As South Korean regulators limit crypto trading and pressure exchanges to monitor unusual activities, crypto market recovery may be delayed.

The South Korean regulatory crackdown on cryptocurrency has put major pressure on crypto trading and exchanges, increasing traders’ uncertainties.

However, the action comes as South Korean officials work to improve regulations under the new digital asset law, which goes into force later this month.

Experts believe the guidelines will present considerable hurdles to several altcoins.

South Korea Tightens Crypto Trading

On July 4, the Financial Supervisory Service of South Korea announced the implementation of a system to improve oversight and monitor odd crypto trading activity.

Meanwhile, crypto exchanges are required to submit data and information to the system upon the implementation of the Virtual Asset User Protection Act on July 19.

While South Korea’s Digital Asset Exchange Alliance (DAXA) denies mass delisting, the cryptocurrency authority has initiated a 6-month review of over 1,300 digital assets to ensure compliance with the legislation.

Matt Younghoon Mok, senior foreign attorney and partner with Lee & Ko in Seoul, said FSS guidelines “could pose significant challenges for altcoins that cannot swiftly comply with regulatory requirements.”

Meanwhile, red flags that could result in severe penalties include trading over normal volume and price ranges, large transactions, and relatively sluggish execution.

Why Global Crypto Market Recovery Could Delay?

The Korean won has recently surpassed the US dollar as the most commonly used currency for crypto trading, cementing South Korea’s position as a prominent player in the global crypto market.

Moreover, with the majority of trading occurring in smaller currencies rather than Bitcoin, approximately 10% of the country’s population is exposed to digital assets.

The most recent report by Korea Forbes indicates that Upbit and Bithumb are the most highly ranked crypto apps in South Korea.

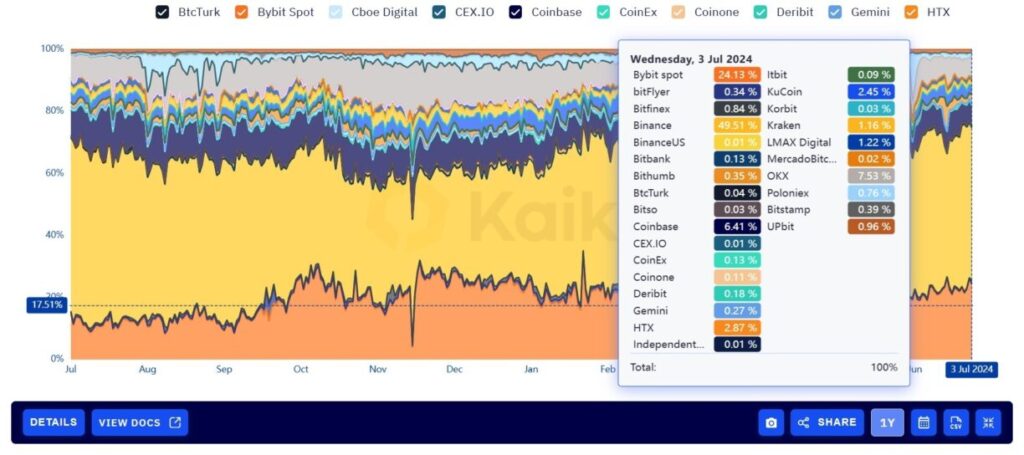

As per Kaiko, the trading volumes have decreased across the major crypto exchanges in South Korea.