The U.S. Spot Bitcoin ETF had an outflow of over $190 million on June 14, suggesting the ongoing risk to Bitcoin’s price, with analysts providing key insights into its price trend.

On June 14, the U.S. Spot Bitcoin ETF experienced a turbulent week, which led to a substantial outflow of nearly $200 million.

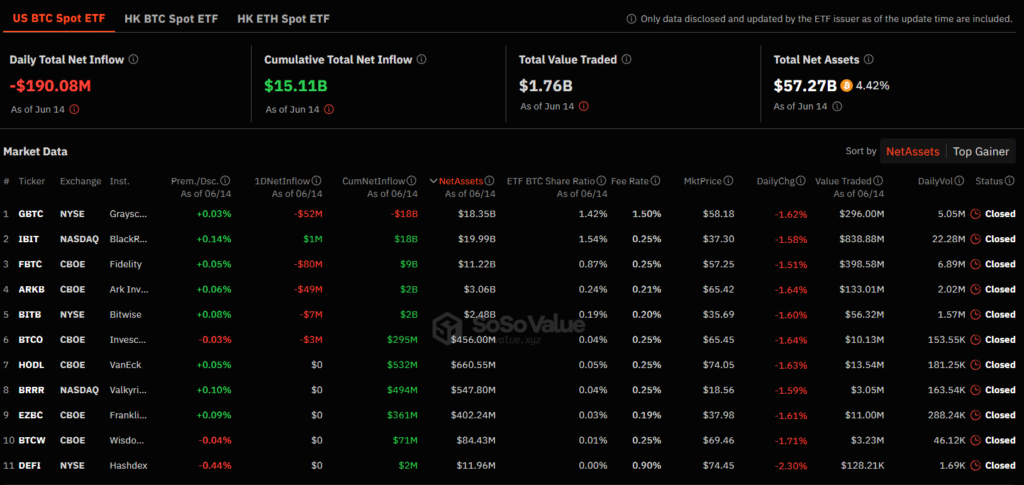

The exodus was spearheaded by Grayscale’s GBTC, which saw a $52.3 million outflow, and Fidelity’s FBTC, which experienced a $80.1 million outflow.

Experts comment on the potential implications for the cryptocurrency market as Bitcoin’s price exhibits volatility amid the bleak U.S. Spot Bitcoin ETF trading, which is particularly noteworthy.

Bitcoin ETF Records $200M Outflow

The U.S. Spot Bitcoin ETF encountered a difficult week, as it experienced persistent outflows accumulating $581.4 million over the past five days.

Outflows from Fidelity’s FBTC and Grayscale’s GBTC were the primary contributors, totaling $189.9 million on Friday alone.

However, Fidelity’s ETF experienced the largest single outflow, which amounts to $80.1 million.

Grayscale’s exchange-traded fund (ETF) followed closely, experiencing a $52.3 million asset loss.

Meanwhile, this week’s trend indicates that Bitcoin ETFs are encountering difficulty in sustaining investor interest.

Outflows have happened on four of the last five trading days, indicating a shift in market sentiment.

Notably, these withdrawals occur following a period of substantial inflows, indicating an abrupt shift in investor attitude.

Furthermore, the rapid outflows are indicative of broader market concerns and the heightened volatility of the Bitcoin price.

This sentiment shift has resulted in heightened caution among investors, which has impacted their risk-bet appetite.

However, the current inquiry is whether these trends will persist or stabilize as the market adjusts to the recent price fluctuations.

What’s Next For Bitcoin Price?

Bitcoin has continued to experience a substantial decline in the past few days, despite the recent positive market indicators.

In other words, the substantial outflows of ETFs have occurred in tandem with the substantial volatility of Bitcoin’s price.

BTC has struggled to maintain stability, swinging near crucial levels.

Amid this, prominent crypto market analysts emphasized a critical point: Bitcoin must maintain its current level to prevent a further decline to $61,000.

Martinez stated in a recent analysis posted on the X platform that Bitcoin must maintain a price above $66,254 to prevent a potential decline to $61,100.

Bitcoin price was $66,242.59 at the time of this writing, representing a 1.01% decrease from the previous day.

In addition, the trading volume experienced a modest decline, and the price encountered a 24-hour low of $65,049.23.

The CoinGlass data indicated that Bitcoin Futures Open Interest experienced a modest recovery in the last four hours, despite the recent decline, while it declined by over 2% in the 24-hour timeframe.