Despite a dip to $135 billion by the end of 2022, the market has rebounded significantly.

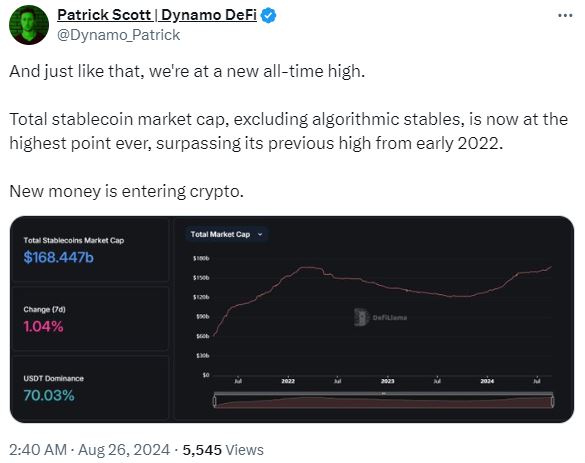

In the midst of eleven months of continuous expansion, the market capitalization of stablecoins has achieved an all-time high of $168 billion. DefiLlama data reveals that the overall market capitalization of stablecoins has reached an all-time high, surpassing its previous peak, which occurred in March of 2022.

The data does not include algorithmic stablecoins, which are characterized by the fact that their value is preserved by computational procedures rather than being tied to exogenous assets such as gold or fiat currency.

It was in March of 2022 when the market achieved its all-time high of $167 billion, but it began to fall shortly thereafter, and it reached a low of $135 billion before the year came to a close.

In a post that he made on X on August 26, the cryptocurrency expert Patrick Scott, who is also known by the alias “Dynamo DeFi,” expressed his belief that this is an indication that “new money is entering crypto”.

We have reached an all-time high, and it happened all of a sudden. With the exception of algorithmic stables, the total market capitalization of stablecoins has now reached an all-time high, exceeding its previous peak from the beginning of 2022, he stated before.

Despite the fact that he did not speculate on the reasons behind the increase, he did mention that “retail has been in some form for at least eight months” in response to another user’s inquiry on whether or not institutional investment was the driving force behind the rally.

Tether has been the most successful stablecoin up until this point. The market capitalization of USDT reached $91.69 billion not long after the new year began to ring in.

Over the course of 2024, it has consistently demonstrated monthly growth, and in August of that year, it achieved a market value of more than $117 billion for the very first time. Circle USD has also experienced a year of growth, reaching a market cap of over $34 billion, marking its peak for 2024.

However, this is still a significant distance from its all-time high of $55.8 million in June 2022.In July, CCData published a study stating that stablecoin trade volumes decreased by 8.35% to $795 billion in the previous month.

The study attributed this decline to the decrease in trading activity on controlled exchanges. The analysis identifies MiCA restrictions as a contributing factor to the decline in stablecoin trading activity on centralized exchanges during the month of July.

Concerns about the future of USDT in Europe have arisen due to these laws. According to CoinMarketCap, the trend continued into August, with the trading volume of the market currently resting slightly above $46 billion.