Transak, a Web3 payments infrastructure provider, has become the first fiat-to-crypto on-ramp to introduce wire transfers in the United States for crypto users.

This is the inaugural instance where crypto users in the world’s largest economy can replenish their digital asset accounts through wire transfers.

According to Sami Start, the co-founder and CEO of Transak, including a secure and recognizable payment mechanism such as wire transfers could increase crypto adoption and make it more accessible to the general public.

The following is what Start disclosed to Cointelegraph:

“Wire transfers are one of the most common and trusted methods for transferring funds, and most US users are already comfortable with how the wire transfer system works. Adding this familiar and secure payment method to our extensive list of options is a significant step forward in driving crypto adoption.”

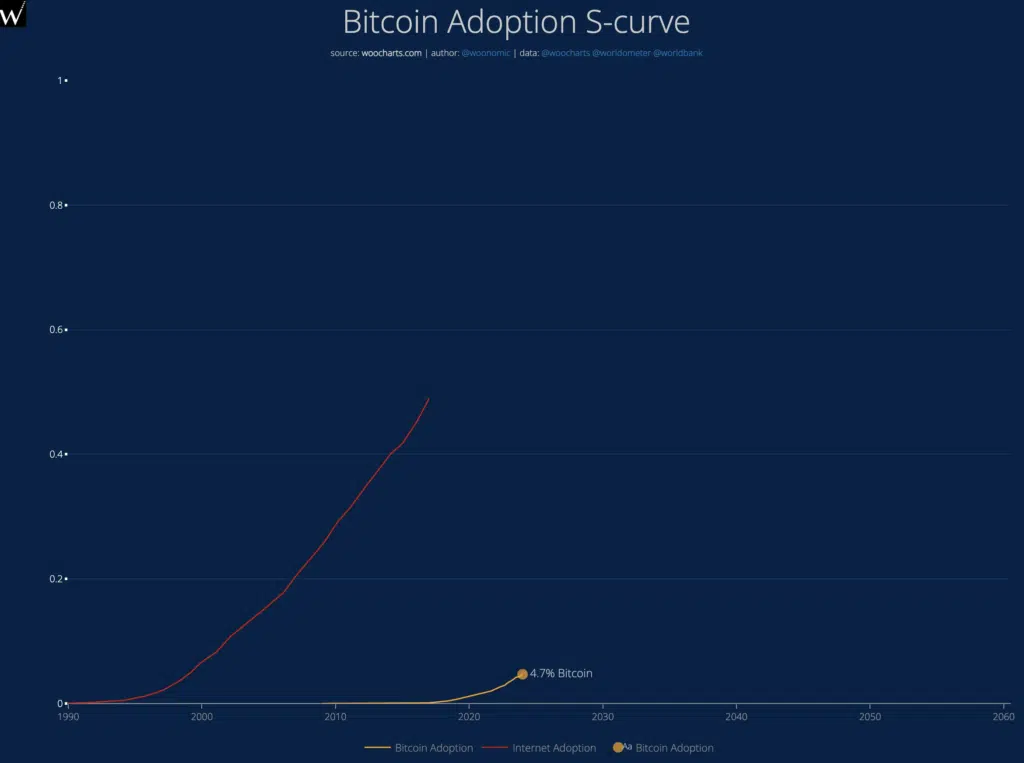

An increase in the number of trusted fiat on-ramps could increase cryptocurrency adoption among mainstream crypto users in the world’s largest economy. Some experts predict the current 560 million crypto users could triple by 2026.

Wire transfers will be a “game-changer”

Compared to wire transfers, previously available fiat-to-crypto on-ramps, such as credit cards, are subject to substantial limitations, including transaction limits and increased fees.

According to Start, this is partially the reason why wire transfers could assist the industry in reaching the first billion crypto users:

“As people become more comfortable using crypto for everyday transactions, we anticipate rapid growth, hopefully reaching a billion users in the next few years. We firmly believe that wire transfers can be a game-changer in accelerating crypto adoption.”

The crypto space could substantially increase new investment due to bank transfers.

After implementing wire transfers, Transak’s CEO informed Cointelegraph that the volume of transactions through bank transfers in the United Kingdom increased by more than fourfold.

“By bridging traditional finance with digital assets, we aim to play a key role in the next wave of crypto adoption.”

Wire transfers for Significant investments and individuals

Transak’s new wire transfer feature is accessible with a minimum threshold of $2,000 and a maximum of $25,000 per transaction.

This is primarily because wire transfers are the preferred transaction method of high-net-worth individuals, as explained by Start:

“Our goal is to offer flexibility and choice, ensuring all users can find a payment method that aligns with their investment objectives.”

Transak has been offered a money transmitter license in the United States since early 2022; however, regulation is only one obstacle.

According to Max von Hulewicz, the director of expansions at Transak, the process of identifying a banking partner in the United States was equally complex:

“We were fortunate to find a bank in the US that is at the forefront of the digital asset space. As one of their alpha customers, we received substantial support, which was crucial in rolling out this product in a compliant and scalable manner.”