedication to collaborating closely with local authorities, legislators, and regulatory bodies to enforce consequences for users who fail to adhere to the price limit. Users can purchase and sell cryptocurrencies for fiat currency directly with other users via Binance P2P.

Traders moved to alternative exchanges where they could engage in unrestricted trading due to the price cap’s imposition of account blocking on accounts attempting to sell above it.

Together with the Central Bank of Nigeria (CBN), the Office of the National Security Adviser of Nigeria launched a joint initiative to combat foreign exchange speculation and address the nation’s challenges to economic stability.

The initiative underscores the substantial impact that speculators’ operations, encompassing various domestic and international channels, have had on the depreciation of the naira, the worsening of inflation, and the emergence of economic instability in Nigeria.

The foreign exchange market witnessed a substantial naira depreciation against the US dollar due to the Nigerian government’s unification of forex channels in mid-2023. The naira/$1 exchange rate experienced a twofold increase, from an estimated 700 naira to a record high of over 1,500.

The Nigerian Securities and Exchange Commission (SEC) warned domestic investors in July 2023 regarding using Binance. With a valid license to operate in the country, the agency insisted that the platform’s activities were lawful. Additionally, it served as a reminder to the public regarding the substantial risk involved and the potential for complete loss of investments.

Nigeria is presently the largest peer-to-peer market globally, a status it attained in 2021 when the Central Bank of Nigeria prohibited institutions from purchasing and selling cryptocurrencies. A circular, however, issued to banks in December 2023 revoked the prohibition on Nigerian banks facilitating cryptocurrency transactions.

Numerous Nigerians need help transacting foreign exchange via conventional banking and Bureau de Change channels. This is because the costs associated with transferring foreign currency through the financial system are considerably higher than those on the cryptocurrency market, rendering P2P transfers more appealing.