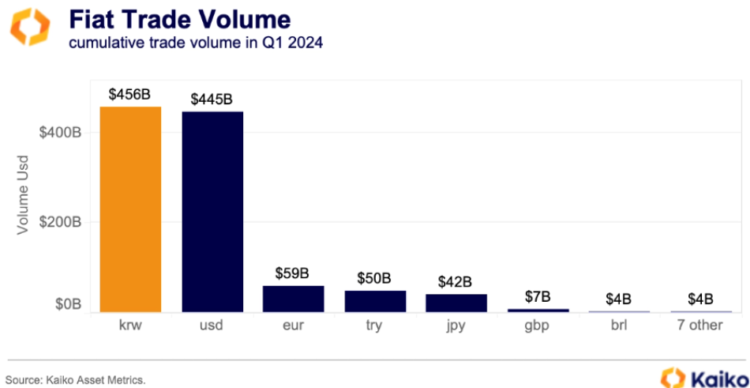

According to research firm Kaiko, South Korean Won is the most-traded fiat currency globally during the first quarter of 2024.

Kaiko research reported on April 15 that the won constituted a trading volume exceeding $456 billion on centralized cryptocurrency exchanges, surpassing the volume of the U.S. dollar by $455 billion.

Due to the “fee war” between Korean cryptocurrency exchanges, the research firm attributes the won’s rising dominance. The report outlined the following:

“The improving macroeconomic environment and fierce competition among Korean exchanges has boosted trade volume on Korean markets which hit its highest level in more than two years in early March. In Q1 2024, the South Korean Won surpassed the US Dollar in terms of cumulative trade volume.”

Comparatively, the cumulative volume of Euro-denominated trading pairs for the first quarter of 2024 was only $59 billion, which ranked them third.

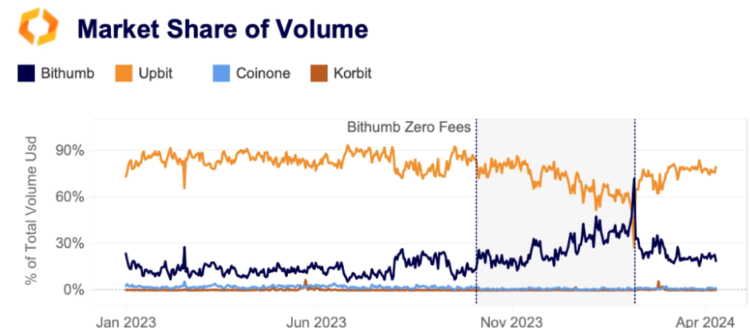

South Korean cryptocurrency exchanges engage in an intensifying fee war, but Upbit remains the leading exchange.

Since 2021, Upbit, the dominant cryptocurrency exchange in the region, has controlled more than 82% of the cryptocurrency market in South Korea.

Late in 2023, however, the Bithumb and Korbit exchanges initiated zero-fee campaigns in response to the increased competition resulting from the recent bull run.

In contrast to Korbit, which maintained a market share below 1%, Bithumb experienced a threefold surge in market share during the months following the implementation of a zero-fee policy for trading in October 2023. Yet, according to Kaiko, the aggressive zero-fee policy caused Bithumb to experience a significant decline in revenue:

“Despite its aggressive zero-fee strategy and the resulting surge in trade volume, Bithumb’s annual revenue dropped by 60% in 2023. The significant decline in revenue may have prompted the exchange to discontinue its zero-fee campaign on Feb. 5, just five months after its launch.”

The research firm additionally observed a decrease in volumes for the Korean Won at the beginning of April, anticipating a substantial recovery following the authorization of spot Bitcoin and Ether exchange-traded funds (ETFs) in Hong Kong.

According to reports, three spot Bitcoin ETFs have been approved by Hong Kong’s financial regulator and are anticipated to list on the Hong Kong Stock Exchange within two weeks.