A whale transfers 357.2 billion PEPE coins to Binance amid a major price drop. Examine the prospective market impact and future price predictions for PEPE.

In a remarkable move that has captivated the cryptocurrency community, a substantial whale has transferred 357.2 billion PEPE tokens to Binance amid a substantial price dip.

The prospective market impact and the future of PEPE have been the subject of speculation as a result of this substantial transaction.

PEPE Market Fluctuations and Whale Activity

According to on-chain data, meme cryptocurrency PEPE has experienced a significant decline in the past week, with a decline of over 10%.

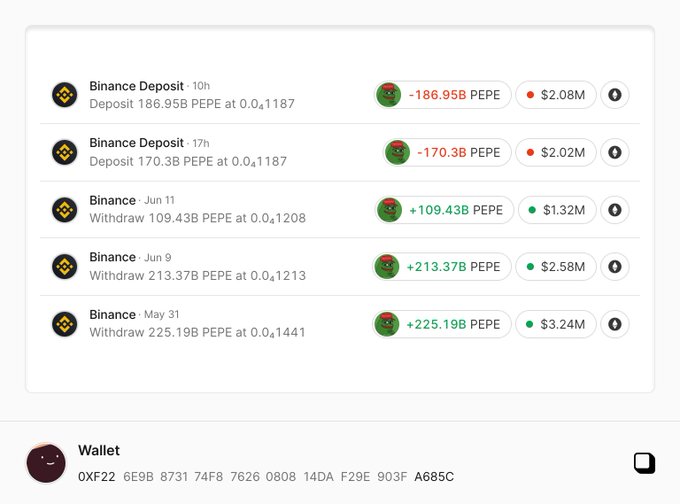

A major holder with the address 0xf22…a685c had to reduce their position.

They initially withdrew 548 billion PEPE tokens from a centralized exchange at an average price of $0.00001341, which is around $7.35 million.

However, in the last 16 hours, this holder has returned 357.2 billion PEPE to Binance through two transactions at a lower price of $0.00001157.

The first transfer consisted of 170.3 billion tokens, while the subsequent transfer was 186.95 billion, resulting in a total of $4.14 million.

If sold at the current rate, the remaining tokens would remain underwater by $320,000, resulting in a $660,000 loss.

This action implies that the whale is strategically repositioning, potentially expecting further dips or in anticipation of new opportunities in the market.

PEPE Market Analysis and Future Prospects

PEPE is currently trading at approximately $0.00001208, with a tremendous 24-hour trading volume of more than $954 million.

However, the price has decreased by 0.35% in the past day and by a more substantial 7.08% over the past week.

The total market cap of PEPE tokens is approximately $5.09 billion, with a circulating supply of 420 trillion tokens.

Moreover, the token is currently fluctuating between $0.00001217 and $0.00001137.

The open interest in PEPE futures has decreased by 8.20% and is currently valued at $79.1 million.

Market consolidation resulted in a V-top reversal from $0.00001725, which caused a 37.2% decline to $0.0000108 and a market cap decrease to $4.54 billion, as per Coingape’s analysis.

Currently, PEPE’s price is on the brink of a potential collapse from the critical $0.0000114 support level, which is also the 50-day exponential moving average and 38.2% Fibonacci retracement.

A breach of this support could intensify the selling pressure and potentially lower the price to $0.000009.

The Fibonacci tool identifies $0.000009 and $0.000007 as key levels that correspond to the 50% and 61.8% retracements.

These levels are where buyers may intervene to reverse the downtrend.