Bitcoin’s resiliency above the $60K support level points to a probable BTC price rally, aided by strong bull accumulation.

Amid its continued rise above the $60,000 support level, Bitcoin, the leading cryptocurrency, is regaining the interest of investors.

Analysts have observed significant accumulation within this price range, which has prompted them to closely monitor this critical juncture.

Despite recent price volatility, Bitcoin’s ability to maintain its position at this level indicates the possibility of forthcoming bullish momentum.

Bitcoin Bulls’ Firm Support At $60K

Recent Bitcoin price action above $60,000 has created the conditions for possible bullish momentum in the crypto market.

Ali Martinez, a renowned crypto analyst, observes that this crucial support level has acquired a firm foothold, signifying that investors are confident in the market.

In contrast, concerns emerge regarding the future course of Bitcoin’s price as the rally momentarily pauses.

Meanwhile, Ali Martinez draws attention to a significant region where Bitcoin is accumulating value, wherein over 1 million addresses acquired substantial amounts of BTC between $60,334 and $62,155.

The surge in buying activity highlights a strong basis of support for Bitcoin, which may serve as a safeguard against additional downward forces.

Additionally, Martinez’s chart analysis underscores the tenacity of Bitcoin’s price, which is supported by the broad trust of investors in the digital asset’s future potential.

An indication of bullish sentiment is the accumulation of Bitcoin at critical price levels, which signifies that market participants consider the present prices to be appealing for investment purposes.

Price & Performance Amid Recent Upheaval

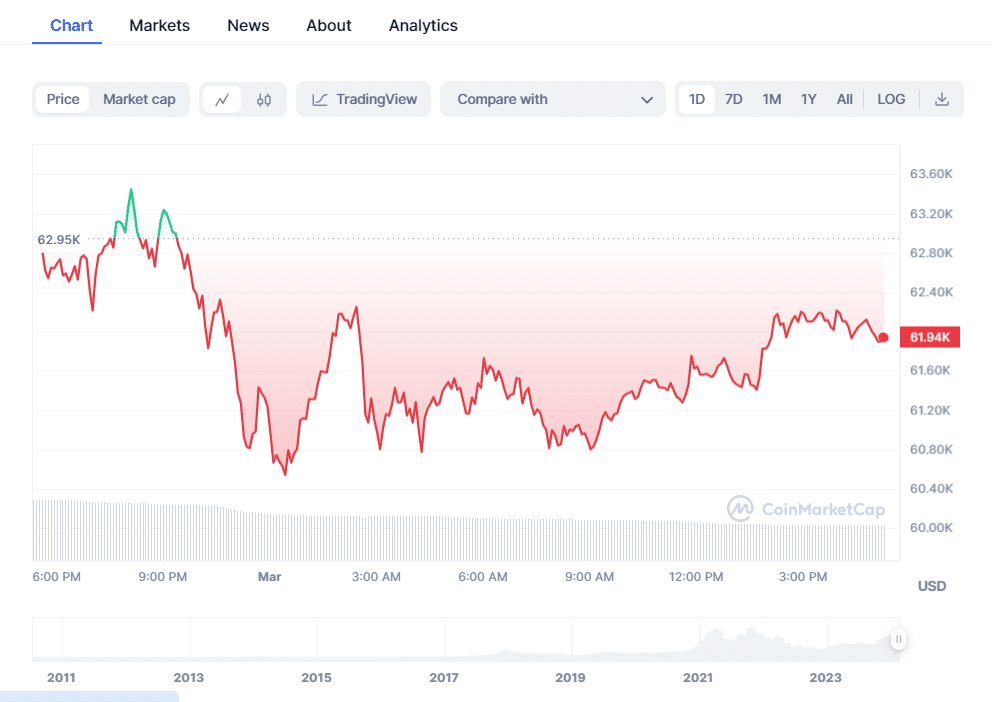

Earlier in the week, Bitcoin surged meteorically, surpassing the $60,000 mark for the first time since November 2021 and escalating to $64,000.

However, as soon as the momentum subsided the cryptocurrency experienced a reversal trajectory.

Although this is the case, the cryptocurrency continues to exhibit resilience as of the time of writing, trading near $62,000.

As a result of the recent Bitcoin collapse, market participants are filled with uncertainty and speculation.

Nevertheless, a considerable number of analysts maintain a positive outlook regarding the long-term course of Bitcoin, attributing its sustained expansion to robust fundamentals and institutional interest.

For instance, the persistent substantial inflows into Bitcoin ETFs and the upcoming Bitcoin halving have bolstered investor confidence.

Notwithstanding lingering concerns in the market and legal ambiguities, the supporters appear to have maintained a positive outlook regarding the crypto’s future trajectory.

As a crucial indicator of market sentiment, market participants are currently observing Bitcoin’s activity near the $60,000 support level with great interest.

However, maintaining a stable position above this threshold may facilitate additional growth opportunities, potentially driving Bitcoin to unprecedented heights in the foreseeable future.

Notably, the Bitcoin price had decreased by 1.55% over the last 24 hours to $61,967.54 at the time of writing, while its trading volume had decreased by 42.45% to $52.74 billion.

Furthermore, Bitcoin has fluctuated between approximately $50,000 and $63,913.13 this week, reflecting its precipitous rise.