Decentralized exchange SushiSwap is renamed Sushi Labs and replaces the decentralized autonomous organization (DAO) with a “council structure.”

The protocol included Sushi Labs on June 11, which is an autonomous administrative, technical, and operational company that will oversee the Sushi ecosystem.

First proposed in March, the revamp sought to respond “to market demands and user requirements,” including the protocol’s slower responsiveness to market changes due to “cumbersome governance.”

In a manner reminiscent of the derivatives protocol Synthetix, the new Labs model will function under a council structure consisting of four councils: the Sushi High Kitchen, the Treasury Council, the Grants Council, and the Ambassador Council.

The protocol’s central governing body is High Kitchen, which contains six to eight members and will supervise a multi-signature transaction arrangement.

Many attribute Sushi’s stagnant growth and AMM liquidity issues to LPs migrating to other DEXs and pursuing a higher yield. Jared Grey, the current managing director of Sushi Labs, stated in a memo to the Sushi community that the company has the resources to improve liquidity on the Sushi DEX by leveraging successful products such as Route Processor, a sufficient budget, and a newly established organizational structure.

Sushi Labs will assume responsibility for the DAO’s multimillion-dollar expenditure, which includes 25 million SushiSwap tokens. Token holders will retain the authority to determine treasury allocations; however, they will not be involved in operational details.

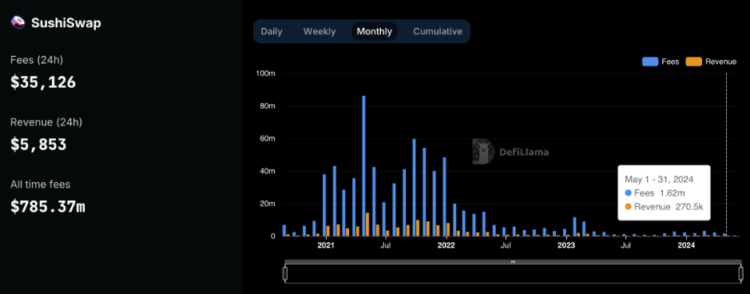

In May, Sushi generated $1.62 million in fees and $270,500 in revenue, as per data from DefiLlama. This represents a significant decrease compared to its performance during the previous bull cycle. Sushi revenue was $14.37 million in May 2021, with $86.24 million in fees generated.

An additional modification arrives in the form of a multi-token product suite. According to Sushi, it will facilitate the distribution of product costs and provide tokenholders with additional reward opportunities.

“A multi-token ecosystem reduces the risk of Sushi token inflation and alleviates the financial burden of funding DAO initiatives when products are not profitable,” the statement reads.

Due to its centralized nature, the new model has recently been debated and criticized. Community members had previously accused the protocol of a hostile takeover concerning the proposal. A Sushi DAO’s governance forum member stated, “It seems that the organization is nearing the conclusion of its journey.”

SushiSwap has been grappling with financial difficulties since 2022 when Grey issued a warning regarding a $30 million decline in liquidity provider incentives, which prompted a modification to its tokenomics.

The decentralized exchange also disclosed in December 2022 that it had only 1.5 years of operational leeway. This revelation resulted in a renewed emphasis on the diversification of its treasury and the enhancement of liquidity management.