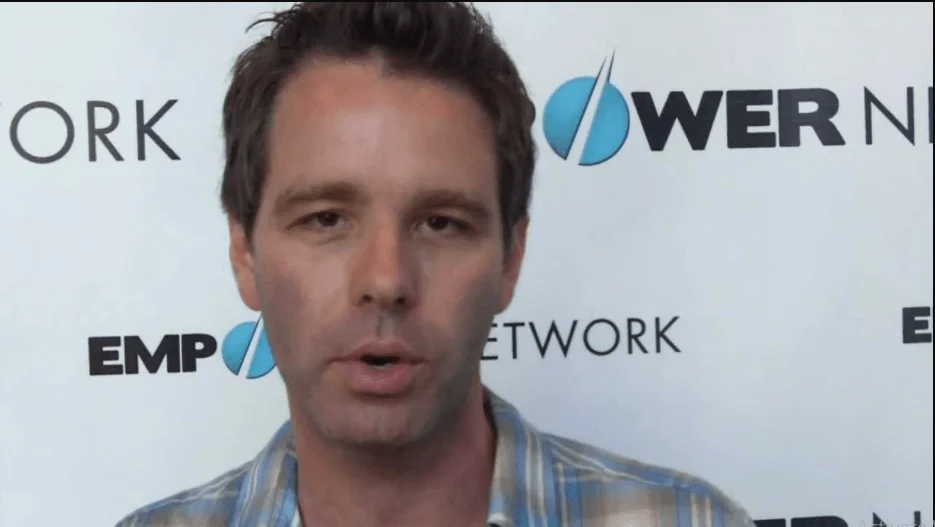

BitConnect promoter Glenn Arcaro has admitted his involvement in the affair, although it is unclear where the company’s creator Satish Kumbhani is hiding out.

Glenn Arcaro, a former director and promoter of the infamous Bitconnect Ponzi scheme, has entered a guilty plea to fraud charges stemming from his involvement with the now-defunct cryptocurrency exchange and lending platform.

Investors have been ordered to get $24 million in compensation from him.

As part of the ongoing investigation, the Securities and Exchange Commission (SEC) of the United States has charged Bitconnect, its creator Satish Kumbhani, former director Arcaro, and Future Money Ltd. with participating in the Ponzi scheme. It is alleged that the defendants conducted a fraudulent, unregistered securities offering that generated $2 billion in profits.

Recent developments came three years after BitConnect shut down its lending platform and cryptocurrency exchange in response to warnings from state and federal officials in Texas and North Carolina.

A Ponzi scheme, Bitconnect has been extensively accused, and the scheme has survived in the form of innumerable memes as a result.

“Fraudulent marketers.”

According to a press release issued on September 1 by the Department of Justice (DoJ), Arcaro entered a guilty plea to charges claiming conspiracy to commit wire fraud and pled guilty.

During his deposition, the Los Angeles resident admitted to working with “others” to abuse investors by “fraudulently marketing” BitConnect’s coin offering and cryptocurrency trading platform as a highly profitable investment opportunity.

Also admitted was deceiving investors about the “BitConnect Trading Bot” and “Volatility Software,” which he claimed were able to make significant profits and guaranteed returns by leveraging investor cash to trade on the volatility of cryptocurrency markets.

“In reality, BitConnect was a textbook Ponzi scheme, paying earlier BitConnect investors with money from later investors,” according to a Department of Justice press release.

A massive network of promoters in North America, termed the “Bitconnect Referral Program,” is believed to have been handled by Arcaro, who is accused of running a pyramid scheme.

It is estimated that he gained roughly 15 percent for each investment he made into BitConnect’s loan scheme. He also took a percentage of all investments through a concealed “slush” fund.

During his trial, the former promoter admitted to earning over $24 million through fraudulent operations and was compelled to repay the entire sum to investors.

As Special Agent in Charge Ryan L. Korner of the IRS Criminal Investigations (IRS-CI) Los Angeles Field Office explained.

Arcaro took advantage of the rise of cryptocurrency markets by enticing innocent investors around the world to invest early by promising them guaranteed returns, and by utilizing the internet and social media to reach a larger pool of victims more quickly and easily.

Charges levied by the SEC

SEC accusations filed today are directed at BitConnect, its creator Satish Kumbhani, former director Arcaro and Future Money Ltd, a company founded by Arcaro in Hong Kong and incorporated under the laws of the United Kingdom.

A complaint filed on September 1 claims that the defendants engaged in a fraudulent and unregistered securities offering through BitConnect’s lending platform between 2017 and 2018, which resulted in the generation of roughly 325,000 Bitcoin (BTC) worth $2 billion at the time of the offering.

Today, we announced that we have filed an action against an online crypto lending platform, its founder, and its top U.S. promoter and his affiliated company.

They allegedly defrauded retail investors out of $2 billion!

More:https://t.co/gO10Ag0tfh pic.twitter.com/XghdUBqaCz

— SEC (@SECGov) September 1, 2021User funds were duped into investing in the lending platform, according to the complaint, by claims that BitConnect’s trading bot would generate guaranteed returns of 40 percent a month.

The complaint also accuses BitConnect of posting “fictitious returns” on its website, which amounted to an average of 1 percent per day, or 3,700 percent annually.

“These claims were a sham. As Defendants knew or recklessly disregarded, BitConnect did not deploy investor funds for trading with its purported Trading Bot. Rather, BitConnect and Kumbhani siphoned investors’ funds off for their own benefit and their associates’ benefit.”

The SEC points out that the whereabouts of BitConnect creator Kumbhani are now unknown, according to the agency.

Among the remedies sought by the SEC are a complete forfeiture of assets, an injunction against the defendants from breaching securities laws in the future, and civil monetary penalties.

After charging six additional BitConnect promoters for their roles in the alleged fraudulent offering, the Securities and Exchange Commission (SEC) said on July 8 that it was near to reaching settlements with four of the six persons involved.