CoinGecko data tracker for digital assets reports that tokenized treasuries in the United States experienced a 641% growth worth $845 million in 2023, with the participation of conventional finance institutions.

CoinGecko released its 2024 report entitled “Rise of Real World Assets in Crypto” on March 21. The report provided an overview of tokenizing real-world assets (RWA) advancements.

Tokenized treasuries increased from $114 million in January 2023 to $845 million by the end of the year, according to CoinGecko. This demonstrates that the value of blockchain-based digital certificates representing U.S. Treasury securities increased by 641% within a year.

Digital tokens supported by RWAs, such as stocks and bonds, constitute tokenized securities. One example is using the OUSG token to represent ownership of a share of the Ondo Short-Term U.S. Government Bond Fund and its yield.

Franklin Templeton, an asset management firm, is presently the preeminent issuer of tokenized treasuries, according to CoinGecko. With the $332 million in tokens issued through its On-Chain U.S. Government Money Fund, the company maintains a 38.6% market share.

In January, ten exchange-traded funds (ETF) issuers introduced spot Bitcoin ETFs in the United States, with Franklin Templeton among them. Additionally, on February 12, it submitted an application to the U.S. Securities and Exchange Commission (SEC) for a Franklin Ethereum ETF, putting it in competition to launch an Ethereum ETF.

Other protocols utilizing yield-bearing stablecoins backed by U.S. treasury bills are acquiring traction in addition to Franklin Templeton. Since its inception in September 2023, the value of Mountain Protocol’s USDM tokens has increased from $26,000 to $154 million, according to a report by CoinGecko.

The foundation of tokenized U.S. treasuries is the Ethereum network. As stated in the report by CoinGecko, Ethereum comprises 57.5% of the tokens. Among others, Franklin Templeton and WisdomTree Prime issued tokenized securities on Stellar, thereby contributing 39% of the market to the network.

The value of tokenized treasuries skyrocketed in 2023, but expansion halted in 2024. The growth of tokenized treasuries in January 2024 was a mere 1.9%. They have a market capitalization of $861 million as of February 1.

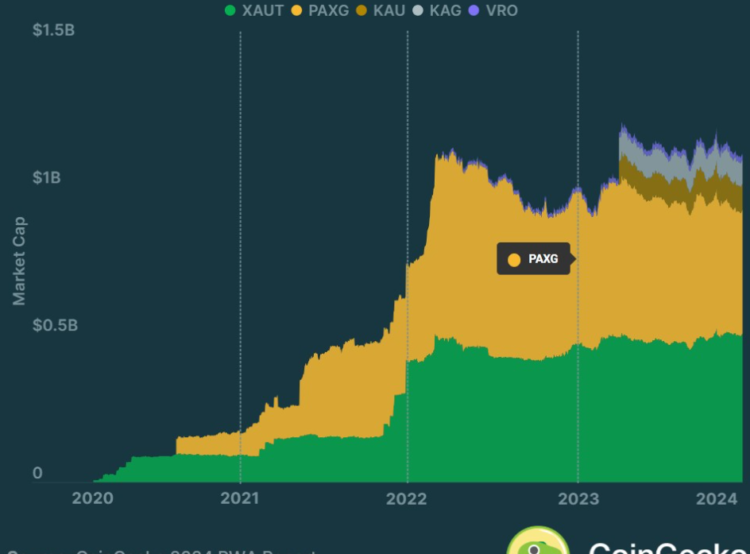

CoinGecko also noted that as of February 1, commodity-backed tokens had amassed a market capitalization of $1.1 billion, in addition to tokenized treasuries. Tether Gold (XAUT) and PAX Gold (PAXG) control 83% of the tokenized precious metals market capitalization.

The tokenization of uranium has also commenced as part of a new initiative that enables the exchange of digital tokens for the precious metal.