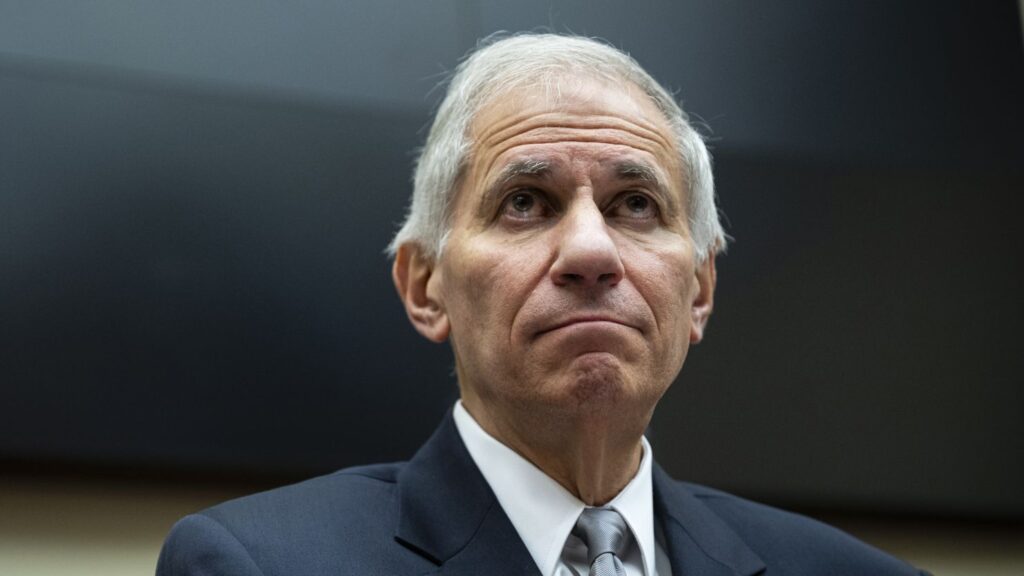

FDIC Chair Martin Gruenberg will step down after an investigation exposed a toxic workplace culture at the agency.

The chairman of the US Federal Deposit Insurance Corporation (FDIC), Martin Gruenberg, has announced his resignation in the wake of a damning probe that exposed a poisonous work environment at the bank watchdog.

Martin Gruenberg, who has led the FDIC since August 2005, announced on May 20 that he was ready to retire from the role.

“In light of recent events, I am prepared to step down from my responsibilities once a successor is confirmed,” he said in an email to staff before adding, “Until that time, I will continue to fulfill my responsibilities as Chairman of the FDIC, including the transformation of the FDIC’s workplace culture.”

The FDIC is a separate government organization in the United States that provides insurance to customers of commercial and savings banks.

The announcement comes after a third-party inquiry into claims of sexual harassment and other interpersonal misbehavior at the FDIC was made public on May 7. The investigation also included the management’s response to the wrongdoing.

Gruenberg testified before Congress on May 15 regarding the many accusations of sexual harassment and maltreatment of subordinates. Republicans and Democrats criticized him, expressing shock, dismay, and amazement at the severity of the problems at the FDIC, according to Reuters.

Legislators have demanded that he resign, and Senate Banking Chair Sherrod Brown was among those who urged President Biden to take Gruenberg’s position.

The White House declared that it will propose a fresh candidate to lead the FDIC.

Senator Elizabeth Warren, however, expressed her trust in Gruenberg’s capacity to bring about reform within the agency.

The cryptocurrency community has praised the move, with Nic Carter, a partner at Castle Island Ventures, calling it “the best day ever.”

Operation Choke Point 2.0—a term coined by Nic Carter in 2023 to describe a concerted attempt by the FDIC to dissuade banks from retaining cryptocurrency deposits or provide banking services to cryptocurrency firms—is thought to have been made possible in part by Gruenberg.

In a speech in October 2022, Gruenberg contrasted cryptocurrency assets with the hazardous financial inventions that caused the 2008 financial crisis, namely subprime mortgages and collateralized debt obligations.